F8615 Ellen Income Tax Form 8615 Tax for Certain Children 2021

What is the form 8615?

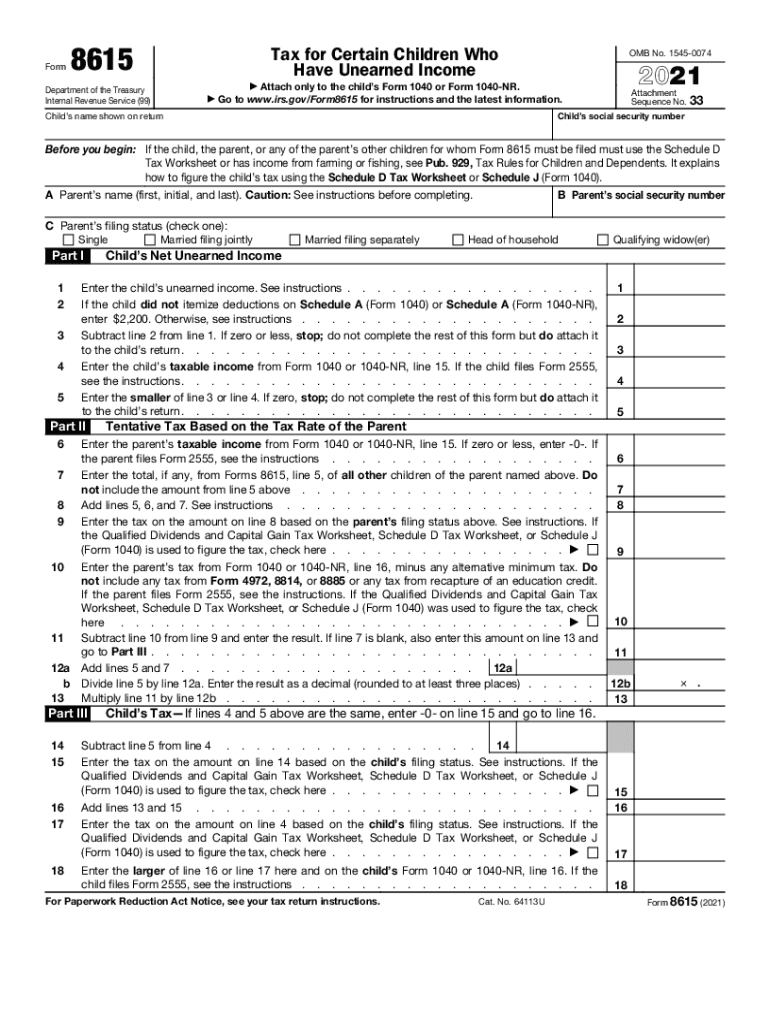

The form 8615, also known as the IRS Form 8615, is a tax document specifically designed for certain children who have unearned income. This form is used to calculate the tax owed on that income, which may be subject to the "kiddie tax" rules. The kiddie tax applies to children under the age of 19, or under 24 if they are full-time students, and it ensures that unearned income is taxed at the parent's tax rate rather than the child's lower rate. This form helps the IRS determine the appropriate tax liability for these young taxpayers.

How to use the form 8615

To effectively use the form 8615, individuals need to gather all necessary information regarding the child's unearned income. This includes interest, dividends, and capital gains. The form requires details about the child’s income and the parent's tax situation. Once the information is collected, the taxpayer should fill out the form accurately, ensuring that all calculations reflect the current tax year’s guidelines. It is essential to follow the instructions provided by the IRS to ensure compliance and avoid errors that could lead to penalties.

Steps to complete the form 8615

Completing the form 8615 involves several key steps:

- Gather all necessary financial documents, including the child’s income statements.

- Determine if the child qualifies for the form based on their age and income type.

- Fill out the personal information section, including the child’s name, Social Security number, and the parent's details.

- Report the child’s unearned income accurately in the designated sections.

- Calculate the tax owed using the provided tax tables or worksheets.

- Review the completed form for accuracy before submission.

Legal use of the form 8615

The legal use of the form 8615 is governed by IRS regulations, which stipulate that it must be filed for children who meet specific criteria regarding unearned income. This form must be submitted along with the parent's tax return, ensuring that the income is reported correctly. Failure to use the form appropriately can result in penalties or additional taxes owed. It is crucial for taxpayers to understand the legal implications of the kiddie tax and ensure compliance with all IRS requirements.

Eligibility criteria for the form 8615

To be eligible to use the form 8615, the child must meet certain criteria:

- The child must be under the age of 19, or under 24 if a full-time student.

- The child must have unearned income exceeding a specified threshold set by the IRS.

- The child's unearned income must be subject to the kiddie tax rules.

Meeting these criteria ensures that the form is applicable and that the correct tax rates are applied to the child's income.

Filing deadlines for the form 8615

The form 8615 must be filed by the same deadline as the parent’s tax return, typically April 15 of the following year. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day. Taxpayers should be aware of any changes in deadlines and ensure that the form is submitted on time to avoid penalties. Extensions for filing may be available, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete f8615 ellen income tax form 8615 tax for certain children

Complete F8615 Ellen Income Tax Form 8615 Tax For Certain Children effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any hold-ups. Handle F8615 Ellen Income Tax Form 8615 Tax For Certain Children on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign F8615 Ellen Income Tax Form 8615 Tax For Certain Children seamlessly

- Find F8615 Ellen Income Tax Form 8615 Tax For Certain Children and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign F8615 Ellen Income Tax Form 8615 Tax For Certain Children and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f8615 ellen income tax form 8615 tax for certain children

Create this form in 5 minutes!

How to create an eSignature for the f8615 ellen income tax form 8615 tax for certain children

The best way to make an e-signature for your PDF file in the online mode

The best way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form 8615 and why is it important?

Form 8615 is a tax form used to determine the tax liability for children under 18 with unearned income. Understanding this form is essential for ensuring compliance with IRS regulations and avoiding potential penalties. By using airSlate SignNow, you can easily manage and e-sign your Form 8615 to streamline your tax filing process.

-

How can airSlate SignNow help with completing Form 8615?

airSlate SignNow offers an intuitive platform for completing and eSigning Form 8615. Our solution simplifies the document management process, ensuring all necessary fields are filled out correctly. Plus, with our robust features, you can manage revisions and gather signatures efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 8615?

Yes, there is a pricing structure for using airSlate SignNow. We offer various subscription plans designed to cater to different business needs and budgets. Investing in airSlate SignNow for managing Form 8615 can save you time and reduce the potential for costly errors.

-

Can I integrate airSlate SignNow with other software to manage Form 8615?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications such as Google Workspace, Salesforce, and more. This allows you to manage your Form 8615 alongside other critical documents and workflows, enhancing productivity and organization.

-

What features does airSlate SignNow offer for signing Form 8615?

Our platform includes features such as in-person or remote signing, customizable templates, and real-time tracking for your Form 8615. These features ensure security and ease in signing, giving you peace of mind during the signing process. Additionally, you can store your signed forms securely in our cloud-based storage.

-

Is airSlate SignNow user-friendly for managing Form 8615?

Yes, airSlate SignNow is designed with user experience in mind. The platform provides a straightforward interface, making it easy for anyone, even those with limited tech skills, to manage and eSign Form 8615 without any hassle. Our helpful resources are also available for guidance along the way.

-

How can airSlate SignNow ensure the security of my Form 8615?

airSlate SignNow prioritizes the security of your documents, including Form 8615. We utilize advanced encryption methods and compliance with data protection regulations to keep your sensitive information safe. You can confidently e-sign and share your Form 8615 with the assurance that it remains secure.

Get more for F8615 Ellen Income Tax Form 8615 Tax For Certain Children

- Life warranty deed form

- Quitclaim deed from corporation to husband and wife georgia form

- Warranty deed from corporation to husband and wife georgia form

- Quitclaim deed from corporation to individual georgia form

- Warranty deed from corporation to individual georgia form

- Quitclaim deed from corporation to llc georgia form

- Quitclaim deed from corporation to corporation georgia form

- Warranty deed from corporation to corporation georgia form

Find out other F8615 Ellen Income Tax Form 8615 Tax For Certain Children

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will