Pit 1 Instructions 2018

What is the Pit 1 Instructions

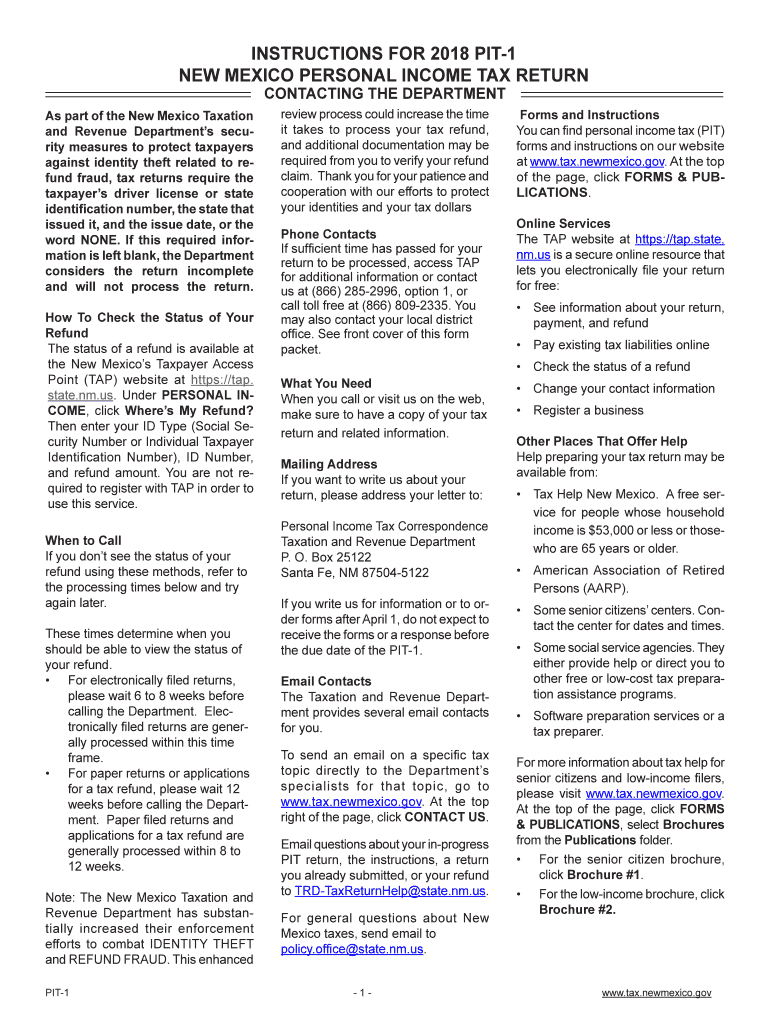

The Pit 1 Instructions refer to the guidelines provided by the New Mexico Taxation and Revenue Department for completing the PIT-1 form, which is used for personal income tax filing in New Mexico. This form is essential for residents and non-residents who earn income in the state. The instructions detail the necessary steps, requirements, and information needed to accurately fill out the form, ensuring compliance with state tax laws.

Steps to complete the Pit 1 Instructions

Completing the Pit 1 Instructions involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Review the Pit 1 form carefully, noting specific sections that require attention based on your income sources.

- Fill out personal information accurately, ensuring that names and Social Security numbers are correct.

- Calculate your total income and any deductions you may qualify for, as outlined in the instructions.

- Double-check all entries for accuracy before submitting the form.

Legal use of the Pit 1 Instructions

The legal use of the Pit 1 Instructions is crucial for ensuring that your tax filings are valid and accepted by the New Mexico Taxation and Revenue Department. Compliance with these instructions means that you are adhering to state tax laws, which can help avoid penalties or legal issues. It is important to understand the legal implications of your entries, including the accuracy of reported income and the legitimacy of claimed deductions.

Required Documents

To complete the Pit 1 Instructions effectively, you will need several key documents:

- W-2 forms from employers, detailing your annual income and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or investment earnings.

- Documentation for deductions, including receipts for medical expenses or charitable contributions.

Form Submission Methods

The completed Pit 1 form can be submitted through various methods:

- Online submission via the New Mexico Taxation and Revenue Department's website, which allows for electronic filing.

- Mailing the physical form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices, where assistance may be available.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Pit 1 form to avoid penalties:

- The standard deadline for filing is typically April 15 of each year.

- Extensions may be available, but they require filing a separate request before the original deadline.

- Check for any specific state holidays or changes that may affect the filing schedule.

Quick guide on how to complete nm trd pit 1 instructions 2018

Complete Pit 1 Instructions effortlessly on any device

Online document management has become widely adopted by companies and individuals alike. It offers a perfect green alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without any hold-ups. Handle Pit 1 Instructions on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to edit and eSign Pit 1 Instructions with ease

- Obtain Pit 1 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Pit 1 Instructions and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nm trd pit 1 instructions 2018

Create this form in 5 minutes!

How to create an eSignature for the nm trd pit 1 instructions 2018

How to create an electronic signature for the Nm Trd Pit 1 Instructions 2018 in the online mode

How to make an eSignature for your Nm Trd Pit 1 Instructions 2018 in Google Chrome

How to make an electronic signature for putting it on the Nm Trd Pit 1 Instructions 2018 in Gmail

How to create an eSignature for the Nm Trd Pit 1 Instructions 2018 from your smart phone

How to make an eSignature for the Nm Trd Pit 1 Instructions 2018 on iOS

How to generate an electronic signature for the Nm Trd Pit 1 Instructions 2018 on Android devices

People also ask

-

What are the key features of the airSlate SignNow platform for handling 2018 nm pit 1 instructions 2017?

The airSlate SignNow platform offers a range of features such as robust eSignature capabilities, customizable templates, and document management solutions that streamline the handling of 2018 nm pit 1 instructions 2017. These tools help businesses enhance their operational efficiency and prepare documents with ease.

-

How does airSlate SignNow improve the process of completing the 2018 nm pit 1 instructions 2017?

airSlate SignNow simplifies the process of completing 2018 nm pit 1 instructions 2017 by offering an intuitive interface and automated workflows. Users can easily fill in required fields, sign documents securely, and share them without any hassle.

-

What is the pricing structure for airSlate SignNow when using it for 2018 nm pit 1 instructions 2017?

AirSlate SignNow provides flexible pricing plans that cater to various needs, allowing you to manage 2018 nm pit 1 instructions 2017 without breaking the bank. These plans typically include a free trial, enabling you to explore features before committing to a subscription.

-

Can airSlate SignNow integrate with other tools for processing 2018 nm pit 1 instructions 2017?

Yes, airSlate SignNow offers integrations with numerous third-party applications, making it easy to manage 2018 nm pit 1 instructions 2017 alongside your existing tools. Popular integrations include Google Drive, Salesforce, and numerous CRM systems, enhancing your document workflow.

-

What are the benefits of using airSlate SignNow for the 2018 nm pit 1 instructions 2017?

Using airSlate SignNow for your 2018 nm pit 1 instructions 2017 provides speed and efficiency, allowing you to complete essential documentation quickly and securely. Additionally, it enhances collaboration among team members and ensures compliance with the latest regulations.

-

Is airSlate SignNow secure for processing sensitive 2018 nm pit 1 instructions 2017?

Absolutely! airSlate SignNow implements industry-standard security measures, such as encryption and secure cloud storage, ensuring that your 2018 nm pit 1 instructions 2017 are protected from unauthorized access. This reliability gives businesses peace of mind when handling sensitive documents.

-

How can I get started with airSlate SignNow for my 2018 nm pit 1 instructions 2017 needs?

To get started with airSlate SignNow for your 2018 nm pit 1 instructions 2017, simply visit our website and sign up for a free trial. The platform is user-friendly, allowing you to quickly navigate its tools and features to meet your documentation requirements.

Get more for Pit 1 Instructions

Find out other Pit 1 Instructions

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer