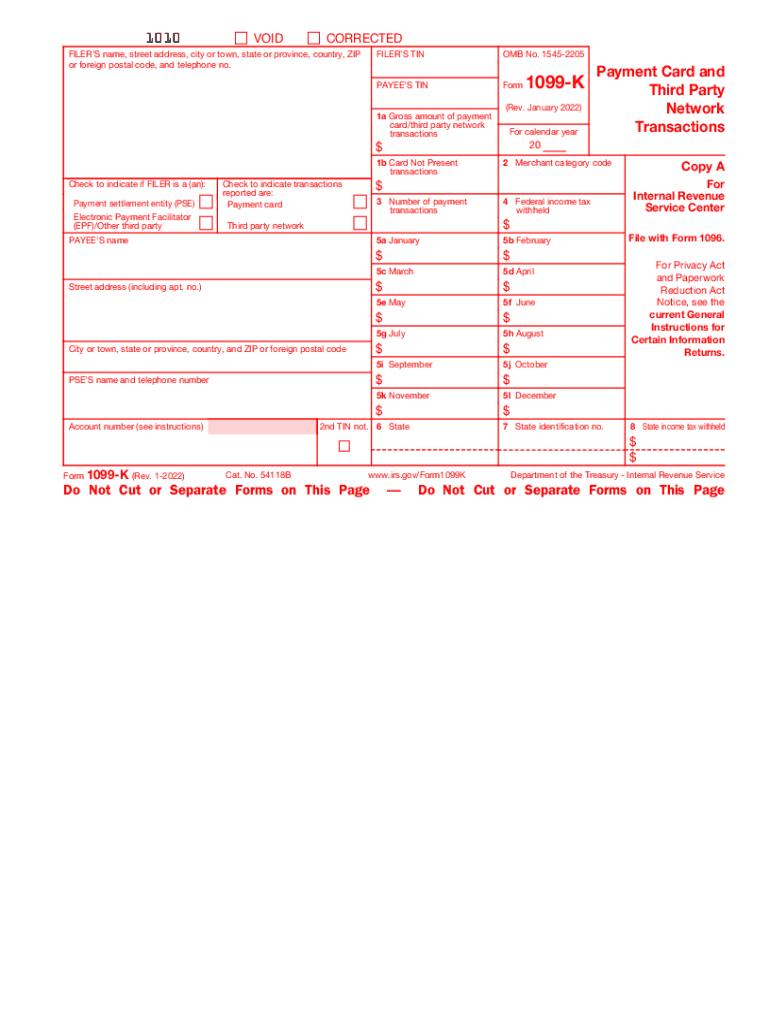

Form 1099 K Rev January Payment Card and Third Party Network Transactions 2022

What is the Form 1099 K Rev January Payment Card And Third Party Network Transactions

The Form 1099 K is a tax document used in the United States to report payment card and third-party network transactions. It is primarily issued by payment processors to report the gross amount of payments made to a business or individual during the calendar year. This form is essential for those who receive payments through platforms like PayPal, Venmo, or credit card transactions. The IRS requires this information to ensure that all income is reported accurately for tax purposes.

How to use the Form 1099 K Rev January Payment Card And Third Party Network Transactions

Using the Form 1099 K involves understanding the information it contains and how it fits into your tax reporting. When you receive this form, it will detail the total amount of transactions processed through payment cards and third-party networks. You need to ensure that the income reported matches your records. This form is typically used when filing your tax return, as it helps to verify income and ensure compliance with IRS regulations.

Steps to complete the Form 1099 K Rev January Payment Card And Third Party Network Transactions

Completing the Form 1099 K involves several key steps:

- Gather all relevant transaction data, including payment amounts and dates.

- Ensure that the information matches what is reported by the payment processor.

- Fill out the form with your business name, address, and taxpayer identification number.

- Report the total gross payments received in the appropriate box on the form.

- Submit the completed form to the IRS by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of Form 1099 K. This includes instructions on who must file the form, the thresholds for reporting, and the deadlines for submission. Generally, businesses must file Form 1099 K if they receive more than twenty thousand dollars in gross payments and have more than two hundred transactions in a calendar year. It is crucial to review the IRS guidelines to ensure compliance and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 K are critical to adhere to in order to avoid penalties. Typically, the form must be submitted to the IRS by January thirty-first of the year following the reporting year. If you are filing electronically, the deadline may extend to March thirty-first. It is essential to keep track of these dates to ensure timely submission and compliance with IRS regulations.

Penalties for Non-Compliance

Failing to file the Form 1099 K or submitting incorrect information can result in significant penalties. The IRS imposes fines for late filings, which can increase depending on how late the form is submitted. Additionally, if the information reported does not match the income reported on tax returns, it may trigger an audit. Understanding these penalties can help ensure that businesses remain compliant and avoid unnecessary financial repercussions.

Quick guide on how to complete form 1099 k rev january 2022 payment card and third party network transactions

Manage Form 1099 K Rev January Payment Card And Third Party Network Transactions effortlessly on any device

Web-based document handling has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Form 1099 K Rev January Payment Card And Third Party Network Transactions across any platform with airSlate SignNow applications for Android or iOS and enhance any document-oriented procedure today.

The easiest way to modify and electronically sign Form 1099 K Rev January Payment Card And Third Party Network Transactions without hassle

- Locate Form 1099 K Rev January Payment Card And Third Party Network Transactions and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 1099 K Rev January Payment Card And Third Party Network Transactions to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 k rev january 2022 payment card and third party network transactions

Create this form in 5 minutes!

People also ask

-

What is a 1099 k form and when do I need it?

A 1099 k form is a tax document that reports the total payments received through credit card transactions and third-party payment networks. You usually need it if your business processes payments that exceed $20,000 or have more than 200 transactions in a calendar year. Understanding the implications of the 1099 k is crucial for tax reporting.

-

How does airSlate SignNow help with 1099 k management?

airSlate SignNow streamlines the process of creating and signing 1099 k forms, making document management effortless. With our platform, you can easily send, track, and eSign your 1099 k forms securely, ensuring timely and accurate tax compliance. This automation reduces the chance of errors and saves you valuable time.

-

What are the pricing options for using airSlate SignNow for 1099 k forms?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Our pricing model ensures that you only pay for the features you require, including specific solutions for managing 1099 k forms. We provide transparent pricing with no hidden fees, allowing you to budget effectively.

-

Can I integrate airSlate SignNow with my accounting software for 1099 k generation?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing for effortless generation and management of 1099 k forms. This integration ensures that all necessary financial data is synchronized, providing a comprehensive solution for your tax-related documentation needs. This capability enhances efficiency and reduces manual input errors.

-

What features does airSlate SignNow provide for secure handling of 1099 k forms?

Our platform incorporates industry-leading security features to protect your 1099 k forms and sensitive business information. We use encryption, secure cloud storage, and compliance with regulations such as GDPR to ensure your documents are safe. This high level of security provides peace of mind when handling sensitive financial documents.

-

Are there any benefits to using airSlate SignNow for electronic signatures on 1099 k forms?

Using electronic signatures for 1099 k forms with airSlate SignNow accelerates the signing process, allowing for faster tax compliance. Electronic signatures are legally binding and provide a comprehensive audit trail, ensuring that all parties are in agreement. This convenience signNowly enhances your document workflow.

-

What types of businesses can benefit from using airSlate SignNow for 1099 k forms?

Any business that processes payments and issues 1099 k forms can benefit from using airSlate SignNow. Whether you're a small business, freelancer, or corporation, our platform is designed to accommodate diverse needs and streamline the preparation of 1099 k forms. This flexibility makes it a valuable tool for various industries.

Get more for Form 1099 K Rev January Payment Card And Third Party Network Transactions

- Ohio incorporation form

- Js 44 civil cover sheet federal district court ohio form

- Lead based paint disclosure for sales transaction ohio form

- Based paint disclosure form

- Notice of lease for recording ohio form

- Sample cover letter for filing of llc articles or certificate with secretary of state ohio form

- Supplemental residential lease forms package ohio

- Landlord tenant form 497322491

Find out other Form 1099 K Rev January Payment Card And Third Party Network Transactions

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast