Form 8615 Tax for Certain Children Who Have Unearned 2024-2026

What is the Form 8615 Tax for Certain Children Who Have Unearned Income

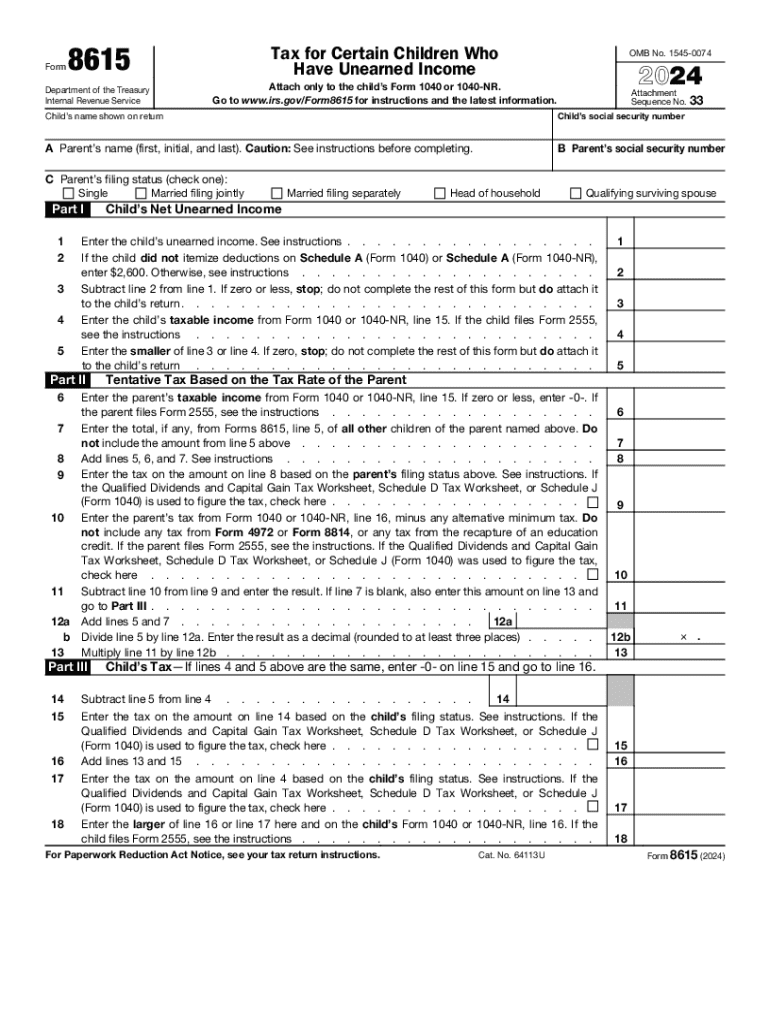

The Form 8615 is a tax form used by the Internal Revenue Service (IRS) for certain children who have unearned income. This form is specifically designed for children under the age of 19, or under 24 if they are full-time students, who have unearned income exceeding a specified threshold. Unearned income includes interest, dividends, and capital gains, which can be subject to taxation at the parent's tax rate under the "kiddie tax" rules. The purpose of the form is to ensure that the tax liability for this income is calculated correctly, reflecting the child's tax situation while preventing tax avoidance through the use of children's lower tax brackets.

How to Obtain the Form 8615

The Form 8615 can be easily obtained from the IRS website. Users can download the form in PDF format, which allows for easy printing and completion. Additionally, the form may be available at local IRS offices or through tax professionals who assist with tax preparation. It is important to ensure that the most current version of the form is used, as tax laws and requirements can change from year to year.

Steps to Complete the Form 8615

Completing the Form 8615 involves several key steps:

- Gather necessary information, including the child's unearned income details and the parent's tax information.

- Fill out the personal information section, including the child's name, Social Security number, and address.

- Calculate the child's unearned income and determine if it exceeds the threshold for filing.

- Complete the required sections, including the calculation of tax liability based on the parent's tax rate.

- Review the form for accuracy and completeness before submission.

It is advisable to consult IRS guidelines or a tax professional if there are any uncertainties while completing the form.

IRS Guidelines for Form 8615

The IRS provides specific guidelines regarding the use of Form 8615. These guidelines include eligibility criteria, income thresholds, and instructions for calculating tax liability. The IRS outlines the importance of accurately reporting unearned income and adhering to the filing requirements to avoid penalties. Taxpayers are encouraged to refer to the IRS instructions that accompany the form, which provide detailed explanations and examples to aid in the completion process.

Filing Deadlines for Form 8615

Form 8615 must be filed along with the child's tax return by the standard tax deadline, which is typically April 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential for taxpayers to be aware of these deadlines to avoid late filing penalties. Additionally, if an extension is filed for the tax return, Form 8615 must still be submitted by the extended deadline.

Penalties for Non-Compliance with Form 8615

Failure to file Form 8615 when required can result in penalties imposed by the IRS. These penalties may include fines for late filing or failure to pay taxes owed. In some cases, the IRS may assess additional interest on unpaid taxes. It is crucial for taxpayers to understand their obligations regarding this form to avoid potential financial repercussions. Consulting with a tax professional can help ensure compliance and proper filing.

Create this form in 5 minutes or less

Find and fill out the correct form 8615 tax for certain children who have unearned

Create this form in 5 minutes!

How to create an eSignature for the form 8615 tax for certain children who have unearned

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8615 and why is it important?

Form 8615 is a tax form used to calculate the tax liability for certain children who have unearned income. Understanding how to properly fill out Form 8615 is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

-

How can airSlate SignNow help with Form 8615?

airSlate SignNow provides a seamless way to eSign and send Form 8615 electronically. Our platform simplifies the document management process, allowing you to focus on completing your tax filings efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 8615?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage Form 8615 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 8615?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for documents like Form 8615. These tools enhance your workflow and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other software for Form 8615?

Absolutely! airSlate SignNow integrates with various applications, allowing you to streamline your workflow when handling Form 8615. This integration capability enhances productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Form 8615?

Using airSlate SignNow for Form 8615 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive tax documents are protected while simplifying the signing process.

-

Is airSlate SignNow user-friendly for completing Form 8615?

Yes, airSlate SignNow is designed with user experience in mind. Our intuitive interface makes it easy for anyone to complete and eSign Form 8615, regardless of their technical expertise.

Get more for Form 8615 Tax For Certain Children Who Have Unearned

- 1st grade screening test form

- Lifeline program annual recertification form

- Borang tuntutan etiqa takaful form

- Eye drop schedule template 240203268 form

- Sample hoa architectural request form

- Eia 176 printable form

- Pain assessment in advanced dementia painad mittari potilaan kivun form

- Form i agent to agent agreement pdf

Find out other Form 8615 Tax For Certain Children Who Have Unearned

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy