About Form 8843, Statement for Exempt Individuals and Individuals WithAbout Form 8843, Statement for Exempt Individuals and Indi

Understanding Form 8843

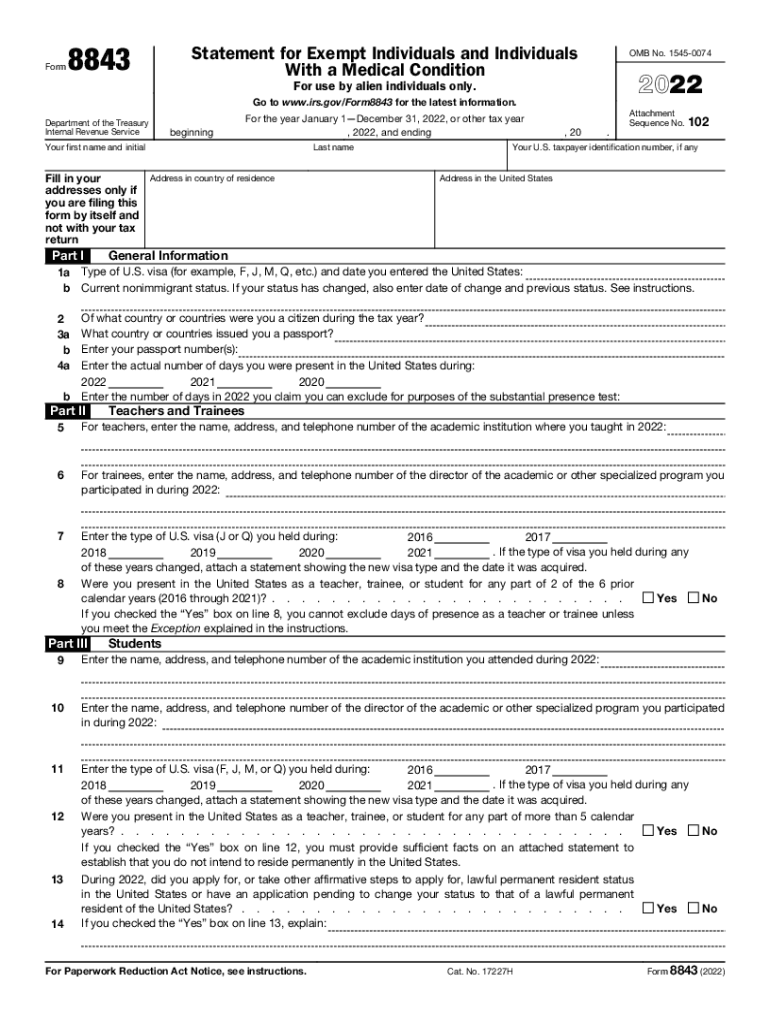

The 2022 Form 8843, officially titled "Statement for Exempt Individuals and Individuals with a Medical Condition," is a tax document required by the Internal Revenue Service (IRS) for certain non-resident aliens. This form is primarily used by international students and scholars to claim exemption from the substantial presence test, which determines residency for tax purposes. Completing this form is essential for individuals who wish to maintain their non-resident status while in the United States.

Steps to Complete the 2022 Form 8843

Filling out the 2022 Form 8843 involves several key steps:

- Gather necessary information, including personal details, visa status, and the number of days spent in the U.S.

- Complete the form accurately, ensuring that all sections are filled out according to your specific situation.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your information.

It is important to follow these steps carefully to avoid any issues with the IRS.

Filing Deadlines for Form 8843

The due date for submitting the 2022 Form 8843 typically aligns with the tax filing deadline, which is April 15. However, if you are not required to file a tax return, you must still submit Form 8843 by this date to maintain your non-resident status. Be aware of any changes to deadlines that may occur due to special circumstances or extensions provided by the IRS.

Eligibility Criteria for Form 8843

To be eligible to file the 2022 Form 8843, individuals must meet specific criteria, including:

- Holding a valid non-immigrant visa, such as F-1 or J-1.

- Being classified as a non-resident alien for tax purposes.

- Having been present in the United States for a limited number of days during the tax year.

Understanding these criteria is crucial to ensure compliance and avoid potential penalties.

Legal Use of Form 8843

The 2022 Form 8843 serves a legal purpose by documenting the tax status of exempt individuals. It is essential for maintaining compliance with U.S. tax laws and ensuring that individuals are not incorrectly classified as residents. This form can protect individuals from unnecessary tax liabilities and is a vital part of the tax filing process for international students and scholars.

Form Submission Methods

Submitting the 2022 Form 8843 can be done through various methods:

- Online submission through the IRS e-file system, if applicable.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Choosing the right submission method can help ensure that your form is processed efficiently and on time.

Quick guide on how to complete about form 8843 statement for exempt individuals and individuals withabout form 8843 statement for exempt individuals and

Effortlessly prepare About Form 8843, Statement For Exempt Individuals And Individuals WithAbout Form 8843, Statement For Exempt Individuals And Indi on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow offers all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage About Form 8843, Statement For Exempt Individuals And Individuals WithAbout Form 8843, Statement For Exempt Individuals And Indi on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign About Form 8843, Statement For Exempt Individuals And Individuals WithAbout Form 8843, Statement For Exempt Individuals And Indi seamlessly

- Find About Form 8843, Statement For Exempt Individuals And Individuals WithAbout Form 8843, Statement For Exempt Individuals And Indi and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign About Form 8843, Statement For Exempt Individuals And Individuals WithAbout Form 8843, Statement For Exempt Individuals And Indi and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 8843 and why is it important?

Form 8843 explained is a critical document for certain non-resident aliens. It helps individuals claim exempt status for specific income and ensures compliance with U.S. tax regulations.

-

How does airSlate SignNow facilitate the eSigning of Form 8843?

With airSlate SignNow, Form 8843 explained is made easy through its user-friendly interface. Users can quickly upload, fill out, and eSign the form, ensuring a seamless process without physical paperwork.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to various business needs. Understanding the pricing structure is essential, and knowing how Form 8843 explained fits into the service can help users determine the best option.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports various integrations which allow users to manage documents effortlessly. This is particularly useful when dealing with multiple forms, including the 8843 explained, which can streamline your workflow.

-

What benefits does airSlate SignNow provide for eSigning documents?

Using airSlate SignNow provides numerous benefits such as enhanced security, reduced turnaround time, and easy access to signed documents. These advantages make dealing with forms like the 8843 explained more efficient and reliable.

-

How secure is the eSigning process with airSlate SignNow?

The eSigning process offered by airSlate SignNow is highly secure, incorporating robust encryption and compliance measures. This ensures that documents, including 8843 explained, are protected against unauthorized access.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with all their queries. Whether you have questions about using the platform or need help with the 8843 explained, support is readily available.

Get more for About Form 8843, Statement For Exempt Individuals And Individuals WithAbout Form 8843, Statement For Exempt Individuals And Indi

Find out other About Form 8843, Statement For Exempt Individuals And Individuals WithAbout Form 8843, Statement For Exempt Individuals And Indi

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document