Www Irs Govforms Pubsabout Form 2210About Form 2210, Underpayment of Estimated Tax by Individuals 2021

Understanding Form 2210

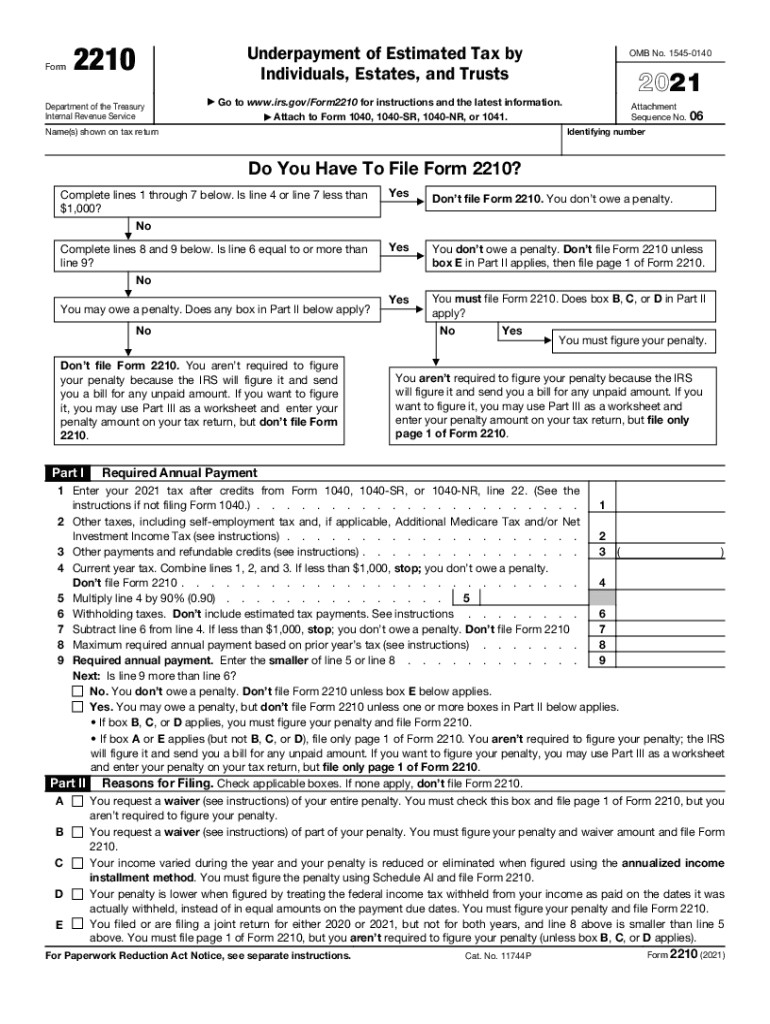

The IRS Form 2210 is designed for individuals who may have underpaid their estimated taxes throughout the year. This form helps determine if you owe a penalty for underpayment and calculates the amount owed. It is crucial for taxpayers who do not have sufficient withholding or estimated tax payments to cover their tax liability. Completing this form accurately ensures compliance with federal tax laws and helps avoid unnecessary penalties.

Steps to Complete Form 2210

Completing Form 2210 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Determine your total tax liability for the year using your income statements.

- Calculate the amount of tax you have already paid through withholding and estimated payments.

- Use the form to compare your total tax liability with what you have paid to identify any underpayment.

- Complete the necessary sections of the form, including any applicable schedules.

- Review your calculations for accuracy before submission.

Legal Use of Form 2210

Form 2210 is legally binding when completed and submitted correctly. It must be filed with your annual tax return if you owe a penalty for underpayment. The form provides the IRS with necessary information to assess your tax situation accurately. Ensuring compliance with IRS guidelines while filling out this form is essential to avoid penalties and ensure that your tax obligations are met.

Filing Deadlines for Form 2210

Form 2210 must be filed along with your annual tax return, which is typically due on April 15 of the following year. If you file for an extension, the deadline is extended to October 15. However, any taxes owed must still be paid by the original due date to avoid interest and penalties. It is important to keep track of these deadlines to maintain compliance with IRS regulations.

Penalties for Non-Compliance

Failing to file Form 2210 when required can result in significant penalties. The IRS may impose a penalty for underpayment of estimated tax, which can be calculated based on the amount owed and the duration of the underpayment. Understanding these penalties can help taxpayers take proactive steps to avoid them, ensuring that they meet their tax obligations in a timely manner.

Obtaining Form 2210

Form 2210 can be obtained directly from the IRS website or through various tax preparation software. It is available in both digital and printable formats, allowing taxpayers to choose the method that best suits their needs. Ensuring that you have the correct version of the form is vital for accurate completion and compliance with IRS requirements.

Quick guide on how to complete wwwirsgovforms pubsabout form 2210about form 2210 underpayment of estimated tax by individuals

Complete Www irs govforms pubsabout form 2210About Form 2210, Underpayment Of Estimated Tax By Individuals effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Www irs govforms pubsabout form 2210About Form 2210, Underpayment Of Estimated Tax By Individuals on any platform with airSlate SignNow Android or iOS applications and simplify any document-based operation today.

How to modify and eSign Www irs govforms pubsabout form 2210About Form 2210, Underpayment Of Estimated Tax By Individuals without breaking a sweat

- Obtain Www irs govforms pubsabout form 2210About Form 2210, Underpayment Of Estimated Tax By Individuals and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or missing files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Www irs govforms pubsabout form 2210About Form 2210, Underpayment Of Estimated Tax By Individuals and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovforms pubsabout form 2210about form 2210 underpayment of estimated tax by individuals

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovforms pubsabout form 2210about form 2210 underpayment of estimated tax by individuals

How to generate an e-signature for your PDF file in the online mode

How to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the significance of the 2210 form for businesses using airSlate SignNow?

The 2210 form is crucial for businesses to understand their tax obligations, especially when it comes to estimated tax payments. Using airSlate SignNow, you can quickly create and submit your 2210 form electronically, ensuring compliance and timely submissions.

-

How does airSlate SignNow simplify the process of completing the 2210 form?

AirSlate SignNow streamlines the completion of the 2210 form by providing an intuitive interface that guides users through each step. With built-in templates and eSignature capabilities, businesses can complete their forms efficiently without the hassle of printing or scanning.

-

What features of airSlate SignNow are best for managing the 2210 workflow?

AirSlate SignNow offers features such as automated reminders, secure eSigning, and integration with popular business tools to help manage the 2210 workflow. These features ensure that you stay organized and compliant while handling your tax documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2210 form?

Yes, airSlate SignNow has a pricing structure that accommodates various business needs. While there is a nominal fee associated with using their eSigning services, the time saved and improved accuracy of your 2210 form can lead to signNow savings for your business.

-

Can I integrate airSlate SignNow with other software to handle the 2210 form?

Absolutely! AirSlate SignNow integrates seamlessly with numerous business applications, allowing for a smooth workflow when managing the 2210 form. This integration helps reduce manual entry, making it easier to pull in data and minimize errors.

-

What are the benefits of using airSlate SignNow for eSigning the 2210 form?

Using airSlate SignNow for eSigning the 2210 form offers several benefits, including enhanced speed, security, and convenience. Electronic signatures ensure that your documents are securely signed and returned quickly, helping you meet all necessary deadlines.

-

How secure is my information when using airSlate SignNow for the 2210 form?

AirSlate SignNow prioritizes security, employing advanced encryption and authentication processes to protect your information while completing the 2210 form. Your data remains confidential and is securely stored, aligning with best practices in data protection.

Get more for Www irs govforms pubsabout form 2210About Form 2210, Underpayment Of Estimated Tax By Individuals

- Legal last will and testament for married person with minor children from prior marriage missouri form

- Legal last will and testament form for married person with adult children from prior marriage missouri

- Legal last will and testament form for divorced person not remarried with adult children missouri

- Legal last will and testament form for divorced person not remarried with no children missouri

- Legal last will and testament form for divorced person not remarried with minor children missouri

- Legal last will and testament form for divorced person not remarried with adult and minor children missouri

- Mutual wills package with last wills and testaments for married couple with adult children missouri form

- Mutual wills package with last wills and testaments for married couple with no children missouri form

Find out other Www irs govforms pubsabout form 2210About Form 2210, Underpayment Of Estimated Tax By Individuals

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement