About Form 2210, Underpayment of Estimated Tax by 2019

Understanding Form 2210: Underpayment of Estimated Tax

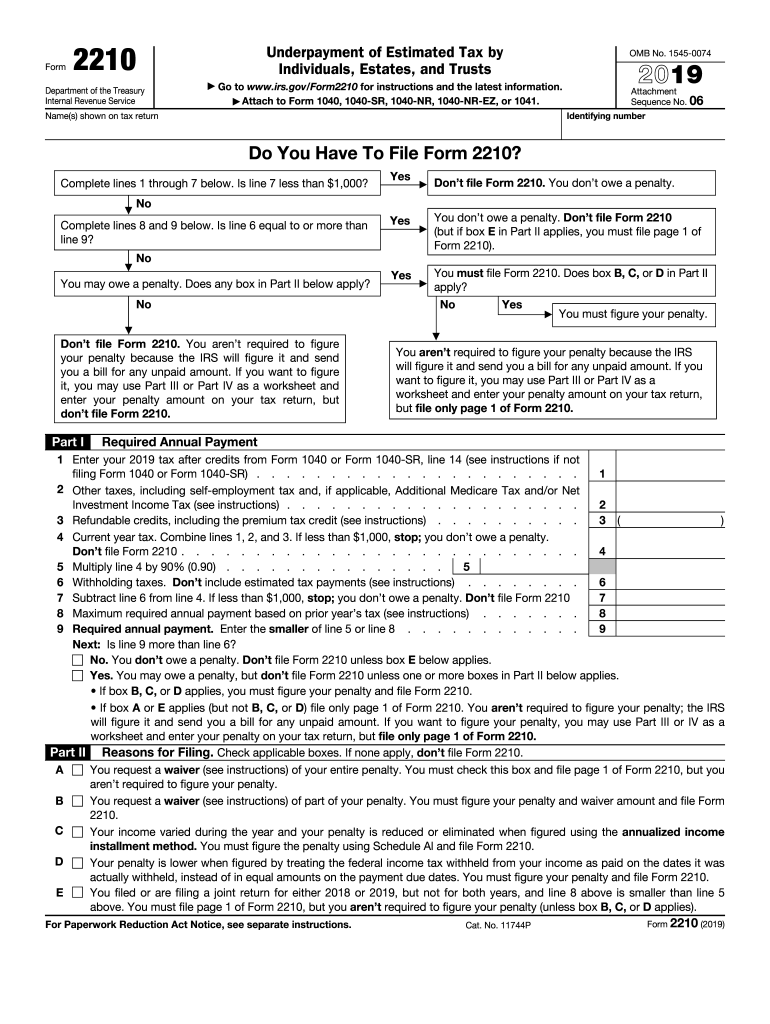

The 2019 IRS Form 2210 is designed for individuals who may have underpaid their estimated taxes throughout the year. This form helps taxpayers calculate any potential penalties for underpayment and determine whether they owe additional taxes. It is essential for those who have income that is not subject to withholding, such as self-employment income, rental income, or investment income. By accurately completing Form 2210, taxpayers can ensure compliance with IRS regulations and avoid unnecessary penalties.

Steps to Complete Form 2210

Completing Form 2210 involves several key steps:

- Gather Documentation: Collect all relevant financial documents, including income statements and previous tax returns.

- Calculate Your Estimated Tax Liability: Determine your total expected income and calculate the estimated taxes owed for the year.

- Determine Payments Made: Review your tax payments made throughout the year, including withholding and estimated tax payments.

- Complete the Form: Fill out the form with the calculated figures, ensuring accuracy in all entries.

- Review for Errors: Double-check all calculations and information for accuracy before submission.

IRS Guidelines for Form 2210

The IRS provides specific guidelines for using Form 2210. Taxpayers must understand the criteria for underpayment, which generally applies if the total tax owed is greater than one thousand dollars and if the taxpayer did not pay at least ninety percent of the current year's tax or one hundred percent of the prior year's tax. It is crucial to follow these guidelines to avoid penalties and ensure proper filing.

Filing Deadlines for Form 2210

Form 2210 must be filed along with your annual tax return by the tax deadline, which is typically April fifteenth for most taxpayers. If you are unable to meet this deadline, you may be eligible for an extension, but it is important to file Form 2210 by the original due date to avoid additional penalties. Understanding the deadlines helps ensure timely compliance with tax obligations.

Penalties for Non-Compliance with Form 2210

Failure to file Form 2210 when required can result in significant penalties. The IRS may impose a penalty based on the amount of underpayment and the length of time the payment is overdue. It is essential for taxpayers to be aware of these penalties and take necessary steps to file accurately and on time to avoid financial repercussions.

Digital vs. Paper Version of Form 2210

Taxpayers have the option to complete Form 2210 either digitally or on paper. The digital version can be filled out and submitted online, providing convenience and immediate processing. The paper version requires mailing the completed form to the IRS. Choosing the digital option can streamline the process and reduce the risk of errors associated with manual entry.

Quick guide on how to complete about form 2210 underpayment of estimated tax by

Manage About Form 2210, Underpayment Of Estimated Tax By effortlessly on any device

Digital document management has gained signNow traction among both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage About Form 2210, Underpayment Of Estimated Tax By on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign About Form 2210, Underpayment Of Estimated Tax By with ease

- Find About Form 2210, Underpayment Of Estimated Tax By and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important parts of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then hit the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or disorganized files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign About Form 2210, Underpayment Of Estimated Tax By and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 2210 underpayment of estimated tax by

Create this form in 5 minutes!

How to create an eSignature for the about form 2210 underpayment of estimated tax by

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the 2019 2210 form, and how can airSlate SignNow assist?

The 2019 2210 form is used to figure the underpayment of estimated tax by individuals. airSlate SignNow provides a seamless way to complete and eSign this form, ensuring compliance and accuracy. Our platform simplifies the process, allowing users to manage important tax documents like the 2019 2210 efficiently.

-

What are the key features of airSlate SignNow for handling the 2019 2210?

AirSlate SignNow offers numerous features tailored to enhance the completion of the 2019 2210 form. Users can easily upload, fill, and eSign their documents securely, and track the status in real time. The platform’s intuitive interface ensures that even complex forms like the 2019 2210 can be managed with ease.

-

Is airSlate SignNow cost-effective for managing the 2019 2210 form?

Yes, airSlate SignNow is a cost-effective solution for managing the 2019 2210 form. We offer various pricing plans that cater to both individuals and businesses, ensuring you get great value while simplifying your document management process. With our transparent pricing, users can be confident they are investing wisely in their document solutions.

-

Can I integrate airSlate SignNow with accounting software for the 2019 2210?

Absolutely! AirSlate SignNow integrates seamlessly with multiple accounting softwares, making it easy to manage documents related to the 2019 2210 form. This integration streamlines your workflow by allowing you to send signed documents directly to your accounting system, reducing manual entry and improving efficiency.

-

How secure is airSlate SignNow for eSigning the 2019 2210?

Security is a top priority for airSlate SignNow when eSigning documents like the 2019 2210 form. We utilize industry-standard encryption methods and secure servers to protect your sensitive information throughout the signing process. You can rest assured that your document is handled securely and confidentially.

-

What benefits does airSlate SignNow offer for small businesses dealing with the 2019 2210?

Small businesses utilizing airSlate SignNow to manage the 2019 2210 form can benefit from increased efficiency and reduced administrative tasks. Our platform simplifies document sending and signing processes, allowing businesses to focus on growth rather than paperwork. The time saved can signNowly improve overall productivity.

-

Can I customize the signing process for the 2019 2210 in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the signing process for documents like the 2019 2210 form. You can set specific signing orders, add team members for review, and create templates that streamline repetitive tasks. Customization ensures that the signing process fits your individual business needs perfectly.

Get more for About Form 2210, Underpayment Of Estimated Tax By

- Current year income assessment form 201920 current year income assessment form 201920

- Bsbitu306section2pkdocx from pk sent friday23 july form

- Wwwuetedupk studentresource downloadssummer semestersubject repetition registration form uetedupk

- Fillable online hayatabad medical complex peshawar no fax form

- Saving bank index card pakistan post form

- Pakistan centre for philanthropy form

- Isle of man public service careerslinkedin form

- Motor accident personal injury claim form

Find out other About Form 2210, Underpayment Of Estimated Tax By

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT