Form CIFT 401W Unrelated Business Income Worksheet for 2024-2026

What is the Form CIFT 401W Unrelated Business Income Worksheet For

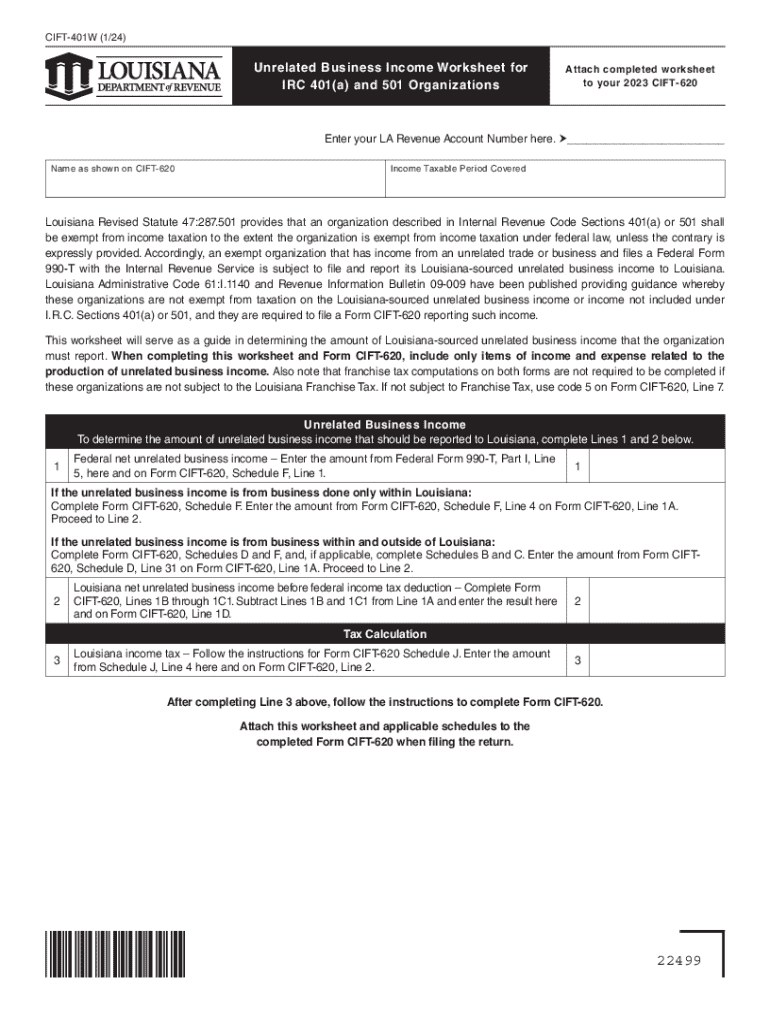

The Form CIFT 401W Unrelated Business Income Worksheet is primarily used by tax-exempt organizations to calculate and report unrelated business income. This form helps organizations determine the amount of income that is subject to federal income tax. It is essential for ensuring compliance with IRS regulations regarding unrelated business activities, which may include income from activities not substantially related to the organization's exempt purpose.

How to use the Form CIFT 401W Unrelated Business Income Worksheet For

To effectively use the Form CIFT 401W, organizations should first gather all relevant financial information related to their unrelated business activities. This includes income from sales, services, and other revenue-generating activities that do not align with the organization's primary exempt purpose. Once the necessary data is collected, organizations can fill out the worksheet to calculate their taxable income, ensuring that all figures are accurate and complete.

Steps to complete the Form CIFT 401W Unrelated Business Income Worksheet For

Completing the Form CIFT 401W involves several key steps:

- Collect financial records related to unrelated business income.

- Identify and report all sources of unrelated business income on the worksheet.

- Calculate allowable deductions related to the income generated.

- Determine the net unrelated business income by subtracting deductions from total income.

- Review the completed worksheet for accuracy before submission.

Key elements of the Form CIFT 401W Unrelated Business Income Worksheet For

Important elements of the Form CIFT 401W include sections for reporting gross income, allowable deductions, and the calculation of net unrelated business income. Additionally, the form requires organizations to provide details about the nature of the unrelated business activities, which is crucial for IRS compliance. Accurate reporting is essential to avoid potential penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form CIFT 401W. Organizations must adhere to these guidelines to ensure proper reporting of unrelated business income. This includes understanding what constitutes unrelated business activities and how to accurately report income and expenses. Familiarity with IRS regulations helps organizations maintain their tax-exempt status while complying with federal tax laws.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Form CIFT 401W. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's tax year. Meeting this deadline is crucial to avoid late filing penalties and ensure compliance with IRS requirements.

Create this form in 5 minutes or less

Find and fill out the correct form cift 401w unrelated business income worksheet for

Create this form in 5 minutes!

How to create an eSignature for the form cift 401w unrelated business income worksheet for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form CIFT 401W Unrelated Business Income Worksheet For?

The Form CIFT 401W Unrelated Business Income Worksheet For is designed to help organizations calculate their unrelated business taxable income. This worksheet simplifies the reporting process for tax-exempt entities, ensuring compliance with IRS regulations. By using this form, organizations can accurately report income from activities not directly related to their exempt purpose.

-

How can airSlate SignNow assist with the Form CIFT 401W Unrelated Business Income Worksheet For?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form CIFT 401W Unrelated Business Income Worksheet For. Our solution streamlines the document management process, allowing users to complete and submit their worksheets quickly. With our user-friendly interface, you can ensure that your forms are filled out accurately and sent securely.

-

What are the pricing options for using airSlate SignNow for the Form CIFT 401W Unrelated Business Income Worksheet For?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when handling the Form CIFT 401W Unrelated Business Income Worksheet For. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. You can choose from monthly or annual subscriptions, with options for additional users and features as required.

-

What features does airSlate SignNow offer for managing the Form CIFT 401W Unrelated Business Income Worksheet For?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the Form CIFT 401W Unrelated Business Income Worksheet For. These tools enhance your workflow, making it easier to manage and submit your forms. Additionally, our platform allows for collaboration, enabling multiple users to work on the same document seamlessly.

-

Can I integrate airSlate SignNow with other software for the Form CIFT 401W Unrelated Business Income Worksheet For?

Yes, airSlate SignNow offers integrations with various software applications to enhance your experience with the Form CIFT 401W Unrelated Business Income Worksheet For. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline your document management. This integration capability allows for a more cohesive workflow across your business operations.

-

What are the benefits of using airSlate SignNow for the Form CIFT 401W Unrelated Business Income Worksheet For?

Using airSlate SignNow for the Form CIFT 401W Unrelated Business Income Worksheet For provides numerous benefits, including increased efficiency and reduced paperwork. Our platform ensures that your documents are securely signed and stored, minimizing the risk of errors. Additionally, the ease of use allows your team to focus on their core tasks rather than getting bogged down in administrative work.

-

Is airSlate SignNow secure for handling the Form CIFT 401W Unrelated Business Income Worksheet For?

Absolutely! airSlate SignNow prioritizes security when handling the Form CIFT 401W Unrelated Business Income Worksheet For. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your documents are safe and accessible only to authorized users.

Get more for Form CIFT 401W Unrelated Business Income Worksheet For

- Karnataka bank account opening form filling

- Getting things done flowchart pdf form

- Stanford form for advance healthcare directive

- City of mesa contractor verification form

- P58 inland form

- Punjab form

- Town of bluffton business license form

- Application for duplicate plates andor stickers minnesota dps mn form

Find out other Form CIFT 401W Unrelated Business Income Worksheet For

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free