Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts 2024-2026

Understanding the 2210 Form for Underpayment of Estimated Tax

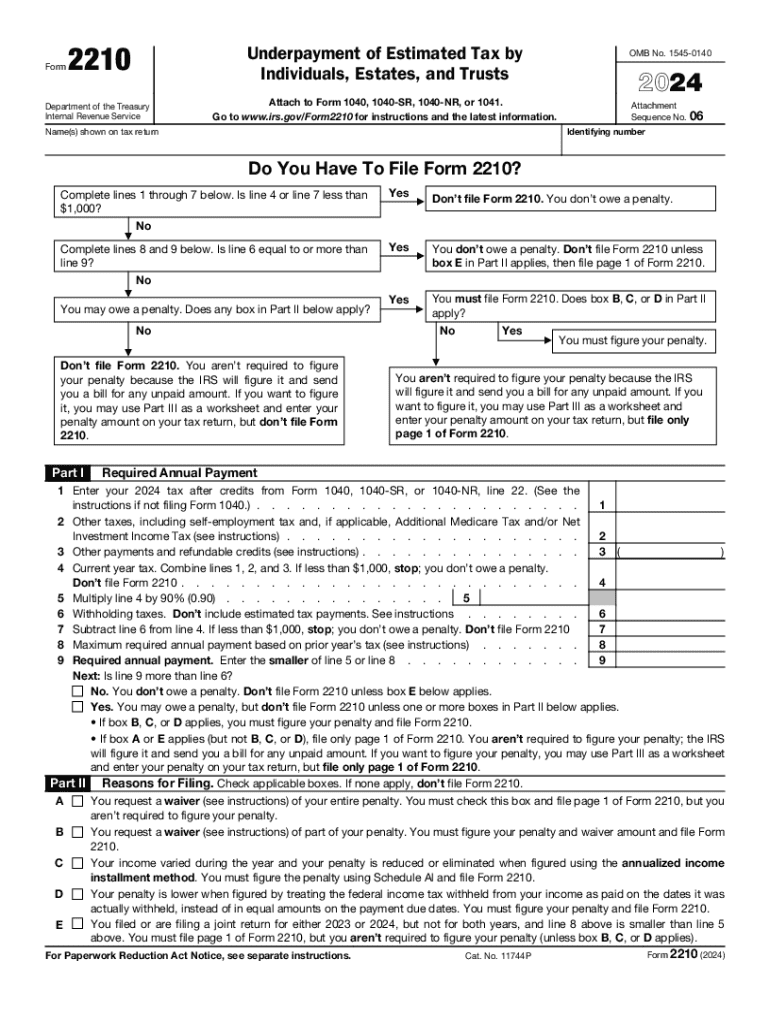

The 2210 form is a crucial document used by individuals, estates, and trusts to report underpayment of estimated tax. This form is particularly relevant for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated tax payments. The IRS requires this form to determine if you owe a penalty for underpayment and to calculate the amount of that penalty. Understanding the nuances of the 2210 form can help ensure compliance and avoid unnecessary penalties.

Steps to Complete the 2210 Form

Completing the 2210 form involves several key steps:

- Gather necessary information: Collect your income details, tax payments, and any applicable credits.

- Determine your tax liability: Calculate your total tax liability for the year to understand if you have underpaid.

- Complete the form: Fill out the relevant sections, including your income, tax payments, and any penalties.

- Review for accuracy: Double-check all entries to ensure accuracy and completeness.

- Submit the form: File the completed form with your tax return or as directed by the IRS.

IRS Guidelines for the 2210 Form

The IRS provides specific guidelines regarding the use of the 2210 form. These guidelines include eligibility criteria for filing the form, instructions for calculating penalties, and details on how to avoid underpayment. Taxpayers should refer to the IRS instructions for the 2210 form to ensure they meet all requirements and understand their obligations. This information is crucial for accurately completing the form and avoiding penalties.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the 2210 form. Generally, the form must be submitted along with your annual tax return. For most taxpayers, this means filing by April 15 of the following year. However, if you file for an extension, the deadline may be extended to October 15. Staying informed about these dates helps ensure timely submission and compliance with IRS regulations.

Examples of Using the 2210 Form

Various scenarios may necessitate the use of the 2210 form. For instance, self-employed individuals who do not make sufficient estimated tax payments throughout the year may need to file this form. Similarly, retirees who rely on pension income or investments might find themselves underpaying their taxes. Understanding these examples can help taxpayers recognize their need to file the 2210 form and take appropriate action.

Penalties for Non-Compliance with the 2210 Form

Failing to file the 2210 form when required can result in penalties imposed by the IRS. These penalties can vary based on the amount of underpayment and how long the payment is overdue. Taxpayers should be aware of these potential penalties to avoid unexpected financial burdens. Timely filing and accurate reporting can significantly reduce the risk of incurring penalties.

Handy tips for filling out Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts online

Quick steps to complete and e-sign Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a HIPAA and GDPR compliant solution for maximum simplicity. Use signNow to e-sign and send Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 2210 underpayment of estimated tax by individuals estates and trusts 771313653

Create this form in 5 minutes!

How to create an eSignature for the form 2210 underpayment of estimated tax by individuals estates and trusts 771313653

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2210 form and why is it important?

The 2210 form is used by taxpayers to determine if they owe a penalty for underpayment of estimated tax. It is important because it helps individuals and businesses avoid unnecessary penalties by ensuring they meet their tax obligations. Understanding the 2210 form can help you manage your finances more effectively.

-

How can airSlate SignNow help with the 2210 form?

airSlate SignNow simplifies the process of completing and eSigning the 2210 form. Our platform allows you to fill out the form electronically, ensuring accuracy and efficiency. With airSlate SignNow, you can easily send the completed 2210 form to your accountant or tax professional.

-

Is there a cost associated with using airSlate SignNow for the 2210 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution ensures that you can manage documents like the 2210 form without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the 2210 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the 2210 form. These features enhance the user experience by making it easy to manage and sign documents. Additionally, our platform ensures that your data is secure and compliant.

-

Can I integrate airSlate SignNow with other software for the 2210 form?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage the 2210 form alongside your other business tools. This seamless integration helps streamline your workflow and ensures that all your documents are in one place. You can connect with popular platforms like Google Drive and Dropbox.

-

What are the benefits of using airSlate SignNow for tax documents like the 2210 form?

Using airSlate SignNow for tax documents like the 2210 form offers numerous benefits, including time savings and improved accuracy. Our platform allows for quick completion and eSigning, reducing the time spent on paperwork. Additionally, the secure storage of your documents ensures peace of mind.

-

Is airSlate SignNow user-friendly for completing the 2210 form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 2210 form. Our intuitive interface guides you through the process, ensuring that you can fill out and eSign your documents without any hassle.

Get more for Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts

- Sample letter requesting rent payment pdf form

- Quit claim deed quit claims to buyer genesee county form

- Interior overtime form

- Chiropractic care plan template form

- Employee hourly rate and work status change form this form is intended to communicate all pay rate changes of individual

- California tax table form

- Aadl vendor fitting form

- State il form

Find out other Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract