How Do I Find a Good IRS Tax Attorney? 2023

Understanding IRS Form 433-A

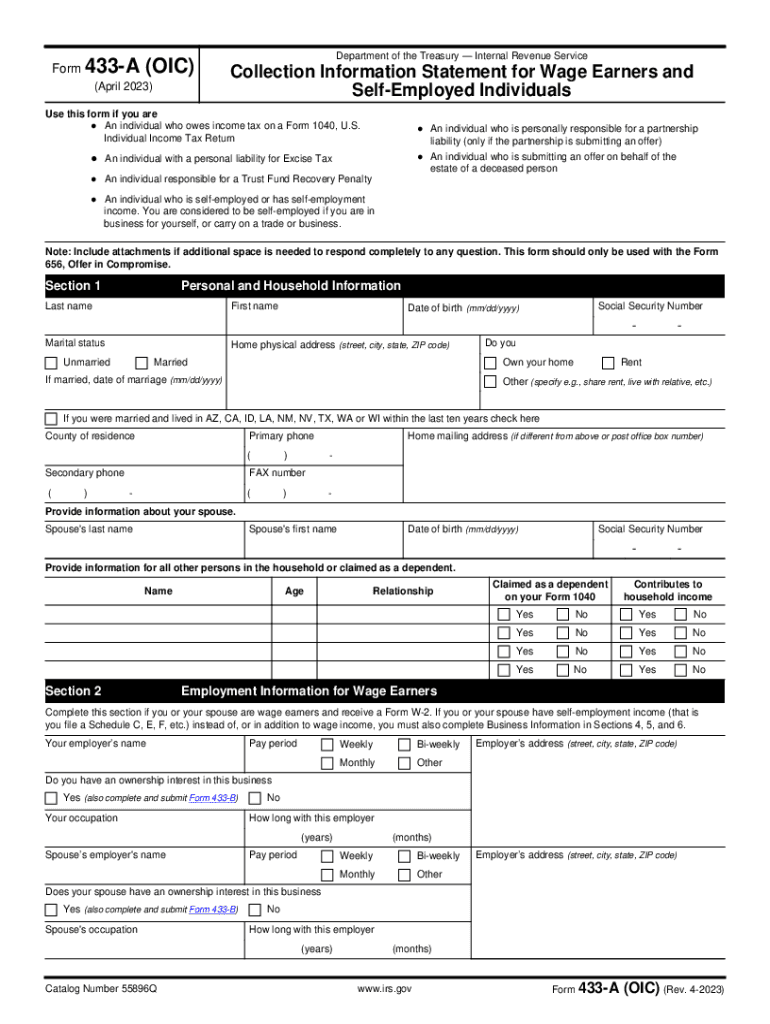

IRS Form 433-A is a crucial document used by individuals to provide the Internal Revenue Service with detailed information about their financial situation. This form is often required when taxpayers apply for an Offer in Compromise (OIC), which allows them to settle their tax debts for less than the full amount owed. Completing Form 433-A accurately is essential for a successful application, as it helps the IRS assess a taxpayer's ability to pay their debts.

Eligibility Criteria for Filing Form 433-A

To qualify for an Offer in Compromise using Form 433-A, taxpayers must meet specific eligibility criteria. Generally, individuals must be current with their tax filings and not be in an open bankruptcy case. The IRS evaluates the taxpayer's income, expenses, and asset equity to determine if they qualify for the OIC program. Understanding these criteria can help taxpayers prepare their financial information accurately.

Steps to Complete IRS Form 433-A

Filling out IRS Form 433-A involves several key steps:

- Gather necessary financial documents, including pay stubs, bank statements, and any other relevant financial information.

- Complete the personal information section, including your name, Social Security number, and contact details.

- Detail your income sources, including wages, self-employment income, and any other earnings.

- List your monthly expenses, categorizing them into necessary living expenses such as housing, utilities, and food.

- Provide information about your assets, including real estate, vehicles, and bank accounts.

Required Documents for Form Submission

When submitting IRS Form 433-A, several supporting documents are required to substantiate the information provided. These documents may include:

- Recent pay stubs or proof of income.

- Bank statements for the last three months.

- Documentation of any assets, such as property deeds or vehicle titles.

- Monthly expense receipts or statements to support your claimed expenses.

Form Submission Methods

IRS Form 433-A can be submitted to the IRS in various ways. Taxpayers can choose to file the form online through the IRS website, mail it to the appropriate address, or deliver it in person at a local IRS office. Choosing the right submission method can impact processing times and the overall experience.

IRS Guidelines for Form 433-A

The IRS provides specific guidelines for completing and submitting Form 433-A. It is essential to follow these guidelines closely to avoid delays or rejections. The form must be filled out completely, and all supporting documents should be included to ensure that the IRS has all the information needed to process the application efficiently.

Quick guide on how to complete how do i find a good irs tax attorney

Effortlessly Prepare How Do I Find A Good IRS Tax Attorney? on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage How Do I Find A Good IRS Tax Attorney? on any device using the airSlate SignNow Android or iOS applications and enhance your document-oriented operations today.

How to Modify and Electronically Sign How Do I Find A Good IRS Tax Attorney? with Ease

- Locate How Do I Find A Good IRS Tax Attorney? and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign How Do I Find A Good IRS Tax Attorney? and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how do i find a good irs tax attorney

Create this form in 5 minutes!

How to create an eSignature for the how do i find a good irs tax attorney

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 433a schedule?

The 2020 433a schedule is a tax form required by the IRS for reporting a taxpayer's financial position. It includes necessary details about assets, liabilities, and income. Understanding this schedule is crucial for accurately assessing your financial situation when filing taxes.

-

How can airSlate SignNow simplify the process of handling the 2020 433a schedule?

airSlate SignNow provides a user-friendly platform to easily send, sign, and manage your documents related to the 2020 433a schedule. With our electronic signature capabilities, you can streamline the approval process and ensure that your forms are completed on time. This software saves you from the stress of paper documents and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for the 2020 433a schedule?

Yes, airSlate SignNow offers various pricing plans tailored to your business's needs when dealing with the 2020 433a schedule. Our plans include features that enable you to efficiently manage your signing and document management processes, providing great value for the cost. A free trial option is also available to help you evaluate our service.

-

What features does airSlate SignNow offer to assist with the 2020 433a schedule?

airSlate SignNow includes features like templates for the 2020 433a schedule, document tracking, and integration with various cloud services. These functionalities ensure a seamless signing experience and simplify document management. You can automate repetitive tasks, making it faster to handle forms like the 2020 433a schedule.

-

What are the benefits of using airSlate SignNow for the 2020 433a schedule?

Using airSlate SignNow for the 2020 433a schedule helps you save time and reduce errors in document handling. Our eSigning solution is legally binding, ensuring that your signed documents are secure and compliant with regulations. Additionally, you can access your documents anytime, anywhere, providing flexibility in your workflow.

-

Can I integrate airSlate SignNow with other software for the 2020 433a schedule?

Absolutely! airSlate SignNow seamlessly integrates with various platforms, including Google Drive, Salesforce, and more, making it easier to manage your 2020 433a schedule documents. These integrations allow you to pull information directly from other applications, further streamlining your document preparation process. This flexibility enables you to work efficiently with existing tools.

-

How secure is airSlate SignNow when handling the 2020 433a schedule?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the 2020 433a schedule. Our platform uses advanced encryption technologies and follows industry best practices to protect your data. You can trust that your information is secure and compliant with data protection regulations.

Get more for How Do I Find A Good IRS Tax Attorney?

- West virginia notice 497431674 form

- Temporary lease agreement to prospective buyer of residence prior to closing west virginia form

- Wv eviction 497431676 form

- Letter from landlord to tenant returning security deposit less deductions west virginia form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return west virginia form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return west form

- Letter from tenant to landlord containing request for permission to sublease west virginia form

- West virginia paid form

Find out other How Do I Find A Good IRS Tax Attorney?

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease