Pit 1 Instructions Form 2015

What is the Pit 1 Instructions Form

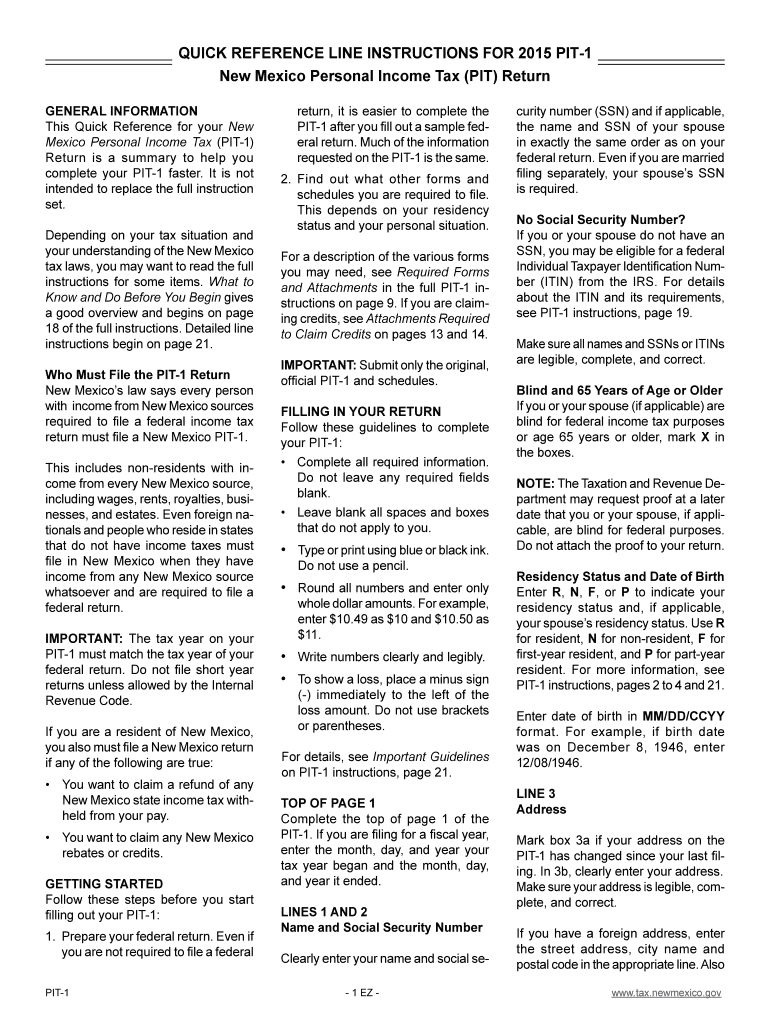

The Pit 1 Instructions Form is a document designed to guide taxpayers in completing their tax obligations accurately. This form provides essential information on how to report income and calculate tax liabilities. It is particularly relevant for individuals who need assistance understanding the specific requirements set forth by the IRS. The form outlines the necessary steps to ensure compliance with federal tax laws, making it a vital resource for accurate tax reporting.

How to use the Pit 1 Instructions Form

Using the Pit 1 Instructions Form involves several straightforward steps. First, download the form from a reliable source or access it through a tax preparation software that supports it. Carefully read through the instructions provided on the form to understand what information is required. Fill out the form by entering your personal details, income information, and any deductions or credits you may qualify for. Once completed, review the form for accuracy before submitting it to the IRS.

Steps to complete the Pit 1 Instructions Form

Completing the Pit 1 Instructions Form can be broken down into a series of manageable steps:

- Download the form from a trusted source.

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documents, such as W-2s or 1099s.

- Fill in your personal information accurately.

- Report your income and any applicable deductions.

- Review the completed form for errors or omissions.

- Submit the form electronically or via mail, following the guidelines provided.

Legal use of the Pit 1 Instructions Form

The legal use of the Pit 1 Instructions Form is crucial for ensuring compliance with IRS regulations. This form serves as an official document that taxpayers must complete to report their income and tax liabilities accurately. Using the form correctly helps avoid potential penalties and ensures that taxpayers fulfill their legal obligations. It is important to adhere to the instructions and guidelines provided to maintain the integrity of the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Pit 1 Instructions Form are critical for taxpayers to observe. Typically, the deadline for submitting tax forms is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to deadlines, especially in light of special circumstances such as extensions granted by the IRS during extraordinary events.

Form Submission Methods (Online / Mail / In-Person)

The Pit 1 Instructions Form can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online: Many taxpayers choose to file electronically using tax preparation software, which streamlines the process and often includes eSignature capabilities.

- Mail: Taxpayers can print the completed form and send it via postal mail to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-Person: Some individuals may prefer to file their forms in person at designated IRS offices or authorized tax assistance centers.

Quick guide on how to complete pit 1 instructions 2015 form

Your assistance manual on how to prepare your Pit 1 Instructions Form

If you want to understand how to complete and submit your Pit 1 Instructions Form, here are a few straightforward pointers to make tax filing simpler.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that allows you to modify, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to amend information as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Pit 1 Instructions Form in just a few minutes:

- Set up your account and begin editing PDFs in moments.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to open your Pit 1 Instructions Form in our editor.

- Complete the necessary fillable fields with your details (text entries, figures, check marks).

- Employ the Sign Tool to add your legally-valid eSignature (if required).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Remember that paper filing can increase return errors and postpone refunds. Additionally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct pit 1 instructions 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the pit 1 instructions 2015 form

How to generate an electronic signature for your Pit 1 Instructions 2015 Form in the online mode

How to generate an eSignature for your Pit 1 Instructions 2015 Form in Google Chrome

How to generate an eSignature for signing the Pit 1 Instructions 2015 Form in Gmail

How to generate an electronic signature for the Pit 1 Instructions 2015 Form from your smartphone

How to make an eSignature for the Pit 1 Instructions 2015 Form on iOS

How to generate an electronic signature for the Pit 1 Instructions 2015 Form on Android

People also ask

-

What is the Pit 1 Instructions Form?

The Pit 1 Instructions Form is a document template designed for easy digital signing and form submission using airSlate SignNow. This form simplifies the signing process, ensuring that all necessary information is captured efficiently and securely, making it ideal for both businesses and individual users.

-

How much does the Pit 1 Instructions Form cost?

The pricing for the Pit 1 Instructions Form varies based on the subscription plan you choose with airSlate SignNow. We offer flexible pricing options, including monthly and annual plans, allowing users to select the best option according to their needs and budget.

-

What features does the Pit 1 Instructions Form offer?

The Pit 1 Instructions Form comes with a range of features, including eSignature capabilities, customizable templates, and the ability to track document status. These features enhance workflow efficiency and ensure that each form is completed and returned in a timely manner.

-

How can I integrate the Pit 1 Instructions Form into my existing workflow?

Integrating the Pit 1 Instructions Form into your current workflow is simple with airSlate SignNow. Our platform supports various integrations with popular applications, making it easier to manage documents and transactions seamlessly without disrupting your existing processes.

-

What are the benefits of using the Pit 1 Instructions Form?

Using the Pit 1 Instructions Form offers numerous benefits, including improved turnaround times for document signing, enhanced security for sensitive information, and reduced paper usage. This ensures a more efficient, environmentally-friendly way to manage business documentation.

-

Is it easy to use the Pit 1 Instructions Form?

Absolutely! The Pit 1 Instructions Form is designed with user-friendliness in mind. With an intuitive interface, users can quickly navigate the signing process, making it accessible for individuals of all skill levels, from beginners to seasoned professionals.

-

Can multiple users sign the Pit 1 Instructions Form?

Yes, multiple users can seamlessly sign the Pit 1 Instructions Form in a structured sequence. This allows for efficient collaboration, ensuring that all necessary parties can provide their signatures without delays.

Get more for Pit 1 Instructions Form

- Corporatecommercial banking account opening hsbc philippines form

- Sp ausnet inverter energy system ies generator connection form

- Quit claim deed nc form

- Borang single form

- Jac contest entry form

- Is ithttpswww mononagrove org form

- Low income taxpayer clinic grant application form

- Cultura vitae et lucis form

Find out other Pit 1 Instructions Form

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile