Form 656 Booklet Offer in Compromise 2023

What is the Form 656 Booklet Offer In Compromise

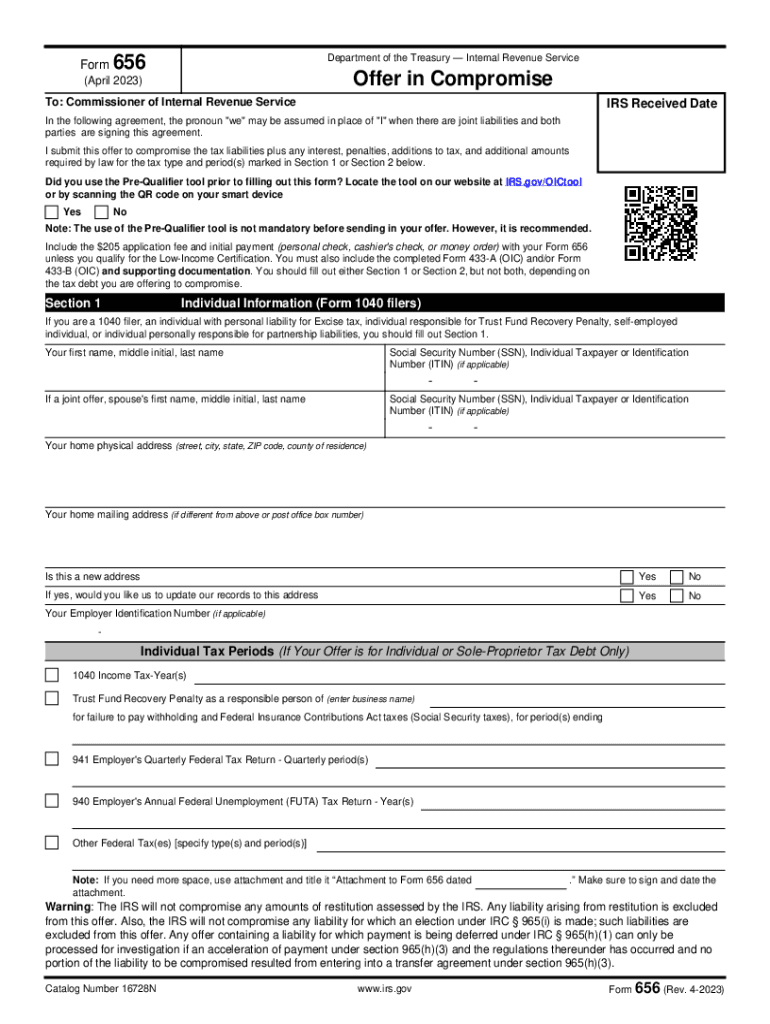

The Form 656 Booklet, also known as the Offer In Compromise (OIC), is a crucial document provided by the IRS that allows taxpayers to settle their tax debts for less than the full amount owed. This program is designed for individuals who cannot pay their tax liabilities in full or who would face financial hardship if they did. The booklet provides detailed instructions on how to apply for this program, including eligibility criteria, necessary documentation, and the overall process. Understanding the Form 656 is essential for anyone considering this option to resolve their tax issues effectively.

Steps to complete the Form 656 Booklet Offer In Compromise

Completing the Form 656 requires careful attention to detail to ensure all information is accurate. The process typically involves the following steps:

- Gather necessary documents: Collect financial information, including income, expenses, and assets, to support your application.

- Fill out the Form 656: Complete the form accurately, providing all required personal and financial details. Ensure that you select the appropriate offer type based on your situation.

- Complete the Form 433-A or 433-B: Depending on whether you are an individual or a business, you will need to fill out the corresponding financial disclosure form to provide the IRS with a clear picture of your financial situation.

- Review your application: Double-check all entries for accuracy and completeness before submission.

- Submit your application: Send your completed forms and any required documentation to the appropriate IRS address as indicated in the Form 656 Booklet.

Legal use of the Form 656 Booklet Offer In Compromise

The Form 656 is legally recognized as a binding agreement between the taxpayer and the IRS once accepted. To ensure its legal validity, it must be completed in accordance with IRS guidelines and submitted with the required fee. This form allows taxpayers to negotiate their tax liabilities, and upon acceptance, the IRS agrees to settle the debt for the amount specified in the offer. It is important to understand that submitting this form does not automatically halt collection actions; taxpayers must ensure compliance with all IRS requests during the review process.

Eligibility Criteria

To qualify for the Offer In Compromise program, taxpayers must meet specific eligibility criteria set by the IRS. These include:

- Inability to pay: Taxpayers must demonstrate that they cannot pay their tax debts in full without experiencing financial hardship.

- Compliance with tax obligations: Applicants must be current with all filing requirements and not have any outstanding tax returns.

- Reasonable collection potential: The IRS will evaluate the taxpayer's financial situation to determine if the offered amount is acceptable based on their ability to pay.

Required Documents

When submitting the Form 656, certain documents are required to support the application. These typically include:

- Form 433-A or 433-B: These forms provide detailed financial information about the taxpayer's income, expenses, and assets.

- Proof of income: Recent pay stubs, bank statements, or other documentation that verifies income sources.

- Proof of expenses: Documentation showing monthly living expenses, such as housing, utilities, and medical costs.

- Tax returns: Copies of recent tax returns to ensure compliance with IRS filing requirements.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 656 can be done through various methods, depending on the taxpayer's preference and the specific requirements outlined by the IRS. The primary submission methods include:

- Mail: The most common method, where the completed form and supporting documents are sent to the designated IRS address.

- Online submission: Certain taxpayers may have the option to submit their offer electronically through the IRS website, streamlining the process.

- In-person: While not typical, some taxpayers may choose to deliver their forms directly to an IRS office, especially if they have questions or need assistance.

Quick guide on how to complete form 656 booklet offer in compromise

Complete Form 656 Booklet Offer In Compromise effortlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without delays. Manage Form 656 Booklet Offer In Compromise on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The optimal method to modify and eSign Form 656 Booklet Offer In Compromise with ease

- Locate Form 656 Booklet Offer In Compromise and then click Get Form to initiate.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form 656 Booklet Offer In Compromise and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 booklet offer in compromise

Create this form in 5 minutes!

How to create an eSignature for the form 656 booklet offer in compromise

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow offer 2022?

The airSlate SignNow offer 2022 provides a versatile eSigning solution designed to streamline document management for businesses of all sizes. With this offer, users can enjoy advanced features at competitive pricing, making it easier to send and eSign important documents securely.

-

How much does the airSlate SignNow offer 2022 cost?

The pricing for the airSlate SignNow offer 2022 is structured to be budget-friendly, accommodating various business needs. You can choose from different subscription plans that cater to your signing volume and feature requirements, ensuring you get the best value for your investment.

-

What features are included in the airSlate SignNow offer 2022?

The airSlate SignNow offer 2022 includes features like customizable templates, bulk sending, and secure cloud storage. These tools empower businesses to manage their signing processes efficiently while enhancing collaboration and reducing turnaround time on important documents.

-

What are the benefits of using airSlate SignNow under the offer 2022?

Utilizing airSlate SignNow through the offer 2022 brings signNow benefits such as improved workflow efficiency, cost savings, and enhanced security. Companies can streamline their document signing processes, allowing for quicker decision-making and better compliance with industry standards.

-

Can I integrate airSlate SignNow with other software using the offer 2022?

Yes, the airSlate SignNow offer 2022 supports integration with various software applications, such as CRMs and project management tools. This enables users to enhance their business workflows, creating a seamless process for document management and eSigning.

-

Is there a free trial available for the airSlate SignNow offer 2022?

Yes, airSlate SignNow offers a free trial as part of the offer 2022, allowing potential customers to experience its features firsthand. This trial period gives businesses the opportunity to assess how the platform can meet their specific eSigning needs before committing to a subscription.

-

How secure is airSlate SignNow under the offer 2022?

Security is a top priority for airSlate SignNow under the offer 2022, featuring advanced encryption and compliance with industry standards such as GDPR and HIPAA. This ensures that your documents and data are protected throughout the signing process, giving you peace of mind.

Get more for Form 656 Booklet Offer In Compromise

- North carolina agreement form

- Notice of default on residential lease north carolina form

- Landlord tenant lease co signer agreement north carolina form

- Application for sublease north carolina form

- North carolina post form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out north carolina form

- Property manager agreement north carolina form

- Agreement for delayed or partial rent payments north carolina form

Find out other Form 656 Booklet Offer In Compromise

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT