Form 8615 Tax for Certain Children Who Have Unearned Income Fill 2022

What is the Form 8615 Tax for Certain Children Who Have Unearned Income

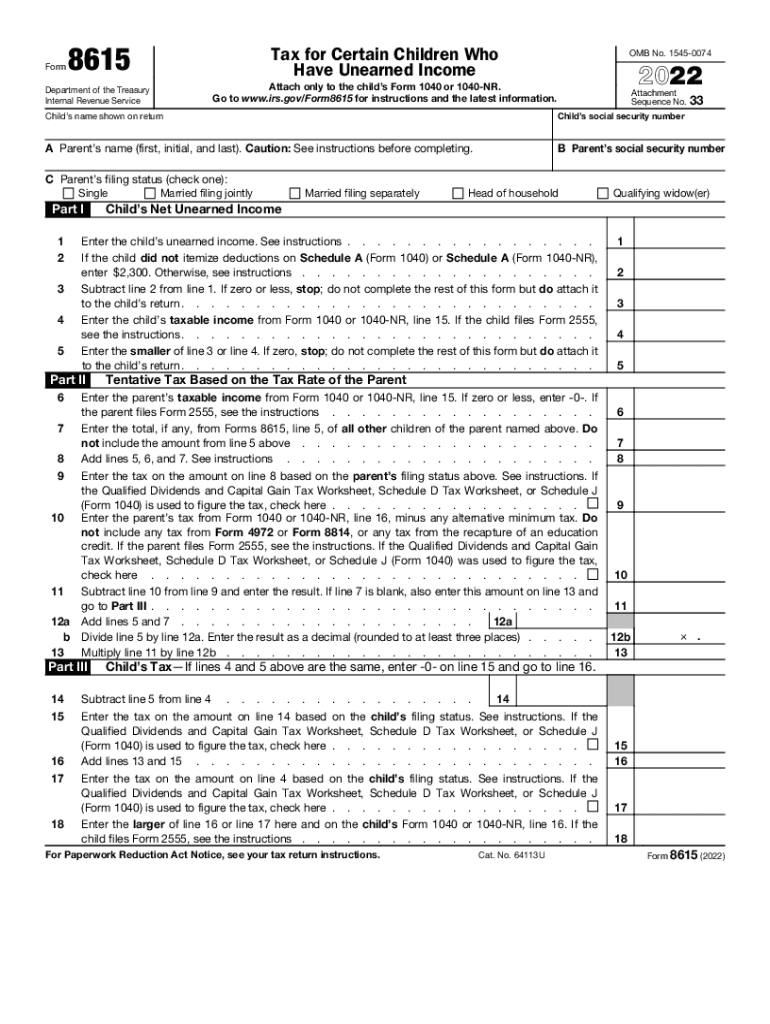

The Form 8615 is used to calculate the tax for certain children who have unearned income, such as interest, dividends, or capital gains. This form is specifically designed for children under the age of 19, or under 24 if they are full-time students, whose unearned income exceeds a specific threshold set by the IRS. The purpose of this form is to ensure that the tax rates applied to this unearned income are appropriate, as children may be subject to higher tax rates than their parents due to the so-called "kiddie tax" rules.

Steps to Complete the Form 8615 Tax for Certain Children Who Have Unearned Income

Completing the Form 8615 involves several key steps:

- Gather necessary information about the child’s unearned income, including amounts from interest, dividends, and capital gains.

- Determine the applicable tax rate by referring to the IRS guidelines for the current tax year.

- Fill out the form by entering the child’s name, Social Security number, and the total amount of unearned income.

- Calculate the tax owed based on the provided instructions, ensuring to check for any additional credits or deductions that may apply.

- Review the completed form for accuracy before submission.

Legal Use of the Form 8615 Tax for Certain Children Who Have Unearned Income

The legal use of Form 8615 is essential for compliance with IRS regulations. When properly completed, this form ensures that the tax obligations for children with unearned income are met according to the law. It is crucial to file this form accurately to avoid penalties or issues with the IRS. Additionally, using electronic signature solutions can help in ensuring that the submission is legally binding and secure.

Filing Deadlines / Important Dates for Form 8615

Filing deadlines for Form 8615 typically align with the general tax filing deadlines. For most taxpayers, the due date for filing is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines, especially in light of any IRS announcements or legislative changes.

IRS Guidelines for Form 8615

The IRS provides specific guidelines for completing and submitting Form 8615. These guidelines include eligibility criteria, instructions for calculating tax, and information about filing methods. Taxpayers should refer to the official IRS instructions for the form to ensure compliance and to understand any updates or changes that may affect their filing. This ensures that all calculations are accurate and that the form is submitted correctly.

Eligibility Criteria for Form 8615

To be eligible to use Form 8615, the child must meet certain criteria. These include being under the age of 19, or under 24 if a full-time student, and having unearned income exceeding the IRS threshold for the tax year. Additionally, the child must not be filing a joint return with a spouse. Understanding these criteria is essential for determining whether the form should be completed for a particular child.

Quick guide on how to complete form 8615 tax for certain children who have unearned income fill

Accomplish Form 8615 Tax For Certain Children Who Have Unearned Income Fill effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly with no delays. Manage Form 8615 Tax For Certain Children Who Have Unearned Income Fill on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Form 8615 Tax For Certain Children Who Have Unearned Income Fill without hassle

- Locate Form 8615 Tax For Certain Children Who Have Unearned Income Fill and choose Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Form 8615 Tax For Certain Children Who Have Unearned Income Fill and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8615 tax for certain children who have unearned income fill

Create this form in 5 minutes!

People also ask

-

What is Form 8615 and why is it important?

Form 8615 is used to calculate the tax liability for children with unearned income above a certain threshold. Understanding and accurately completing Form 8615 is crucial for ensuring compliance with IRS regulations and for minimizing tax liabilities. Utilizing tools like airSlate SignNow can simplify the eSigning and submission process for this form.

-

How can airSlate SignNow assist with filling out Form 8615?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign Form 8615 digitally. With our straightforward templates and guided features, you can ensure that you provide all necessary information while remaining compliant with tax requirements. Our service aims to make this process as efficient and hassle-free as possible.

-

Is there a cost associated with using airSlate SignNow for Form 8615?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, making it a cost-effective solution for processing Form 8615. Our flexible pricing options ensure that both individuals and enterprises can find a plan that meets their budget while still accessing all essential features for seamless eSigning. You can check our website for specific pricing details.

-

Can I integrate airSlate SignNow with other software to streamline Form 8615 submissions?

Absolutely! airSlate SignNow supports integrations with a variety of third-party applications, enhancing your workflow for handling Form 8615. Whether you use CRM systems, accounting software, or document management tools, our platform can connect seamlessly to create a more efficient document signing process.

-

What security measures are in place for documents like Form 8615 in airSlate SignNow?

airSlate SignNow employs robust security protocols to protect sensitive information, ensuring that documents like Form 8615 are safe during the signing process. We use encryption, secure data storage, and two-factor authentication, allowing users to confidently manage and submit their tax documents digitally without fear of data bsignNowes.

-

How quickly can I complete and send Form 8615 using airSlate SignNow?

With airSlate SignNow, you can complete and send Form 8615 in just a few clicks. Our user-friendly interface is designed for speed and efficiency, enabling you to fill out your tax forms quickly and securely. This means less time worrying about paperwork and more time focusing on what matters.

-

Are there mobile options for using airSlate SignNow to manage Form 8615?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage and eSign Form 8615 on-the-go. Whether you’re at home or in the office, you can access our platform anytime, ensuring that you can stay on track with your tax responsibilities no matter where you are.

Get more for Form 8615 Tax For Certain Children Who Have Unearned Income Fill

Find out other Form 8615 Tax For Certain Children Who Have Unearned Income Fill

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement