U S Individual Income Tax Return Forms Instructions & 2023

Understanding IRS Form 8615

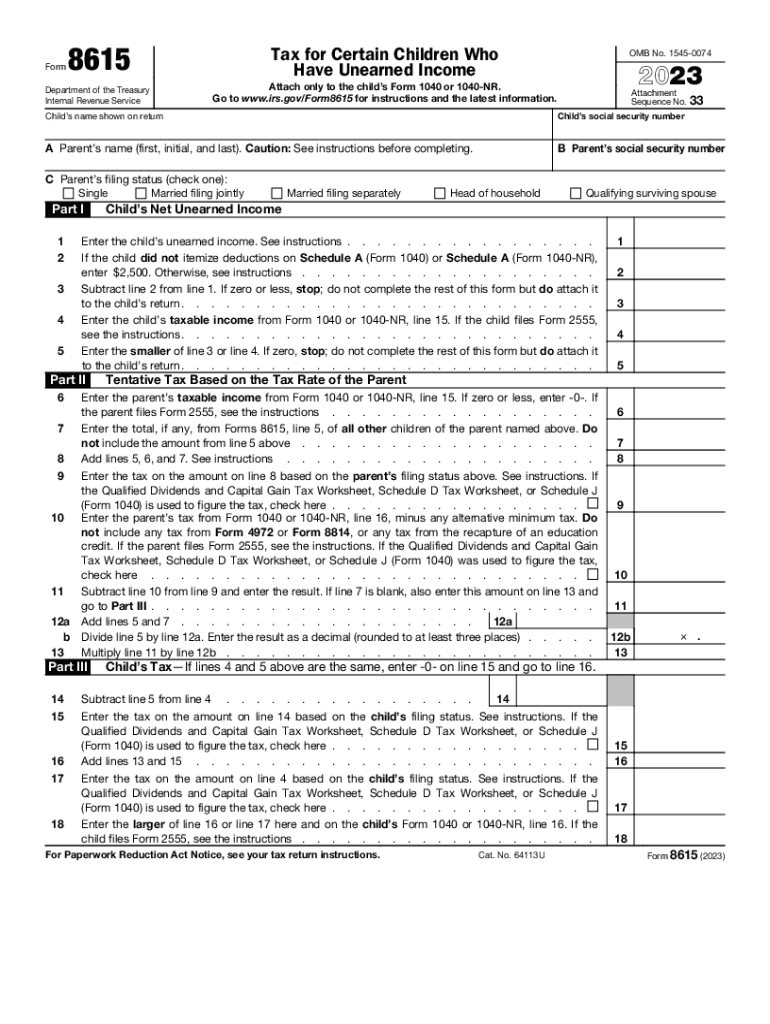

IRS Form 8615, also known as the "Tax for Children Under Age 18," is designed for minors who have unearned income exceeding a specific threshold. This form helps determine the tax liability for children, ensuring that their income is taxed at the appropriate rates. The form is crucial for parents and guardians to understand, as it outlines how to report a child's unearned income, which may include dividends, interest, and capital gains.

Steps to Complete IRS Form 8615

Completing IRS Form 8615 involves several key steps:

- Gather necessary documents, including the child's income statements and any relevant tax information.

- Fill out the form by providing the child's name, Social Security number, and details about their unearned income.

- Calculate the tax using the tax tables provided in the form instructions.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Using Form 8615

To use IRS Form 8615, certain eligibility criteria must be met:

- The child must be under the age of 18 at the end of the tax year.

- The child must have unearned income exceeding the threshold set by the IRS.

- The child cannot file a joint return with a spouse.

Filing Deadlines for Form 8615

IRS Form 8615 must be filed along with the child's income tax return by the standard tax filing deadline, which is typically April 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about any changes to these dates to avoid penalties.

Common Mistakes When Filing Form 8615

When completing IRS Form 8615, taxpayers should be aware of common mistakes that can lead to issues:

- Incorrectly reporting unearned income or failing to include all sources of income.

- Omitting the child's Social Security number, which is crucial for processing the form.

- Not reviewing the form for mathematical errors before submission.

IRS Guidelines for Filing Form 8615

The IRS provides specific guidelines for completing and filing Form 8615. It is important to refer to the latest IRS publications and instructions to ensure compliance. These guidelines include details on how to calculate taxes owed, as well as any updates to income thresholds or filing requirements that may change annually.

Quick guide on how to complete u s individual income tax return forms instructions ampamp

Complete U S Individual Income Tax Return Forms Instructions & seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage U S Individual Income Tax Return Forms Instructions & on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign U S Individual Income Tax Return Forms Instructions & effortlessly

- Obtain U S Individual Income Tax Return Forms Instructions & and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign U S Individual Income Tax Return Forms Instructions & to ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct u s individual income tax return forms instructions ampamp

Create this form in 5 minutes!

How to create an eSignature for the u s individual income tax return forms instructions ampamp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 8615 form and how does it relate to document signing?

The 2020 8615 form refers to the IRS form used for tax purposes. Companies using airSlate SignNow can efficiently send and eSign the 2020 8615 form, ensuring that all signatures are collected digitally and securely, thereby streamlining the filing process.

-

How does airSlate SignNow ensure the security of my 2020 8615 documents?

airSlate SignNow employs advanced encryption and multifactor authentication to protect your 2020 8615 documents. This ensures that sensitive tax information is only accessible to authorized personnel, maintaining compliance with industry standards.

-

What features does airSlate SignNow offer for managing the 2020 8615 form?

airSlate SignNow provides customizable templates and a user-friendly interface for managing the 2020 8615 form. Users can easily drag and drop fields, set signing order, and automate reminders, making the signing process seamless.

-

Is there a mobile app available for signing the 2020 8615 form?

Yes, airSlate SignNow offers a mobile app that allows users to access and sign the 2020 8615 form from anywhere. The app is designed to provide a smooth, on-the-go experience, enabling remote signing and document management.

-

What pricing plans does airSlate SignNow have for eSigning forms like the 2020 8615?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs, starting from a basic plan for individuals to advanced plans for enterprises. Each plan includes features for eSigning documents such as the 2020 8615, with no hidden fees.

-

Can I integrate airSlate SignNow with other software for handling the 2020 8615?

Yes, airSlate SignNow integrates with a wide range of software applications, allowing for improved workflows when handling the 2020 8615 and other documents. Popular integrations include Google Drive, Salesforce, and Dropbox, making document management effortless.

-

What are the benefits of using airSlate SignNow for the 2020 8615 form?

Using airSlate SignNow for the 2020 8615 form offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform simplifies the signing process, helping businesses save time and avoid costly errors.

Get more for U S Individual Income Tax Return Forms Instructions &

- 2019 form oh income tax return maumee fill online

- 2020 kettering individual tax return form

- If fein doesnt exist enter social security number of owner form

- Dt48030ii form

- 4802 cpt rev 1019 4802 cpt rev 1019 form

- Dd form 2339 international military student information june 2005 reginfo

- Pdf fmcsa form mcsa 5889 federal motor carrier safety

- Pdf statement of consent issuance of a to a minor form

Find out other U S Individual Income Tax Return Forms Instructions &

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe