Form CIFT 401W Unrelated Business Income Worksheet for IRC 2022

What is the Form CIFT 401W Unrelated Business Income Worksheet for IRC

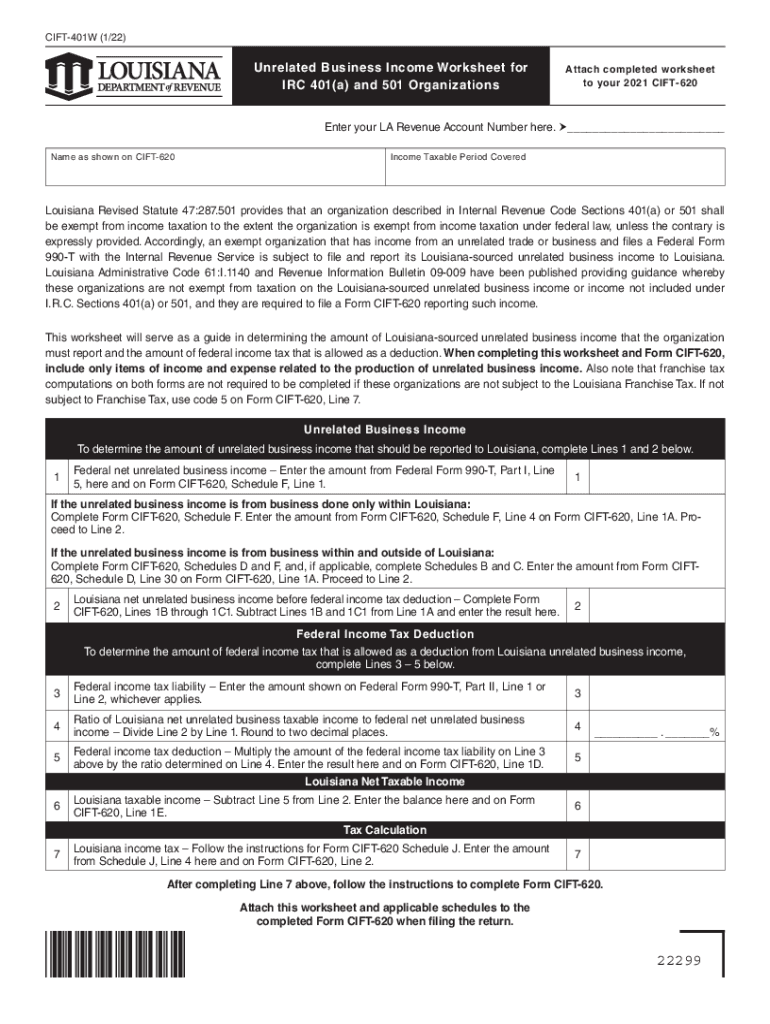

The Form CIFT 401W is specifically designed for organizations to report unrelated business income, as required by the Internal Revenue Code (IRC). This form helps entities determine their taxable income from activities that are not substantially related to their exempt purposes. It is essential for non-profit organizations, including charities and educational institutions, to accurately report this income to ensure compliance with tax regulations.

How to use the Form CIFT 401W Unrelated Business Income Worksheet for IRC

To effectively use the Form CIFT 401W, organizations must first gather all relevant financial information regarding their unrelated business activities. This includes income generated from sales, services, or any other activities that do not align with their primary mission. Once the necessary data is collected, organizations can fill out the form by entering their income and expenses, thus calculating their net unrelated business income accurately.

Steps to complete the Form CIFT 401W Unrelated Business Income Worksheet for IRC

Completing the Form CIFT 401W involves several key steps:

- Gather all financial records related to unrelated business activities.

- List all sources of unrelated business income on the form.

- Document related expenses that can be deducted from the income.

- Calculate the net income by subtracting total expenses from total income.

- Review the form for accuracy before submission.

Legal use of the Form CIFT 401W Unrelated Business Income Worksheet for IRC

The legal use of the Form CIFT 401W is critical for compliance with IRS regulations. Organizations must ensure that they are reporting all unrelated business income accurately to avoid penalties. The form serves as a formal declaration of income and expenses associated with unrelated business activities, which must be filed annually as part of the organization's tax obligations.

Key elements of the Form CIFT 401W Unrelated Business Income Worksheet for IRC

Key elements of the Form CIFT 401W include:

- Identification of the organization, including its name and tax identification number.

- Detailed reporting of all unrelated business income sources.

- Documentation of allowable expenses related to generating that income.

- Calculations for net income, which is essential for tax reporting.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Form CIFT 401W. Generally, the form should be submitted alongside the organization's annual tax return. It is important to stay informed about any changes in deadlines, which may vary based on the organization's fiscal year and IRS regulations.

Penalties for Non-Compliance

Failure to file the Form CIFT 401W accurately and on time can result in significant penalties. Organizations may face fines and interest on unpaid taxes if they do not comply with reporting requirements. It is crucial for organizations to understand these risks and ensure timely and accurate submissions to avoid complications with the IRS.

Quick guide on how to complete form cift 401w unrelated business income worksheet for irc

Prepare Form CIFT 401W Unrelated Business Income Worksheet For IRC effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form CIFT 401W Unrelated Business Income Worksheet For IRC on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign Form CIFT 401W Unrelated Business Income Worksheet For IRC effortlessly

- Obtain Form CIFT 401W Unrelated Business Income Worksheet For IRC and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to share your form, through email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes requiring the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and eSign Form CIFT 401W Unrelated Business Income Worksheet For IRC and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cift 401w unrelated business income worksheet for irc

Create this form in 5 minutes!

People also ask

-

What is a business income worksheet PDF?

A business income worksheet PDF is a document designed to help business owners track their income and expenses efficiently. It serves as a vital tool for preparing taxes and assessing overall financial health. By using a business income worksheet PDF, you can simplify your financial management and ensure accurate reporting.

-

How can I obtain a business income worksheet PDF from airSlate SignNow?

To obtain a business income worksheet PDF from airSlate SignNow, simply visit our website and navigate to our document templates. You can easily download a customizable version that suits your specific business needs. Additionally, you can create your own business income worksheet PDF by using our easy-to-use document editor.

-

Is the business income worksheet PDF customizable?

Yes, the business income worksheet PDF offered by airSlate SignNow is fully customizable. You can modify the fields, add your branding, and tailor the document to fit your business requirements. This flexibility ensures that your business income worksheet PDF meets all the unique aspects of your financial tracking.

-

What features are included with the business income worksheet PDF?

The business income worksheet PDF includes various features such as editable fields for income and expenses, calculation formulas for total income, and user-friendly navigation. These features help you ensure accuracy while saving time during the financial tracking process. Additionally, the document is designed for easy eSigning, making it simple to share and approve.

-

Are there any costs associated with the business income worksheet PDF?

Accessing a business income worksheet PDF through airSlate SignNow is cost-effective, with pricing options that suit different business sizes. You can choose from various plans that best fit your usage needs. Many features are included at no additional cost, allowing you to manage your documents without breaking the budget.

-

Can I integrate the business income worksheet PDF with other software?

Yes, airSlate SignNow allows for seamless integration with various software platforms. You can connect your business income worksheet PDF with accounting tools and CRMs, creating a centralized location for all your financial documents. This integration helps streamline your workflow and enhances overall productivity.

-

How does the business income worksheet PDF benefit my business?

The business income worksheet PDF benefits your business by providing a clear outline of income and expenses, helping you make informed financial decisions. It can save you time during tax season and reduce the risk of errors in your financial reporting. With organized tracking, your business can better manage cash flow and identify areas for growth.

Get more for Form CIFT 401W Unrelated Business Income Worksheet For IRC

Find out other Form CIFT 401W Unrelated Business Income Worksheet For IRC

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure