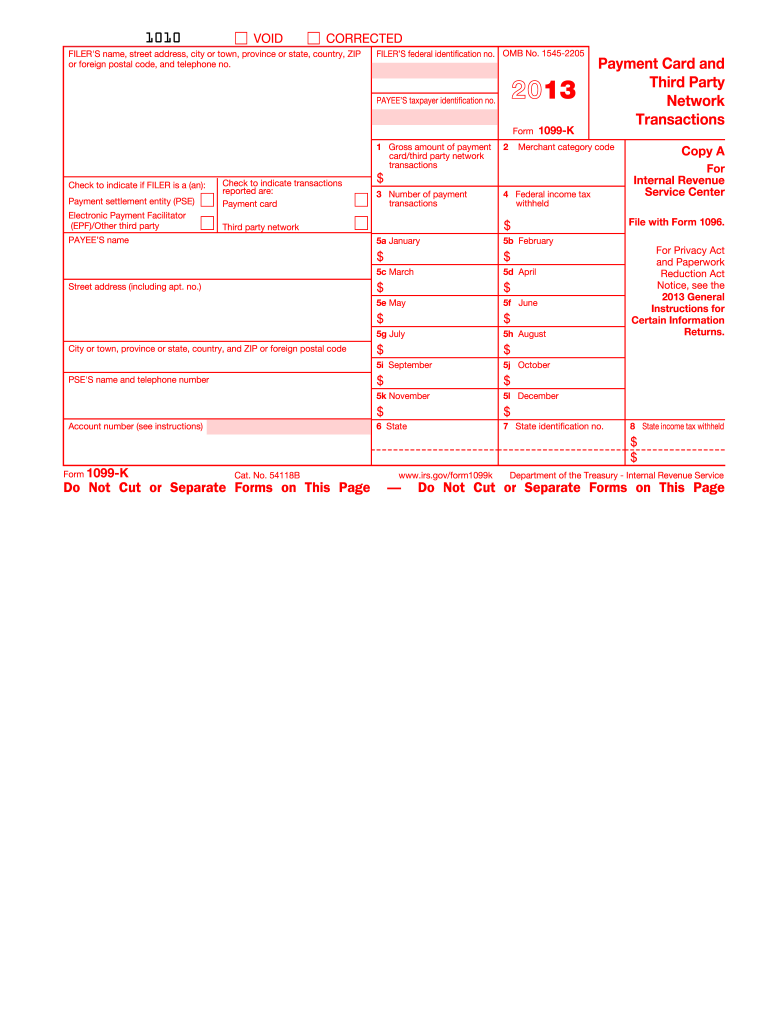

1099 K Form 2013

What is the 1099 K Form

The 1099 K Form is a tax document used in the United States to report payment card and third-party network transactions. It is primarily issued by payment settlement entities, such as credit card companies and online payment platforms, to businesses and individuals who have received payments exceeding a certain threshold. The form helps the Internal Revenue Service (IRS) track income that may not be reported on traditional tax forms, ensuring compliance with tax regulations.

How to use the 1099 K Form

To effectively use the 1099 K Form, recipients must first ensure they receive the form from the payment settlement entity. Once in possession of the form, it should be reviewed for accuracy, particularly the reported amounts and the taxpayer identification number. The information on the form must then be reported on the recipient's tax return, typically on Schedule C for self-employed individuals or as part of business income for entities. It is essential to keep a copy of the form for personal records and future reference.

Steps to complete the 1099 K Form

Completing the 1099 K Form involves several key steps:

- Gather all relevant transaction data, including payment amounts and dates.

- Ensure that the correct taxpayer identification number is included.

- Verify that the form reflects all necessary payments received through credit card transactions or third-party networks.

- Double-check the totals to ensure they match your records.

- Submit the completed form to the IRS by the designated deadline, either electronically or by mail.

IRS Guidelines

The IRS provides specific guidelines regarding the use and filing of the 1099 K Form. These guidelines outline the thresholds for reporting, which generally include any business that receives over twenty thousand dollars in payments and more than two hundred transactions in a calendar year. The IRS also specifies the deadlines for filing the form, typically by the end of January for recipients and by the end of February for the IRS if filed by paper. It is crucial to adhere to these guidelines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 K Form are critical for compliance. The form must be sent to recipients by January thirty-first of the following year. If filing electronically with the IRS, the deadline is usually set for March thirty-first. It is important to keep track of these dates to ensure timely submission and avoid potential penalties for late filing.

Penalties for Non-Compliance

Failure to comply with the requirements for the 1099 K Form can result in significant penalties. The IRS imposes fines for late filings, which can increase with the delay. Additionally, if a business fails to report income accurately, it may face further scrutiny during audits, leading to additional penalties and interest on unpaid taxes. Therefore, it is essential to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete 2013 1099 k form

Discover the most efficient method to complete and sign your 1099 K Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to finish and sign your 1099 K Form and similar forms for public services. Our advanced eSignature tool provides everything required to handle documents swiftly while adhering to official standards - robust PDF editing, management, protection, signing, and sharing features accessible within a user-friendly interface.

Only a few steps are needed to fill out and sign your 1099 K Form:

- Upload the editable template to the editor using the Get Form button.

- Identify the information you need to enter in your 1099 K Form.

- Move between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Conceal sections that are no longer relevant.

- Click on Sign to create a legally enforceable eSignature using any method you prefer.

- Add the Date alongside your signature and finalize your task with the Done button.

Store your completed 1099 K Form in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our service also allows flexible file sharing. There's no need to print your templates when you must submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2013 1099 k form

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

I just received a 1099-K form from Coinbase? How do I fill my taxes?

1099-Ks from Coinbase, Gemini, and other exchanges only show your CUMULATIVE transaction value. That’s why the amount may seem HUGE if you swing traded your entire balance multiple times.However you only need to pay taxes on your capital gains/losses, so that amount is likely less than the 1099K’s amount. You need to file a Schedule D 1040 with a 8949.I recommend checking out Crypto tax sites like TokenTax that calculate all of that for you — Here is an article about 1099Ks from them - Coinbase Pro sent me a 1099-K. What do I do now? | TokenTax Blog

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

Do you need to fill I-9 form for 1099 contract?

There's no such thing as a “1099 employee.” You are either an employee or you are not. The IRS rules are here Independent Contractor Self Employed or Employee and ICE uses a similar process to determine who is an employee and who is not.While it is illegal to retain a contractor whom you know to be working illegally, you are not required to connect Form I-9 from your independent contractors. You may do so if you wish.Who Needs Form I-9? Explains who must provide Form I-9.

-

How do I print out my Form 1099 from SSA?

I fill in the Form 1099 and immediately print it here: http://bit.ly/2Nkf48f

Create this form in 5 minutes!

How to create an eSignature for the 2013 1099 k form

How to generate an electronic signature for the 2013 1099 K Form in the online mode

How to create an electronic signature for the 2013 1099 K Form in Chrome

How to create an eSignature for putting it on the 2013 1099 K Form in Gmail

How to create an electronic signature for the 2013 1099 K Form straight from your mobile device

How to generate an electronic signature for the 2013 1099 K Form on iOS devices

How to generate an eSignature for the 2013 1099 K Form on Android OS

People also ask

-

What is a 1099 K Form and why do I need it?

The 1099 K Form is a tax document used to report the payment card and third-party network transactions. If your business processes payments through platforms like PayPal or credit cards, you’ll need the 1099 K Form for accurate tax reporting. Using airSlate SignNow, you can easily eSign and send this form to your recipients, ensuring compliance with IRS requirements.

-

How does airSlate SignNow help with the 1099 K Form?

airSlate SignNow streamlines the process of managing the 1099 K Form by allowing you to create, send, and eSign documents electronically. This reduces the hassle of paper forms and ensures that your documents are securely stored and easily accessible. With our cost-effective solution, you can efficiently handle all your tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for the 1099 K Form?

Yes, airSlate SignNow offers various pricing plans suited for different business needs. Our plans are designed to be cost-effective, allowing you to manage the 1099 K Form and other documents without breaking the bank. You can choose a plan that fits your requirements and budget.

-

Can I integrate airSlate SignNow with other accounting software for 1099 K Form processing?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software like QuickBooks and Xero, making it easy to handle the 1099 K Form alongside your other financial documents. This integration helps streamline your workflow and keeps your financial data organized.

-

What features does airSlate SignNow offer for handling the 1099 K Form?

Our platform provides features such as electronic signatures, document templates, and secure cloud storage, all tailored to facilitate the management of the 1099 K Form. With airSlate SignNow, you can track the status of your documents in real-time and ensure that all parties have completed their signatures.

-

How secure is airSlate SignNow when handling sensitive documents like the 1099 K Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and comply with industry standards to ensure that your 1099 K Form and other sensitive documents are protected. You can trust us to keep your information safe during the signing process.

-

Can I use airSlate SignNow on mobile devices for the 1099 K Form?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to manage and eSign the 1099 K Form on the go. Whether you’re using a smartphone or tablet, you can easily access your documents and keep your business running smoothly from anywhere.

Get more for 1099 K Form

- Unicare prior authorization form

- Louisiana form r 7006 instructions

- Visa canada mauritius form

- Early childhood programs romecsdorg form

- Personal training client feedback form

- Alcpt form 72

- Bi weekly casual time sheet columbia university hr columbia form

- Ct 4 general business corporation franchise tax return short form

Find out other 1099 K Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors