Pit 1 Instructions Form 2015

What is the Pit 1 Instructions Form

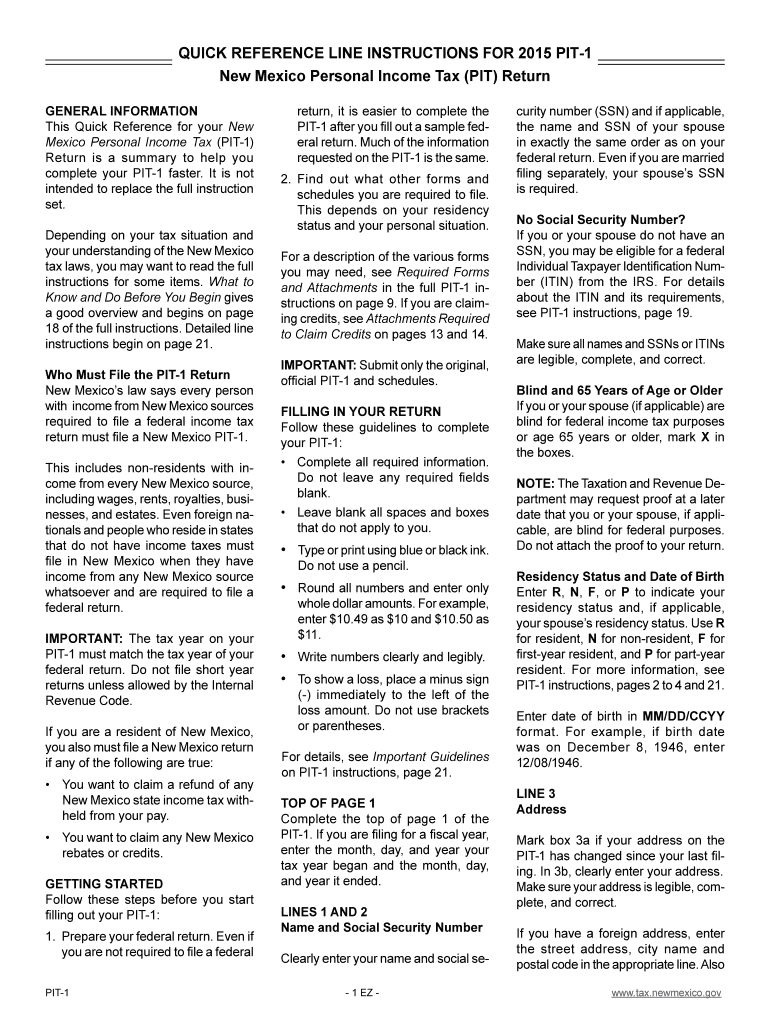

The Pit 1 Instructions Form is a document designed to guide taxpayers in completing their tax obligations accurately. This form provides essential information on how to report income and calculate tax liabilities. It is particularly relevant for individuals who need assistance understanding the specific requirements set forth by the IRS. The form outlines the necessary steps to ensure compliance with federal tax laws, making it a vital resource for accurate tax reporting.

How to use the Pit 1 Instructions Form

Using the Pit 1 Instructions Form involves several straightforward steps. First, download the form from a reliable source or access it through a tax preparation software that supports it. Carefully read through the instructions provided on the form to understand what information is required. Fill out the form by entering your personal details, income information, and any deductions or credits you may qualify for. Once completed, review the form for accuracy before submitting it to the IRS.

Steps to complete the Pit 1 Instructions Form

Completing the Pit 1 Instructions Form can be broken down into a series of manageable steps:

- Download the form from a trusted source.

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documents, such as W-2s or 1099s.

- Fill in your personal information accurately.

- Report your income and any applicable deductions.

- Review the completed form for errors or omissions.

- Submit the form electronically or via mail, following the guidelines provided.

Legal use of the Pit 1 Instructions Form

The legal use of the Pit 1 Instructions Form is crucial for ensuring compliance with IRS regulations. This form serves as an official document that taxpayers must complete to report their income and tax liabilities accurately. Using the form correctly helps avoid potential penalties and ensures that taxpayers fulfill their legal obligations. It is important to adhere to the instructions and guidelines provided to maintain the integrity of the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Pit 1 Instructions Form are critical for taxpayers to observe. Typically, the deadline for submitting tax forms is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to deadlines, especially in light of special circumstances such as extensions granted by the IRS during extraordinary events.

Form Submission Methods (Online / Mail / In-Person)

The Pit 1 Instructions Form can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online: Many taxpayers choose to file electronically using tax preparation software, which streamlines the process and often includes eSignature capabilities.

- Mail: Taxpayers can print the completed form and send it via postal mail to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-Person: Some individuals may prefer to file their forms in person at designated IRS offices or authorized tax assistance centers.

Quick guide on how to complete pit 1 instructions 2015 form

Your assistance manual on how to prepare your Pit 1 Instructions Form

If you want to understand how to complete and submit your Pit 1 Instructions Form, here are a few straightforward pointers to make tax filing simpler.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that allows you to modify, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to amend information as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Pit 1 Instructions Form in just a few minutes:

- Set up your account and begin editing PDFs in moments.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to open your Pit 1 Instructions Form in our editor.

- Complete the necessary fillable fields with your details (text entries, figures, check marks).

- Employ the Sign Tool to add your legally-valid eSignature (if required).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Remember that paper filing can increase return errors and postpone refunds. Additionally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct pit 1 instructions 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the pit 1 instructions 2015 form

How to generate an electronic signature for your Pit 1 Instructions 2015 Form in the online mode

How to generate an eSignature for your Pit 1 Instructions 2015 Form in Google Chrome

How to generate an eSignature for signing the Pit 1 Instructions 2015 Form in Gmail

How to generate an electronic signature for the Pit 1 Instructions 2015 Form from your smartphone

How to make an eSignature for the Pit 1 Instructions 2015 Form on iOS

How to generate an electronic signature for the Pit 1 Instructions 2015 Form on Android

People also ask

-

What is the Pit 1 Instructions Form and how is it used?

The Pit 1 Instructions Form is a specialized document designed to guide users through the process of completing specific instructions related to their operations. This form simplifies complex procedures, ensuring accuracy and compliance. By utilizing the Pit 1 Instructions Form, businesses can streamline workflows and enhance clarity in their documentation.

-

How can I create a Pit 1 Instructions Form with airSlate SignNow?

Creating a Pit 1 Instructions Form with airSlate SignNow is quick and straightforward. Simply log in to your account, select 'Create Document', and choose a template or start from scratch. You can customize the form to suit your specific needs and add electronic signature fields for easy completion.

-

Is there a cost associated with using the Pit 1 Instructions Form on airSlate SignNow?

Yes, there is a cost associated with using the Pit 1 Instructions Form on airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing varies based on the plan you choose, which offers different features and capabilities. Evaluate our pricing plans to find one that best fits your needs while leveraging the benefits of the Pit 1 Instructions Form.

-

What are the key features of the Pit 1 Instructions Form in airSlate SignNow?

The Pit 1 Instructions Form in airSlate SignNow includes several key features such as customizable templates, electronic signatures, and document tracking. These features enhance user experience and ensure that all parties can easily access and complete the form. Additionally, the form integrates seamlessly with other tools, making it an essential part of your document management system.

-

Can the Pit 1 Instructions Form be integrated with other software?

Absolutely! The Pit 1 Instructions Form can be integrated with a variety of software applications through airSlate SignNow's robust API. This integration capability allows businesses to streamline their processes by connecting the form with CRM systems, cloud storage, and other essential tools. This ensures that your team can work efficiently and effectively.

-

What benefits does the Pit 1 Instructions Form provide for businesses?

The Pit 1 Instructions Form offers numerous benefits for businesses including increased efficiency, improved accuracy, and enhanced compliance. By utilizing this form, organizations can reduce errors and speed up the documentation process. Furthermore, the electronic nature of the Pit 1 Instructions Form allows for quicker turnaround times and easier access to important information.

-

How does airSlate SignNow ensure the security of the Pit 1 Instructions Form?

airSlate SignNow takes the security of the Pit 1 Instructions Form seriously, employing advanced encryption and secure data storage methods. This ensures that sensitive information remains protected throughout the document signing process. Regular security audits and compliance with industry standards further reinforce the safety of your documents.

Get more for Pit 1 Instructions Form

- Corporatecommercial banking account opening hsbc philippines form

- Sp ausnet inverter energy system ies generator connection form

- Quit claim deed nc form

- Borang single form

- Jac contest entry form

- Is ithttpswww mononagrove org form

- Low income taxpayer clinic grant application form

- Cultura vitae et lucis form

Find out other Pit 1 Instructions Form

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement