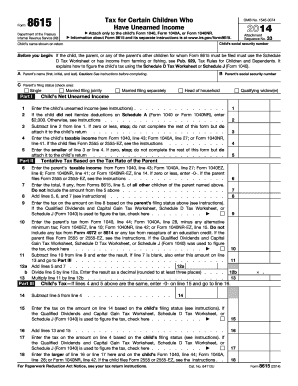

Form 8615 Tax for Certain Children Who Have Unearned Income Irs 2014

What is the Form 8615 Tax for Certain Children Who Have Unearned Income IRS

The Form 8615 is a tax form used by the IRS specifically for children under the age of 18 who have unearned income exceeding a certain threshold. This form is essential for determining the tax liability of these children, as their income may be taxed at their parents' tax rate rather than their own. The primary purpose of the form is to prevent parents from shifting income to their children to take advantage of lower tax rates. Understanding the nuances of this form is crucial for families managing unearned income.

How to Use the Form 8615 Tax for Certain Children Who Have Unearned Income IRS

Utilizing the Form 8615 requires careful attention to detail. First, gather all necessary financial information regarding the child’s unearned income, which may include interest, dividends, and capital gains. Next, complete the form by entering the child's income details and calculating the tax owed. It is important to ensure accuracy, as errors can lead to delays or penalties. Once completed, the form should be submitted along with the child’s tax return, ensuring compliance with IRS regulations.

Steps to Complete the Form 8615 Tax for Certain Children Who Have Unearned Income IRS

Completing the Form 8615 involves several key steps:

- Gather financial documents related to the child's unearned income.

- Fill out the personal information section, including the child's name and Social Security number.

- Report the total unearned income on the form.

- Calculate the tax using the appropriate tax rates for the child.

- Review the form for accuracy before submission.

Following these steps carefully can help ensure that the form is filled out correctly, minimizing the risk of issues with the IRS.

IRS Guidelines for Form 8615 Tax for Certain Children Who Have Unearned Income

The IRS provides specific guidelines for completing and submitting the Form 8615. These guidelines outline eligibility criteria, income thresholds, and filing requirements. It is crucial to refer to the latest IRS publications to stay updated on any changes in tax laws that may impact the form. Additionally, the IRS emphasizes the importance of accurate reporting to avoid potential audits or penalties.

Filing Deadlines for Form 8615 Tax for Certain Children Who Have Unearned Income IRS

Filing deadlines for the Form 8615 align with the general tax filing deadlines for individuals. Typically, the form must be submitted by April 15 of the tax year following the income earned. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to plan ahead to ensure timely submission and avoid any late fees or penalties.

Penalties for Non-Compliance with Form 8615 Tax for Certain Children Who Have Unearned Income IRS

Failure to comply with the requirements of the Form 8615 can result in significant penalties. The IRS may impose fines for incorrect filings, late submissions, or failure to file altogether. Additionally, unreported income can lead to back taxes owed, interest charges, and potential legal ramifications. It is essential for families to understand these risks and ensure compliance with all tax obligations.

Quick guide on how to complete 2014 form 8615 tax for certain children who have unearned income irs

Effortlessly Prepare Form 8615 Tax For Certain Children Who Have Unearned Income Irs on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Manage Form 8615 Tax For Certain Children Who Have Unearned Income Irs on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Form 8615 Tax For Certain Children Who Have Unearned Income Irs with Ease

- Obtain Form 8615 Tax For Certain Children Who Have Unearned Income Irs and click Get Form to initiate the process.

- Make use of the tools we provide to complete your document.

- Emphasize crucial parts of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to store your changes.

- Select your preferred method of delivery for your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing fresh copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8615 Tax For Certain Children Who Have Unearned Income Irs to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8615 tax for certain children who have unearned income irs

Create this form in 5 minutes!

People also ask

-

What is the Form 8615 Tax For Certain Children Who Have Unearned Income IRS?

Form 8615 is used by certain children who have unearned income to calculate their tax liability. The IRS requires this form to ensure that children with signNow investments pay taxes at the appropriate rate. Understanding how to properly fill out and submit this form is crucial for compliance.

-

How does airSlate SignNow help with Form 8615 Tax For Certain Children Who Have Unearned Income IRS?

AirSlate SignNow provides a streamlined platform for sending and eSigning IRS forms, including Form 8615. Our solution offers templates and easy-to-use features that simplify the process, ensuring that you can handle tax documents efficiently. This eliminates the hassle of paper-based forms.

-

Is airSlate SignNow affordable for managing Form 8615 Tax For Certain Children Who Have Unearned Income IRS?

Yes, airSlate SignNow offers a cost-effective solution to manage Form 8615 tax documents. With various pricing plans, businesses and individuals can choose a package that fits their needs without breaking the bank. Our pricing reflects our commitment to affordability while providing powerful features.

-

Can I integrate airSlate SignNow with other tools for Form 8615 Tax For Certain Children Who Have Unearned Income IRS?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of third-party applications to enhance your workflow. This includes accounting software and other document management tools, making it simpler to manage Form 8615 and other IRS-related documents.

-

What features does airSlate SignNow offer for handling taxes like Form 8615 Tax For Certain Children Who Have Unearned Income IRS?

AirSlate SignNow offers features such as secure eSigning, document tracking, and customizable templates specifically for tax forms like Form 8615. This ensures that your documents are handled securely and efficiently, streamlining your tax filing process.

-

Is it safe to use airSlate SignNow for Form 8615 Tax For Certain Children Who Have Unearned Income IRS submissions?

Yes, airSlate SignNow prioritizes security and utilizes advanced encryption methods to protect your sensitive tax information, including Form 8615. Our platform is built with compliance in mind, ensuring that your data is safe during the entire signing process.

-

How can I quickly learn to use airSlate SignNow for Form 8615 Tax For Certain Children Who Have Unearned Income IRS?

AirSlate SignNow offers easy-to-follow tutorials and customer support to help you navigate the platform effectively. Whether you're new to eSigning or familiar with IRS forms, our resources will guide you through using Form 8615. Start with our help center for comprehensive guides.

Get more for Form 8615 Tax For Certain Children Who Have Unearned Income Irs

Find out other Form 8615 Tax For Certain Children Who Have Unearned Income Irs

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online