8615 2020

What is the 8615

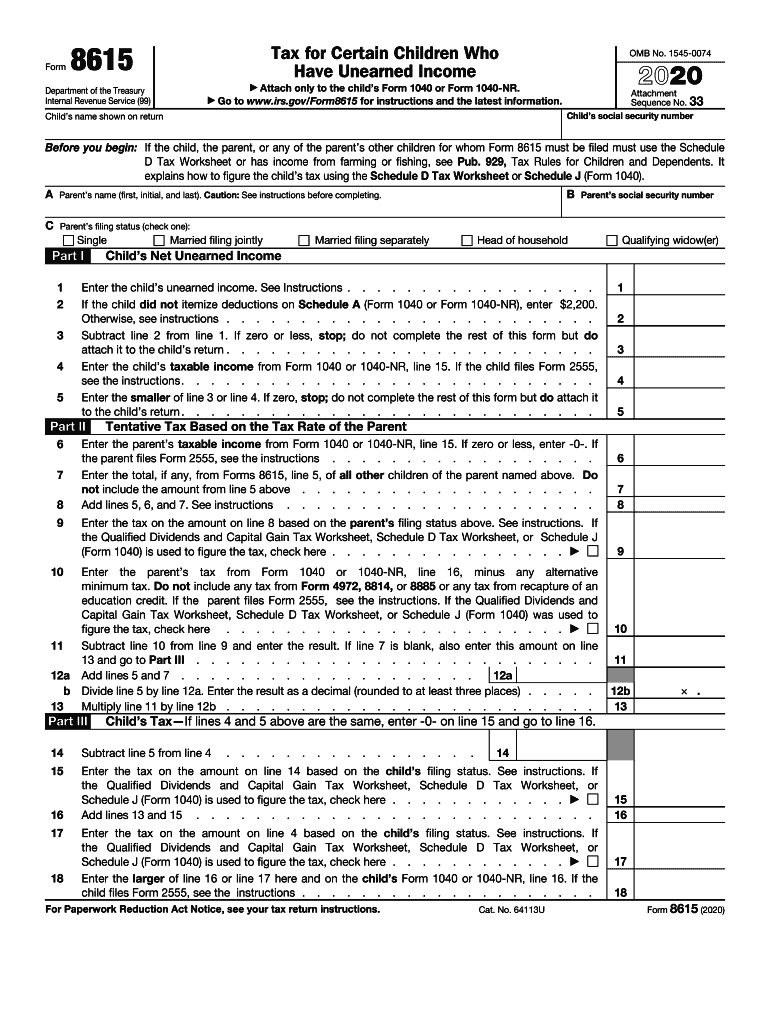

The 2020 Form 8615, also known as the Child Tax Credit form, is a tax document used by certain children who have unearned income. This form is designed to determine the tax liability for children under the age of 18 who have investment income exceeding a specified threshold. The purpose of the 8615 is to ensure that children’s unearned income is taxed at the parents' tax rates, rather than the typically lower rates applied to children. This form is particularly relevant for families looking to navigate the complexities of tax implications related to minor dependents.

How to use the 8615

Using the 2020 Form 8615 involves a few key steps to ensure accurate completion. First, determine if your child qualifies to file this form based on their age and income level. If your child has unearned income over the threshold, you will need to complete the form. Next, gather all necessary financial information, including the child’s income sources and amounts. Fill out the form accurately, reflecting the child’s unearned income and any applicable deductions. Finally, ensure that the form is submitted along with your tax return to the IRS.

Steps to complete the 8615

Completing the 2020 Form 8615 requires careful attention to detail. Follow these steps:

- Determine eligibility based on age and income.

- Collect all relevant financial documents, including income statements.

- Fill out the form, starting with the child's personal information.

- Report the total unearned income on the appropriate lines.

- Calculate the tax owed using the provided tax tables.

- Review the completed form for accuracy before submission.

Once completed, attach the form to your tax return and file it with the IRS.

Legal use of the 8615

The 2020 Form 8615 is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is essential to ensure that all information reported is accurate to avoid potential legal issues. The form must be signed and dated by the taxpayer, affirming that the information provided is true and complete. Failure to comply with IRS regulations regarding this form can result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

For the 2020 tax year, the deadline for filing the 8615 form coincides with the standard tax filing deadline, which is typically April fifteenth of the following year. If you require additional time, you may file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties. Keeping track of these important dates helps ensure compliance and avoids unnecessary complications.

Who Issues the Form

The 2020 Form 8615 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. This form is part of the IRS’s efforts to regulate the taxation of unearned income for minors, ensuring that families understand their tax obligations. It is important to refer to the IRS website or official publications for the most current version of the form and any updates regarding its use.

Quick guide on how to complete 8615

Complete 8615 effortlessly on any device

Digital document management has gained traction with companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and eSign your documents quickly and efficiently. Manage 8615 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign 8615 seamlessly

- Find 8615 and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Edit and eSign 8615 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8615

Create this form in 5 minutes!

How to create an eSignature for the 8615

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the 2020 form 8615 and why is it important?

The 2020 form 8615 is a tax form used by certain children who have unearned income exceeding a specified threshold. Completing this form is essential as it helps determine the tax liability for that income, ensuring compliance with IRS regulations. Utilizing airSlate SignNow simplifies the eSigning process for this and other tax documents.

-

How can airSlate SignNow help with the 2020 form 8615?

airSlate SignNow allows users to easily upload, sign, and send the 2020 form 8615 electronically. This streamlines the process and ensures your tax documentation is submitted accurately and efficiently. You can also set reminders and track the status of your form for added convenience.

-

What are the costs associated with using airSlate SignNow for the 2020 form 8615?

airSlate SignNow offers several pricing plans that cater to different business needs, starting with cost-effective options for individual users. Regardless of the plan, you’ll benefit from unlimited eSignatures and secure document storage, which can save both time and money when managing forms like the 2020 form 8615.

-

Is airSlate SignNow secure for submitting the 2020 form 8615?

Absolutely. airSlate SignNow employs the latest security measures, including encryption and secure cloud storage, to ensure your 2020 form 8615 and other sensitive documents are protected. You can trust that your information remains confidential and secure throughout the signing process.

-

What features does airSlate SignNow offer for managing the 2020 form 8615?

With airSlate SignNow, you can easily manage the 2020 form 8615 through customizable workflows, templates, and automated reminders. The platform also supports document collaboration, allowing multiple parties to sign and review documents in a streamlined manner.

-

Can I integrate airSlate SignNow with other applications while filling out the 2020 form 8615?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and Outlook, which can enhance your workflow when managing the 2020 form 8615. These integrations make it easier to import documents and send them for eSignature directly from your existing tools.

-

What benefits does using airSlate SignNow provide for the 2020 form 8615?

Using airSlate SignNow for the 2020 form 8615 saves time and reduces the hassle of printing, signing, and scanning documents. The platform ensures compliance by providing secure, legally binding eSignatures, which makes the tax filing process straightforward and efficient.

Get more for 8615

- Form vat 37 see rule 63 personal surety legal pundits

- Application for reservation of business name utah division of corporations utah form

- Howitzer range card form

- Meqi hard copy form for use 100106 shepscenter unc

- Unm transcripts form

- Illinois waiver of process and entry of appearance form

- Transfer of lease agreement template form

- Transportation lease agreement template form

Find out other 8615

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast