About Form 2210 F, Underpayment of Estimated Tax 2023

Understanding Form 2210 for Underpayment of Estimated Tax

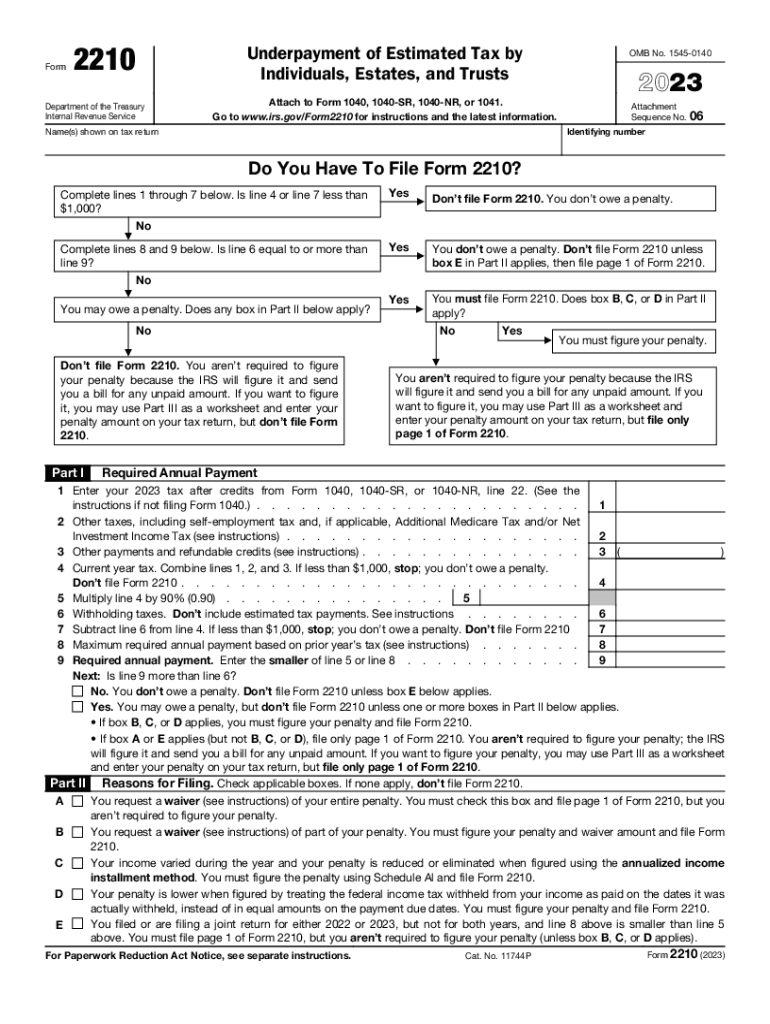

The IRS Form 2210 is specifically designed for taxpayers who may have underpaid their estimated taxes throughout the year. This form helps determine if you owe a penalty for underpayment and calculates the amount owed. It is essential for individuals who do not meet the safe harbor thresholds, which can help avoid penalties. The form is particularly relevant for self-employed individuals, retirees, and those with fluctuating incomes.

Steps to Complete Form 2210

Filling out the IRS Form 2210 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Determine your total tax liability for the year.

- Calculate your estimated tax payments made throughout the year.

- Use the worksheet provided in the form to assess whether you owe a penalty for underpayment.

- Complete the form by following the instructions carefully, ensuring all calculations are accurate.

- Submit the completed form along with your tax return or separately if needed.

Obtaining Form 2210

You can easily obtain the IRS Form 2210 by visiting the IRS website, where it is available for download as a fillable PDF. This allows you to fill out the form digitally, making the process more efficient. Additionally, many tax preparation software programs include this form, simplifying the completion process for users.

Filing Deadlines for Form 2210

The filing deadline for IRS Form 2210 typically aligns with the due date of your federal tax return. For most individuals, this is April 15 of the following year. However, if you file for an extension, you may have until October 15 to submit your return and the associated Form 2210. It is crucial to adhere to these deadlines to avoid potential penalties.

Legal Use of Form 2210

Form 2210 is legally required for taxpayers who owe a penalty for underpayment of estimated taxes. By accurately completing and submitting this form, you ensure compliance with IRS regulations. It is important to understand that failure to file this form when necessary can result in additional penalties and interest on the amount owed.

Examples of Using Form 2210

Consider a self-employed individual who has fluctuating income throughout the year. If they underestimate their tax liability and do not make sufficient estimated tax payments, they may need to file Form 2210 to determine any penalties owed. Another example includes retirees who receive income from pensions and investments but do not withhold enough taxes, leading to a potential underpayment situation.

Quick guide on how to complete about form 2210 f underpayment of estimated tax

Effortlessly prepare About Form 2210 F, Underpayment Of Estimated Tax on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing for the proper form to be obtained and securely stored online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without any hindrance. Manage About Form 2210 F, Underpayment Of Estimated Tax on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

How to modify and electronically sign About Form 2210 F, Underpayment Of Estimated Tax with ease

- Find About Form 2210 F, Underpayment Of Estimated Tax and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign About Form 2210 F, Underpayment Of Estimated Tax to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 2210 f underpayment of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the about form 2210 f underpayment of estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the irs 2210 fillable document and why do I need it?

The irs 2210 fillable document is used to calculate any penalties for underpayment of federal income tax. Filling it out accurately is crucial for individuals and businesses to avoid unnecessary penalties and ensure compliance with IRS regulations. With airSlate SignNow, you can easily access and eSign the irs 2210 fillable form, streamlining your tax submission process.

-

How can airSlate SignNow help me with the irs 2210 fillable form?

airSlate SignNow provides a user-friendly platform to fill out and eSign the irs 2210 fillable form. Our solution allows you to input your tax information digitally, eliminating the hassle of paper forms and ensuring that your submissions are accurate. Plus, with our platform, you can track the status of your forms easily.

-

Is the irs 2210 fillable form available for free?

While the irs 2210 fillable form itself can be obtained for free through the IRS website, using airSlate SignNow to fill it out and eSign it may come with a subscription cost. However, our competitive pricing models offer great value for the range of features we provide, making the entire document handling process more efficient.

-

What features does airSlate SignNow offer for the irs 2210 fillable form?

With airSlate SignNow, you receive features like easy document editing, eSignature capabilities, and collaborative tools that enhance workflow efficiency. Our platform allows multiple parties to sign the irs 2210 fillable form and offers integrations with popular applications, ensuring seamless document management.

-

Can I integrate airSlate SignNow with other software for the irs 2210 fillable form?

Yes, airSlate SignNow supports integrations with widely used applications such as Google Drive, Dropbox, and various CRM systems. This enables you to import your data directly and streamline the completion of the irs 2210 fillable form efficiently, reducing the time spent on paperwork.

-

Is it secure to use airSlate SignNow for the irs 2210 fillable form?

Absolutely! airSlate SignNow prioritizes security and uses advanced encryption to protect your data while completing the irs 2210 fillable form. Our platform complies with industry standards to ensure that your sensitive financial information remains confidential and secure.

-

How long does it take to complete the irs 2210 fillable form using airSlate SignNow?

The time required to complete the irs 2210 fillable form can vary based on your individual tax situation, but our intuitive platform signNowly speeds up the process. With user-friendly tools and prompts, you can complete and sign the form in just a matter of minutes, freeing up your time for other important tasks.

Get more for About Form 2210 F, Underpayment Of Estimated Tax

- Apartment lease rental application questionnaire maryland form

- Md lease form

- Salary verification form for potential lease maryland

- Maryland landlord tenant 497310349 form

- Notice of default on residential lease maryland form

- Landlord tenant lease co signer agreement maryland form

- Application for sublease maryland form

- Maryland post 497310353 form

Find out other About Form 2210 F, Underpayment Of Estimated Tax

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation