the Status of a Refund is Available at 2019

Key elements of the pit 1 instructions

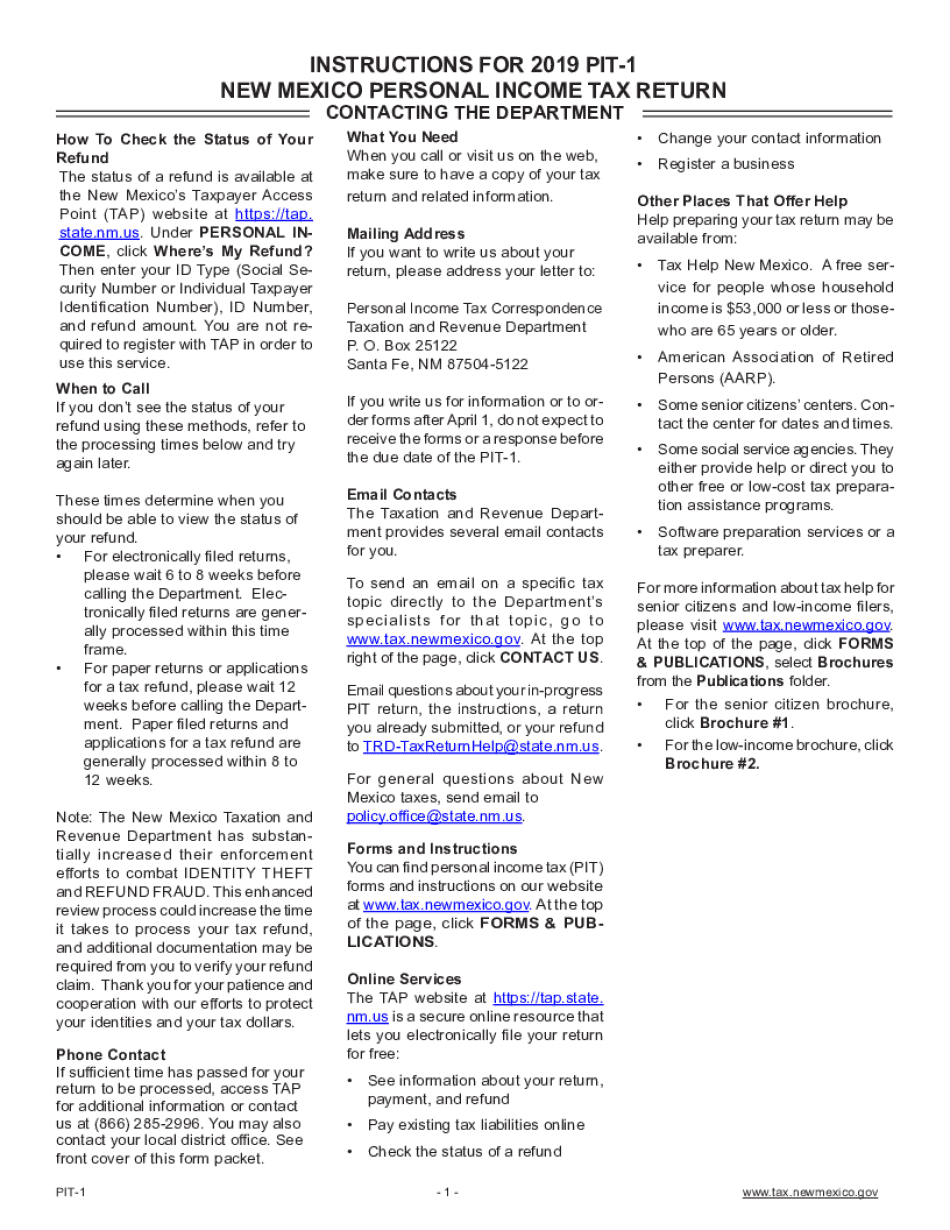

The pit 1 instructions are essential for accurately completing the New Mexico form. Understanding the key elements ensures compliance and helps avoid errors. The form typically includes sections for personal information, income details, and deductions. Each section must be filled out with precision, as inaccuracies can lead to delays in processing or potential penalties. It is crucial to have all necessary documents on hand, such as W-2s, 1099s, and any relevant receipts for deductions.

Steps to complete the pit 1 instructions

Completing the pit 1 instructions involves a series of steps that guide users through the process. Begin by gathering all required documents, including identification and financial records. Next, fill out the personal information section, ensuring that names and addresses match official records. Proceed to the income section, where you will report all sources of income accurately. After that, include any applicable deductions or credits. Finally, review the completed form for accuracy before submission. This careful approach minimizes the risk of errors and enhances the likelihood of a smooth processing experience.

Required documents for the pit 1 instructions

To successfully complete the pit 1 instructions, specific documents are required. These include:

- Personal identification, such as a driver's license or Social Security card

- Income statements, including W-2s and 1099 forms

- Receipts for any deductions claimed, such as medical expenses or educational costs

- Previous year’s tax return, if applicable

Having these documents ready will streamline the completion process and ensure that all necessary information is provided.

Legal use of the pit 1 instructions

The legal use of the pit 1 instructions is crucial for ensuring that the submitted form is valid and compliant with state regulations. Electronic submissions are legally recognized, provided they meet the requirements set forth by the ESIGN Act and UETA. This includes using a secure eSignature solution that verifies the identity of the signer. It is important to understand that submitting false information or failing to comply with legal requirements can result in penalties or legal action.

Form submission methods for the pit 1 instructions

There are several methods available for submitting the pit 1 instructions. Users can choose to submit the form online through a secure portal, which is often the fastest option. Alternatively, forms can be mailed to the appropriate state office, ensuring that they are sent with adequate postage and tracking. In-person submissions are also an option, allowing for direct interaction with state officials. Each method has its own advantages, and users should select the one that best fits their needs.

Filing deadlines for the pit 1 instructions

Understanding the filing deadlines for the pit 1 instructions is essential to avoid late fees or penalties. Typically, the deadline for submission aligns with the federal tax filing deadline, which is usually April fifteenth. However, it is advisable to check for any state-specific extensions or changes to this timeline. Filing early can also help ensure that any potential issues are addressed before the deadline, allowing for a smoother process overall.

Quick guide on how to complete the status of a refund is available at

Complete The Status Of A Refund Is Available At effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without any delays. Manage The Status Of A Refund Is Available At on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign The Status Of A Refund Is Available At with ease

- Locate The Status Of A Refund Is Available At and click on Get Form to initiate.

- Leverage the tools we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign The Status Of A Refund Is Available At and ensure outstanding communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the status of a refund is available at

Create this form in 5 minutes!

How to create an eSignature for the the status of a refund is available at

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What are the pit 1 instructions for using airSlate SignNow?

The pit 1 instructions for airSlate SignNow guide users through the initial setup and document eSigning process. It includes detailed steps on creating an account, uploading documents, and adding recipients for signature. Following these instructions ensures a smooth experience when using our platform.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies depending on the chosen plan, which can include options for individuals, teams, or enterprises. Each plan comes with different features, and the pit 1 instructions detail how to select the best one for your needs. Visit our pricing page for a comprehensive breakdown and comparison of plans.

-

What features are included in the pit 1 instructions?

The pit 1 instructions highlight essential features like document upload, eSignature capabilities, and cloud storage. Users can also learn how to set reminders for signers and track document status through these instructions. This comprehensive approach ensures that users maximize their experience with airSlate SignNow.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers integrations with numerous third-party applications, enhancing workflow efficiency. The pit 1 instructions provide guidance on how to connect and use these integrations effectively. These features help streamline processes by allowing users to work within their preferred software.

-

What are the benefits of following the pit 1 instructions?

Following the pit 1 instructions ensures that users leverage the full capabilities of airSlate SignNow. It helps prevent common mistakes during setup and eSigning, making the experience more efficient and enjoyable. By adhering to these instructions, users can save time and resources, enhancing their productivity.

-

Is there a trial version available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial version for potential users to explore its features and capabilities. The pit 1 instructions explain how to sign up for the trial and utilize the platform fully during the trial period. This allows users to evaluate whether airSlate SignNow meets their document signing needs.

-

What support resources are available for airSlate SignNow users?

Users can access various support resources, including FAQs, video tutorials, and customer support teams. The pit 1 instructions also guide users on how to signNow out for assistance when needed. These resources ensure you have the help you need to make the most out of airSlate SignNow.

Get more for The Status Of A Refund Is Available At

- Hvac contract for contractor washington form

- Landscape contract for contractor washington form

- Commercial contract for contractor washington form

- Excavator contract for contractor washington form

- Renovation contract for contractor washington form

- Cleaning contract contractor form

- Concrete mason contract for contractor washington form

- Demolition contract for contractor washington form

Find out other The Status Of A Refund Is Available At

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free