19 Internal Revenue Service Department of the Treasury19 Internal Revenue Service Department of the Treasury19 Internal Revenue 2020

Understanding the 2019 IRS Form 2210

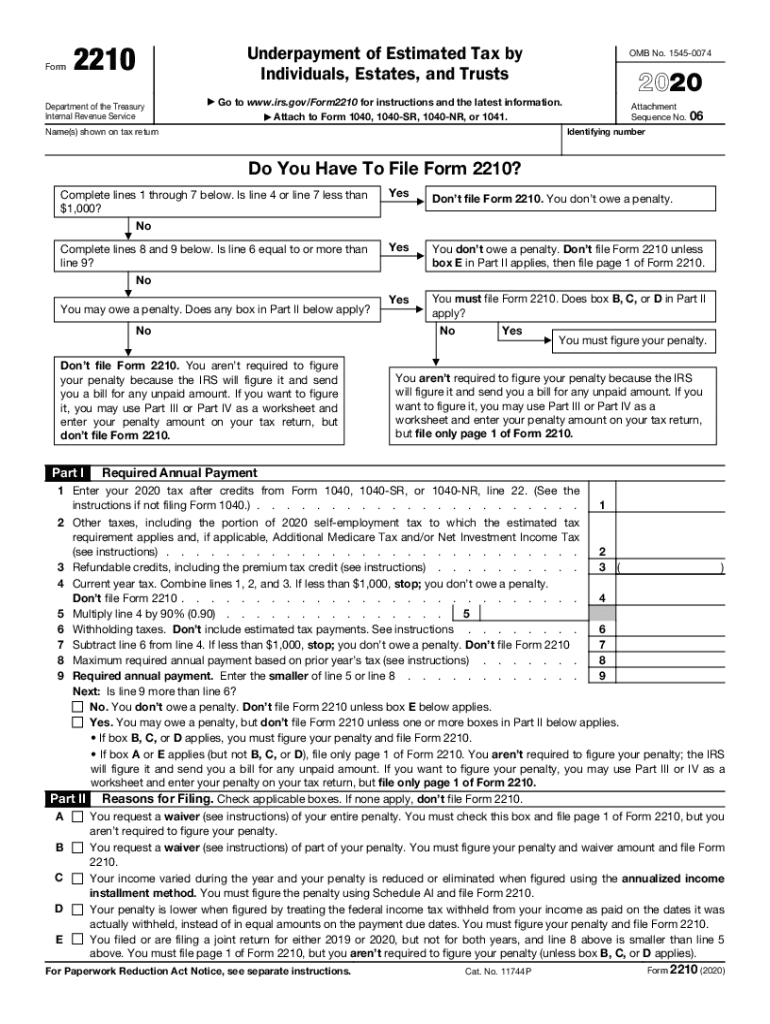

The 2019 IRS Form 2210 is used by individuals to determine if they owe a penalty for underpayment of estimated tax. It is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated tax payments. This form helps calculate the penalty amount, if applicable, and provides a way to report the underpayment to the IRS. Understanding the details of this form is crucial for accurate tax reporting and compliance.

Steps to Complete the 2019 Form 2210

Completing the 2019 Form 2210 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, follow these steps:

- Determine your total tax liability for the year.

- Calculate your total payments made through withholding and estimated payments.

- Identify any underpayment periods and the corresponding amounts.

- Use the provided worksheets within the form to calculate the penalty, if applicable.

- Review the completed form for accuracy before submission.

Filing Deadlines for the 2019 Form 2210

The filing deadline for the 2019 Form 2210 aligns with the standard tax filing deadline. Generally, this means the form must be submitted by April 15 of the following year. If you are unable to file by this date, you may request an extension, but it is important to note that any owed tax must still be paid by the original deadline to avoid additional penalties.

Penalties for Non-Compliance with Form 2210

Failing to file Form 2210 when required can result in significant penalties. The IRS may impose a penalty for underpayment of estimated tax, which is calculated based on the amount of underpayment and the duration of the underpayment period. This penalty can accumulate over time, leading to a larger financial burden if not addressed promptly.

Digital vs. Paper Version of Form 2210

Taxpayers have the option to complete the 2019 Form 2210 either digitally or on paper. The digital version offers several advantages, including ease of completion and automatic calculations for penalties. Additionally, submitting the form electronically can expedite processing times with the IRS. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods or lack access to digital tools.

Eligibility Criteria for Using Form 2210

To utilize the 2019 Form 2210, taxpayers must meet specific eligibility criteria. Generally, this form is applicable to individuals who have underpaid their estimated taxes throughout the year. This may include self-employed individuals, retirees, or anyone whose income fluctuates significantly. It is important to assess your tax situation to determine if you need to file this form.

Quick guide on how to complete 19 internal revenue service department of the treasury19 internal revenue service department of the treasury19 internal revenue

Complete 19 Internal Revenue Service Department Of The Treasury19 Internal Revenue Service Department Of The Treasury19 Internal Revenue effortlessly on any device

Digital document management has gained prominence among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to craft, modify, and electronically sign your documents swiftly without delays. Manage 19 Internal Revenue Service Department Of The Treasury19 Internal Revenue Service Department Of The Treasury19 Internal Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The easiest method to modify and eSign 19 Internal Revenue Service Department Of The Treasury19 Internal Revenue Service Department Of The Treasury19 Internal Revenue without hassle

- Find 19 Internal Revenue Service Department Of The Treasury19 Internal Revenue Service Department Of The Treasury19 Internal Revenue and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign 19 Internal Revenue Service Department Of The Treasury19 Internal Revenue Service Department Of The Treasury19 Internal Revenue to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 19 internal revenue service department of the treasury19 internal revenue service department of the treasury19 internal revenue

Create this form in 5 minutes!

How to create an eSignature for the 19 internal revenue service department of the treasury19 internal revenue service department of the treasury19 internal revenue

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2019 2210 form, and how does airSlate SignNow assist with it?

The 2019 2210 form is used to calculate underpayment of estimated taxes for individuals. With airSlate SignNow, you can easily send, sign, and manage your 2019 2210 documents electronically, ensuring a streamlined process that simplifies your tax obligations.

-

What features does airSlate SignNow offer for managing the 2019 2210 document?

airSlate SignNow provides a range of features for managing your 2019 2210 document, including electronic signatures, document templates, and secure cloud storage. These features enable you to efficiently handle your tax documents and ensure compliance with IRS regulations.

-

How much does it cost to use airSlate SignNow for the 2019 2210 form?

Pricing for airSlate SignNow varies based on the plan you choose, but it offers an affordable solution for managing your 2019 2210 form. You'll find options suitable for individuals and businesses that make compliance cost-effective.

-

Can I integrate airSlate SignNow with other applications for handling the 2019 2210?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your 2019 2210 form alongside your favorite tools. This integration enhances your workflow and improves document handling efficiency.

-

What are the benefits of using airSlate SignNow for my 2019 2210 submission?

Using airSlate SignNow for your 2019 2210 submission offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can ensure timely submissions and maintain records easily with digital document management.

-

Is airSlate SignNow secure for submitting the 2019 2210 form?

Absolutely. airSlate SignNow employs robust security measures, including encryption and authentication, to protect your 2019 2210 form and personal information. This commitment to security makes it a reliable choice for sensitive tax documents.

-

How does airSlate SignNow enhance my experience when completing the 2019 2210?

airSlate SignNow enhances your experience by providing an intuitive user interface and step-by-step guidance for completing the 2019 2210 form. This user-friendly approach simplifies the process, reducing the stress associated with tax filing.

Get more for 19 Internal Revenue Service Department Of The Treasury19 Internal Revenue Service Department Of The Treasury19 Internal Revenue

Find out other 19 Internal Revenue Service Department Of The Treasury19 Internal Revenue Service Department Of The Treasury19 Internal Revenue

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy