Unrelated Business Income Worksheet for IRC 401a and 2023

What is the Unrelated Business Income Worksheet For IRC 401a And

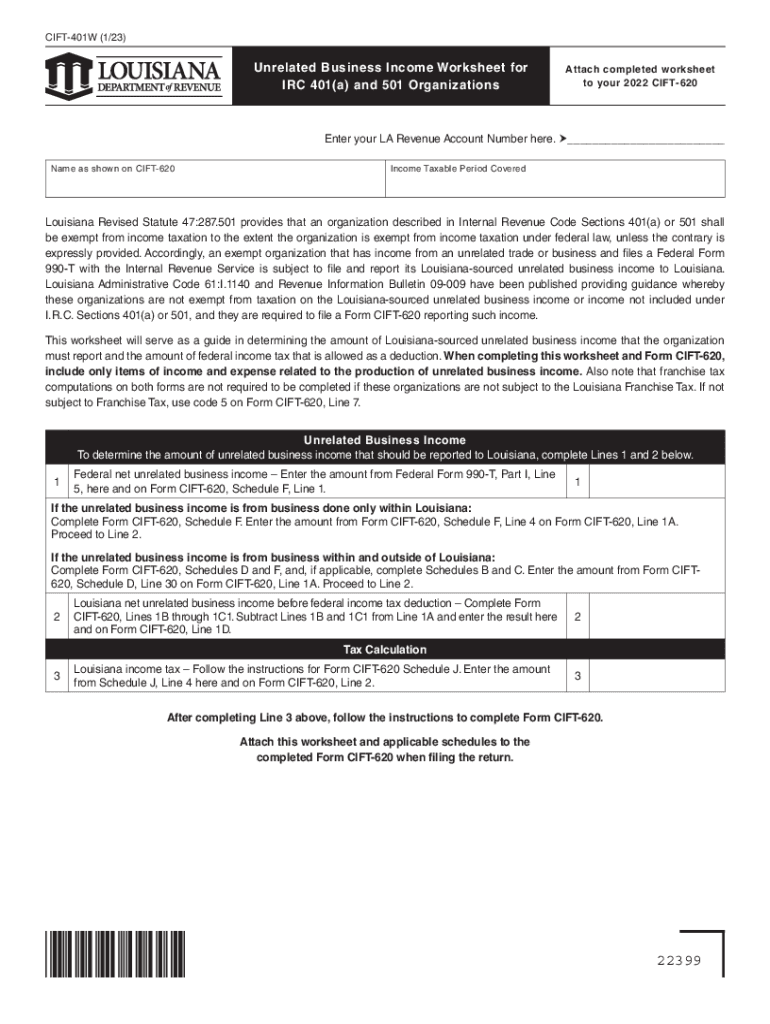

The Unrelated Business Income Worksheet for IRC 401a is a tax form designed for organizations that have tax-exempt status under section 401(a) of the Internal Revenue Code. This worksheet helps these organizations determine their unrelated business taxable income (UBTI), which is income generated from activities not substantially related to their exempt purpose. Understanding UBTI is crucial for compliance with IRS regulations, as it may subject the organization to taxation. The worksheet assists in calculating the amount of UBTI and ensures that organizations report this income accurately on their tax returns.

How to use the Unrelated Business Income Worksheet For IRC 401a And

Using the Unrelated Business Income Worksheet involves several key steps. First, organizations must gather all relevant financial information related to their unrelated business activities. This includes income generated from these activities and any associated expenses. Next, organizations fill out the worksheet by inputting their income and expenses, which will help determine their UBTI. It is essential to follow the instructions carefully to ensure all calculations are accurate. Once completed, the worksheet should be submitted along with the organization's tax return.

Steps to complete the Unrelated Business Income Worksheet For IRC 401a And

Completing the Unrelated Business Income Worksheet requires a systematic approach:

- Gather financial documents related to unrelated business activities.

- List all sources of income generated from these activities.

- Document all expenses incurred while generating this income.

- Calculate the total income and total expenses.

- Subtract total expenses from total income to determine UBTI.

- Complete the worksheet by entering the calculated UBTI.

Review the worksheet for accuracy before submitting it with the organization's tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Unrelated Business Income Worksheet. These guidelines outline what constitutes unrelated business income and detail the types of activities that may generate UBTI. Organizations must adhere to these guidelines to ensure compliance and avoid potential penalties. The IRS also emphasizes the importance of maintaining accurate records of income and expenses related to unrelated business activities. Understanding these guidelines is vital for organizations to navigate their tax obligations effectively.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Unrelated Business Income Worksheet. Typically, the form must be submitted along with the organization's annual tax return. For most tax-exempt organizations, this deadline falls on the fifteenth day of the fifth month after the end of their fiscal year. It is essential to mark these dates on the calendar to avoid late filing penalties. Organizations should also consider any extensions that may apply to their specific tax situation.

Required Documents

To complete the Unrelated Business Income Worksheet, organizations need several key documents:

- Financial statements detailing income and expenses from unrelated business activities.

- Prior year tax returns, if applicable, for reference.

- Any additional documentation that supports income claims, such as invoices or receipts.

Having these documents readily available will streamline the process of filling out the worksheet and ensure accuracy in reporting.

Quick guide on how to complete unrelated business income worksheet for irc 401a and

Complete Unrelated Business Income Worksheet For IRC 401a And effortlessly on any device

Online document organization has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Unrelated Business Income Worksheet For IRC 401a And on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign Unrelated Business Income Worksheet For IRC 401a And without stress

- Locate Unrelated Business Income Worksheet For IRC 401a And and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of your documents or obscure sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal status as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether it be email, text message (SMS), or invitation link, or download it to your desktop.

Eliminate worries about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Unrelated Business Income Worksheet For IRC 401a And and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct unrelated business income worksheet for irc 401a and

Create this form in 5 minutes!

How to create an eSignature for the unrelated business income worksheet for irc 401a and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Unrelated Business Income Worksheet For IRC 401a And?

The Unrelated Business Income Worksheet For IRC 401a And is a structured form used to calculate unrelated business taxable income for organizations within retirement plans. This worksheet helps ensure compliance with IRS regulations and provides clarity on income generated from non-related activities.

-

How can airSlate SignNow assist with the Unrelated Business Income Worksheet For IRC 401a And?

airSlate SignNow streamlines the process of creating, sending, and signing the Unrelated Business Income Worksheet For IRC 401a And. Our platform allows users to easily fill out, share, and eSign documents, making it a convenient solution for organizations managing their tax compliance.

-

Is airSlate SignNow cost-effective for handling the Unrelated Business Income Worksheet For IRC 401a And?

Yes, airSlate SignNow offers competitive pricing that makes it an affordable choice for businesses needing to manage the Unrelated Business Income Worksheet For IRC 401a And. With flexible plans, you can choose the one that best fits your organizational needs without compromising on quality.

-

What features does airSlate SignNow offer for the Unrelated Business Income Worksheet For IRC 401a And?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure eSignature capabilities specifically designed for documents like the Unrelated Business Income Worksheet For IRC 401a And. Additionally, our platform ensures document integrity and compliance with legal standards.

-

Are there any integrations available for the Unrelated Business Income Worksheet For IRC 401a And?

Yes, airSlate SignNow seamlessly integrates with various business tools, allowing users to upload or sync the Unrelated Business Income Worksheet For IRC 401a And from platforms like Google Drive, Dropbox, and more. This integration simplifies document management and enhances productivity.

-

Can airSlate SignNow help ensure accuracy when completing the Unrelated Business Income Worksheet For IRC 401a And?

Absolutely! airSlate SignNow provides helpful features such as validation checks and built-in instructions to ensure accuracy when filling out the Unrelated Business Income Worksheet For IRC 401a And. Our platform guides users through the process, reducing errors and enhancing compliance.

-

What are the benefits of using airSlate SignNow for the Unrelated Business Income Worksheet For IRC 401a And?

Using airSlate SignNow for the Unrelated Business Income Worksheet For IRC 401a And offers numerous benefits, including increased efficiency in document handling, improved accuracy, and faster turnaround times for signatures. Our platform enhances collaboration among team members and stakeholders.

Get more for Unrelated Business Income Worksheet For IRC 401a And

- Civil sacsheriff come services portal county suite portal form

- Conservatorship forms fill online printable fillable blank

- Orange county jury duty call in form

- Adult immunization consent form get immunized guam getimmunizedguam

- Details on april gaus living in conway pa form

- Cover sheet of moving party form

- Www tas equestrian org aushow horseshow horse tasmania equestrian australia form

- Form 16 application to vary or set aside order magistrates court

Find out other Unrelated Business Income Worksheet For IRC 401a And

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free