About Form 2210, Underpayment of Estimated Tax ByFederal Form 2210 Underpayment of Estimated Tax ByFederal Form 2210 Underpaymen 2022

Understanding Form 2210: Underpayment of Estimated Tax

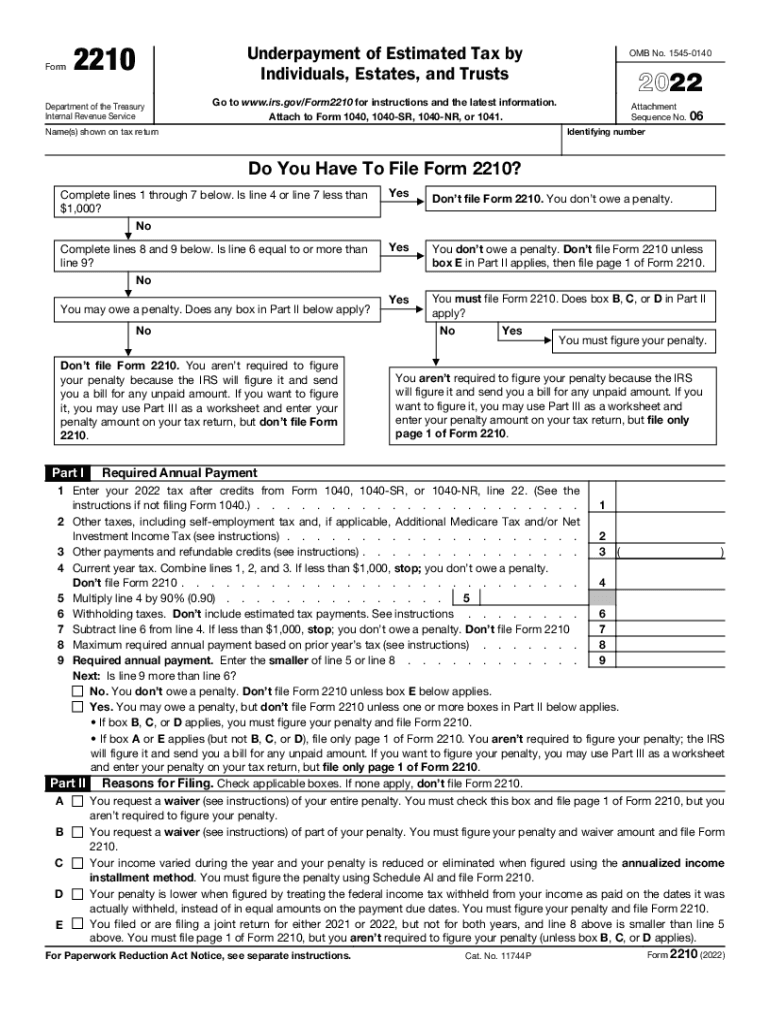

The IRS Form 2210 is designed for taxpayers who may not have paid enough estimated tax throughout the year. This form helps determine if you owe a penalty for underpayment. It is particularly relevant for individuals whose income fluctuates, such as self-employed individuals or those with multiple income sources. Understanding its purpose is crucial for avoiding unexpected penalties when filing your taxes.

Steps to Complete Form 2210

Completing Form 2210 requires careful attention to detail. Here are the essential steps:

- Gather your income information for the year, including all sources of income.

- Calculate your total tax liability using your tax return.

- Determine your total estimated tax payments made throughout the year.

- Use the form to compare your tax liability with your estimated payments.

- Follow the instructions to determine if you owe a penalty and how much it is.

IRS Guidelines for Form 2210

The IRS provides specific guidelines for using Form 2210. Taxpayers should be aware of the following:

- Form 2210 must be filed if you owe a penalty for underpayment.

- There are different versions of the form depending on your situation, such as the short and long forms.

- Ensure that all calculations are accurate to avoid additional penalties.

Filing Deadlines for Form 2210

Timely filing of Form 2210 is essential to avoid penalties. The form is typically due on the same date as your tax return. For most taxpayers, this is April 15. If you file for an extension, you must also file Form 2210 by the extended deadline.

Required Documents for Form 2210

To complete Form 2210, you will need several documents:

- Your previous year’s tax return for reference.

- Records of all income received during the year.

- Documentation of any estimated tax payments made.

- Any relevant forms that provide additional income or deductions.

Penalties for Non-Compliance with Form 2210

Failing to comply with the requirements of Form 2210 can result in penalties. The IRS may impose a penalty if you underpay your estimated taxes. The penalty amount is calculated based on the amount of underpayment and the length of time it remains unpaid. Understanding these penalties can help you avoid unnecessary financial burdens.

Quick guide on how to complete about form 2210 underpayment of estimated tax byfederal form 2210 underpayment of estimated tax byfederal form 2210

Complete About Form 2210, Underpayment Of Estimated Tax ByFederal Form 2210 Underpayment Of Estimated Tax ByFederal Form 2210 Underpaymen seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle About Form 2210, Underpayment Of Estimated Tax ByFederal Form 2210 Underpayment Of Estimated Tax ByFederal Form 2210 Underpaymen on any gadget with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

How to modify and eSign About Form 2210, Underpayment Of Estimated Tax ByFederal Form 2210 Underpayment Of Estimated Tax ByFederal Form 2210 Underpaymen effortlessly

- Obtain About Form 2210, Underpayment Of Estimated Tax ByFederal Form 2210 Underpayment Of Estimated Tax ByFederal Form 2210 Underpaymen and select Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to finalize your edits.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign About Form 2210, Underpayment Of Estimated Tax ByFederal Form 2210 Underpayment Of Estimated Tax ByFederal Form 2210 Underpaymen and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 2210 underpayment of estimated tax byfederal form 2210 underpayment of estimated tax byfederal form 2210

Create this form in 5 minutes!

People also ask

-

What is the significance of the code '2210' in relation to airSlate SignNow?

The code '2210' refers to specific functionalities and features associated with airSlate SignNow's digital signature solutions. By utilizing the 2210 framework, users can streamline their document workflows, ensuring efficient management of eSignatures and approvals.

-

How does airSlate SignNow pricing compare for plans linked to '2210' functionalities?

airSlate SignNow offers various pricing tiers that cater to different business needs, including those leveraging the '2210' features. Each plan provides a cost-effective solution, allowing businesses to choose a package that best fits their requirements and budget, ensuring value without sacrificing essential capabilities.

-

What are the main features of airSlate SignNow related to '2210'?

The '2210' features of airSlate SignNow encompass robust eSigning capabilities, customizable templates, and automated workflows. These features ensure that businesses can efficiently manage their document signing processes while improving compliance and tracking.

-

How can airSlate SignNow benefit my business when dealing with '2210' documents?

Using airSlate SignNow for managing '2210' documents can signNowly enhance your efficiency and workflow management. This platform provides a secure and user-friendly interface, ensuring that your documents are signed quickly and conveniently, which in turn can improve your overall business operations.

-

Can airSlate SignNow integrate with my existing systems related to '2210'?

Yes, airSlate SignNow supports integration with various platforms that may involve '2210' workflows, including CRM systems, cloud storage services, and productivity tools. This ensures a seamless transition and enhances your current processes by incorporating effective eSignature solutions.

-

What types of businesses commonly use airSlate SignNow and its '2210' features?

A wide range of businesses utilize airSlate SignNow and its '2210' features, including small startups, mid-sized companies, and large enterprises. Industries such as real estate, finance, and healthcare benefit signNowly from these tools, as they streamline document handling and improve transactional efficiency.

-

Is airSlate SignNow suitable for individual users when dealing with '2210' functionalities?

Absolutely! airSlate SignNow is designed to cater to both businesses and individual users, providing access to '2210' functionalities that enhance document signing experiences. Individual users can leverage the same efficiency and ease of use, making it an ideal choice for freelancers and professionals.

Get more for About Form 2210, Underpayment Of Estimated Tax ByFederal Form 2210 Underpayment Of Estimated Tax ByFederal Form 2210 Underpaymen

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497321639 form

- New york separation form

- New york certificate marriage form

- New york dissolution package to dissolve corporation new york form

- Ny dissolution llc form

- Living trust for husband and wife with no children new york form

- New york trust 497321645 form

- Living trust for individual who is single divorced or widow or widower with children new york form

Find out other About Form 2210, Underpayment Of Estimated Tax ByFederal Form 2210 Underpayment Of Estimated Tax ByFederal Form 2210 Underpaymen

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF