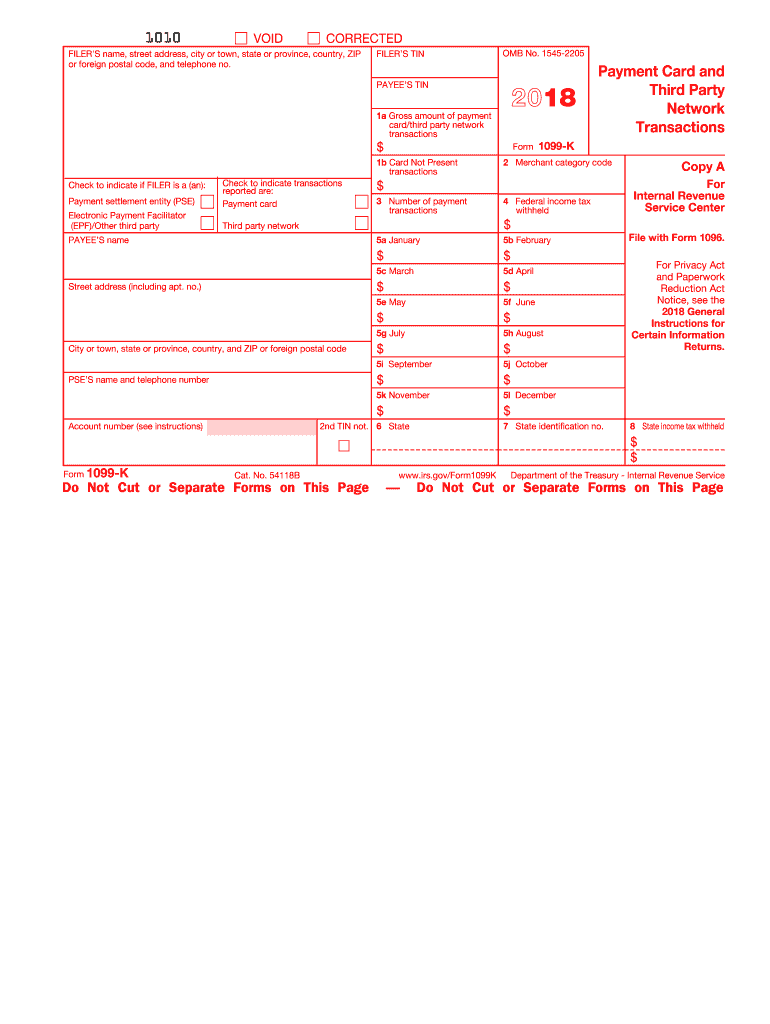

1099 K Form 2018

What is the 1099-K Form?

The 1099-K form is a tax document used to report payment transactions made to a business or individual. This form is primarily issued by payment settlement entities, such as credit card companies and third-party payment processors. It is specifically designed to report income received through electronic means, including credit card transactions and online payments. The 1099-K form is essential for self-employed individuals and businesses that receive payments for goods or services, ensuring that all income is accurately reported to the IRS.

How to Use the 1099-K Form

To use the 1099-K form effectively, individuals and businesses must first ensure they receive it from their payment processors if they meet the reporting threshold. The form provides crucial information, including the total amount of payments received during the tax year. Recipients should use the data on the 1099-K to report their income accurately on their tax returns. It is important to cross-reference the amounts reported on the 1099-K with personal records to ensure consistency and accuracy.

Steps to Complete the 1099-K Form

Completing the 1099-K form involves several steps:

- Gather Information: Collect all necessary details, including the total payment amount and the payer's information.

- Fill Out the Form: Enter the required details, including the payer's name, address, and taxpayer identification number (TIN).

- Report Transactions: Include the total number of transactions and the gross amount received.

- Submit the Form: Ensure that the completed form is sent to the IRS and provided to the payee by the appropriate deadlines.

Key Elements of the 1099-K Form

The 1099-K form contains several key elements that are crucial for accurate reporting:

- Payer Information: Includes the name, address, and TIN of the payment processor.

- Payee Information: Contains the name, address, and TIN of the individual or business receiving payments.

- Transaction Details: Lists the total number of transactions and the gross amount paid during the year.

Filing Deadlines / Important Dates

Filing deadlines for the 1099-K form are critical for compliance. The form must be submitted to the IRS by January thirty-first of the year following the reporting year. Additionally, recipients should receive their copies by the same date. It is essential to be aware of these deadlines to avoid penalties and ensure timely reporting of income.

Who Issues the Form

The 1099-K form is issued by payment settlement entities, which include credit card companies and third-party payment processors. These entities are responsible for providing the form to both the IRS and the payee. It is important for businesses and individuals to keep track of the forms they receive to ensure accurate reporting of their income.

Quick guide on how to complete 2018 form card

Discover the simplest method to complete and endorse your 1099 K Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior method to finalize and endorse your 1099 K Form and similar forms for public services. Our advanced electronic signature solution equips you with all the necessary tools to manage paperwork efficiently while complying with official standards - robust PDF editing, organizing, securing, signing, and sharing capabilities readily available in an intuitive interface.

There are just a few steps needed to fill in and sign your 1099 K Form:

- Upload the editable template to the editor using the Get Form option.

- Identify what information you must input in your 1099 K Form.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure sections that are irrelevant.

- Press Sign to create a legally binding electronic signature through any method you choose.

- Include the Date next to your signature and finalize your task using the Done button.

Store your finished 1099 K Form in the Documents folder in your profile, download it, or transfer it to your chosen cloud storage. Our service also provides versatile file sharing options. There’s no need to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct 2018 form card

FAQs

-

Where will I get the admit card for SSC CGL 2018 for Tier 1? I filled out the form and submitted it.

1st check on your regional SSC website that your application form is accepted or not. If it is accepted (if you filled form as per per guidelines of notification then mostly form will be accepted) then once admit cards get release you will get a SMS or email or both from SSC. Meanwhile you can check some websites like gradeup, sscadda, mahendras, etc. All the best for exam. As per some websites related to SSC study, tier 1 exam may get postponed. So keep following any one standard websire for updates

-

Can I fill out the NDA 2018 form without an Aadhar card?

Yes you can fill NDA 2018 Application form without an Aadhaar card. it is not mandatory.

-

How does WBJEE counselling work?

WBJEE counselling procedure is very much similar to the counselling procedure adopted in JEE MAINS. After obtaining a rank in the exam interested candidates will be required to generate username and password and will have to pay the registration fee. This registration fee will be non-refundable,which is around 500. After registration candidates will be required to fill their choices online through the website. After declaration of round 1 result a candidate will be left with 3 choices. 1- accept the seat and take admission in the allocated seat.2- consider the candidate for up-gradation to higher filled choices.3- surrender the seat and pull out yourself from the counselling procedure.candidates will have to report to the reporting center within the specified period of time and will have to submit their choices failing to do so in round 1 will automatically remove you from further consideration and you will loose your seat. For choices 1 & 2, candidates will have to pay seat acceptance fee which will be returned in further rounds if you opt for choice 3( but will have to report to the reporting center,otherwise the candidate will not be able to claim it).This procedure will be repeated for three rounds and extra rounds can be introduced if the counselling team feels the necessity of it.In last round you will be forced to either accept the allocated seat or surrender your seat.

-

What are the steps to fill out the JEE Mains 2019 application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application formJEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

-

How do I fill out the JEE Main 2019 exam application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application form.JEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

-

How do I fill out the MHT-CET MBA exam application form in detail?

DTE Maharashtra has discharged MHT CET 2018 application form as on January 18 in online mode, can be filled by competitors by following the means said in how to fill MHT CET application frame 2018. Applicants who need to enlist themselves for the selection test should take after the means as given in how to fill MHT CET 2018 application form to maintain a strategic distance from oversights and entire method to go smooth and bother free. The means to fill the application type of MHT CET 2018 incorporates enlistment, filling of required subtle elements, transferring of filtered reports, instalment and affirmation page download. Hopefuls are required to fill the application type of MHT CET 2018 painstakingly to stay away from dismissal by the specialists. It is essential to take the application shape filling methodology of MHT CET genuinely on the grounds that exclusive those hopefuls who will present their structures effectively will get concede cards. Such applicants who will have legitimate MHT CET 2018 concede cards will be permitted to show up in the exam.Competitors must read the means offered underneath to fill and submit MHT CET 2018 application frame in a sorted-out way:Stage 1 – RegistrationApplicants should enrol themselves and give the required details. Candidate should concur whether he or she is an Indian resident or not.Proceeding onward, they will be required to fill the accompanying individual subtle elements:Full name (as showing up on the announcement of characteristics of SSC tenth or proportional exam), Father’s name, Mother’s first name, Last name, Gender, Contact Information, Address for correspondence, House No/Street, Area Name, Town/City , State, District, Pin code, Country, Mobile Number, Primary Email Id (Email will be sent to this email ID), Alternate Email Id (Parent’s Email ID, if accessible), Contact Telephone No. (with STD Code), Permanent Residence in Village/Town/City, Domicile of Maharashtra/Disputed Maharashtra Karnataka Border (MKB)/Outside Maharashtra, Reservation, Category of competitor (Caste perceived in Maharashtra state), Candidates having a place with SC, ST, VJ(A), NT(B), NT(C), NT(D), OBC and SBC classes must have their individual standing authentications, Candidates having a place with Non Creamy Layer (NCL) should create substantial testament upto March 31, 2019, Other DetailsRegardless of whether the candidate has a place with – PWD class or not (competitors qualified who are qualified under this classification ought to have under 40% incapacity), visually impaired, low vision. Orthopedically debilitated and competitors influenced with Cerebral Palsy and Dyslexia, who are not in a situation to compose, can benefit a copyist/author for the MHT-CET 2018 examRegardless of whether the applicant is a J&K vagrant or notReligionOther placement tests that applicant has enrolled for (JEE Main/NEET/None)Add up to Annual Family IncomeAadhaar NumberFinancial balance DetailsName of the record holder according to Bank recordName of the BankName of the Bank BranchKind of Account (Savings/Current)Financial balance NumberIFSC CodePoints of interest of HSC (twelfth/Equivalent Examination)Regardless of whether hopeful has passed/showed up for confirmation in Pharmacy (just for Biology applicants)Place from where hopeful has finished HSC (twelfth)/proportional exam showing up/Passed from school/Jr. School arranged (Maharashtra/Outside Maharashtra)Subtle elements required for MHT-CET 2018Subjects for CET examination (Physics, Chemistry, Mathematics, Biology)Dialect for the exam (English, Marathi, Urdu)Enter secret keyCompetitors should make a secret word (least 8 and most extreme 15 characters and should have one capitalized, one lower case and one numeric)In the wake of entering the secret key, competitors should affirm it. This secret word will be utilized for future logins.Statement by the hopefulApplicants should read the revelation composed and after that tap on “I Agree”Applicants need to enter the security key as gave and after that tap on “Next” catchStage 2 – Confirmation and SubmissionIn the wake of filling the previously mentioned subtle elements, hopefuls will have the capacity to check the data filled and alter certain things in the application frame.Applicants can backpedal and change or alter the accompanying particulars (as noticeable in green shading) before accommodation:Exam focusSubjects pickedDialect of the examIndividual with handicap choiceIn any case, there are particulars (as unmistakable in blue shading) that can’t be altered at this stage once submitted:Father’s nameLast nameDate of birthVersatile numberEmail IDSubsequent to rolling out the improvements, if required, hopefuls should present the shape.Stage 3 – Application number gotApplicants will get a message on the screen in regards to effective enlistment for MHT CET 2018 with their application number. A similar number will be sent to them gave email ID. Competitors can see and check their entered data in this progression.Stage 4 – Edit and Upload photo and markApplicants will have the capacity to alter the points of interest they have filled in the application frame. In any case, regardless they won’t have the capacity to alter their full name, father’s name, last name, date of birth, versatile number and email ID. In the event that candidates would prefer not to alter any points of interest, they can move to the subsequent stage of transferring their photo and mark in the arrangement recommended by the experts.Stage 5 – Uploading photo and markApplicants should transfer their current identification estimate shading photo and mark in the configuration given in the table underneath. On the off chance that, applicants are not ready to transfer the right photographs/marks, they should reload the right records and afterward transfer.Stage 6 – VerificationCompetitors will get a message on their screens with respect to fruitful transferring of photo and mark. They will likewise have the capacity to see a connection saying ” Click here to make payment “. Applicants should tap on the connection to enter the instalment entryway.Stage 7 – Payment gatewayHopefuls will have the capacity to see every one of the subtle elements filled by them alongside their transferred photo and mark on their screens. The application expense sum will likewise be noticeable in this progression, which they should pay in the wake of perusing the revelation. It is to noticed that competitors will have the capacity to change their subjects they are applying for.Applicants will have the capacity to influence application to charge payment through credit/check card, net saving money, plastic (ATM PIN), wallets and then some. They should influence instalment of the application to sum with comfort charge and expense.After instalment of utilisation charge, competitors will have the capacity to see a message on their screen with respect to accomplishment of exchange. Applicants must remove a print from this page.Stage 8 – Acknowledgment pageCompetitors must take a print from the affirmation page and keep it securely for some time later.Hope this Helps!!

Create this form in 5 minutes!

How to create an eSignature for the 2018 form card

How to generate an eSignature for your 2018 Form Card in the online mode

How to make an eSignature for the 2018 Form Card in Chrome

How to generate an electronic signature for putting it on the 2018 Form Card in Gmail

How to make an electronic signature for the 2018 Form Card from your mobile device

How to make an eSignature for the 2018 Form Card on iOS

How to create an eSignature for the 2018 Form Card on Android

People also ask

-

What is the 1099 K Form and when is it needed?

The 1099 K Form is used to report payment card and third-party network transactions. If your business receives payments through credit cards or payment services like PayPal, you may need to file this form. It's crucial for tax reporting and is typically required if you exceed certain thresholds in transactions.

-

How does airSlate SignNow help with the 1099 K Form?

airSlate SignNow simplifies the process of managing your 1099 K Form by allowing you to send and eSign important documents securely. You can easily create, share, and collect signatures on your 1099 K Form, ensuring that your tax documents are handled efficiently and professionally.

-

Is airSlate SignNow cost-effective for small businesses managing 1099 K Forms?

Yes, airSlate SignNow offers a cost-effective solution tailored for small businesses that need to manage 1099 K Forms. With flexible pricing plans, you can choose the best option that suits your budget while ensuring your document signing processes remain efficient and compliant.

-

What features does airSlate SignNow offer for handling 1099 K Forms?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and electronic signatures that make handling 1099 K Forms easy. These tools streamline the document workflow, allowing you to complete your forms quickly while maintaining security and compliance.

-

Can I integrate airSlate SignNow with other software to manage my 1099 K Forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your 1099 K Forms alongside your other financial documents. This integration helps ensure that your data is synchronized and reduces the chances of errors during tax season.

-

What are the benefits of using airSlate SignNow for 1099 K Form processing?

Using airSlate SignNow for your 1099 K Form processing provides numerous benefits, including enhanced efficiency, reduced paper usage, and improved accuracy. With electronic signatures and automated workflows, you can save time and ensure that your forms are completed correctly and on time.

-

How secure is airSlate SignNow when handling sensitive documents like the 1099 K Form?

Security is a top priority for airSlate SignNow. When managing sensitive documents like the 1099 K Form, your data is protected with advanced encryption and secure access controls, ensuring that your information remains confidential and secure at all times.

Get more for 1099 K Form

- Wcd request for formal hearing

- Determination descent form

- Joint petition for dissolution of marriage minnesota 2013 form

- Periodic vehicle inspection report form

- 1902 bir 2012 form

- Mn small estate affidavit form

- Lists request form minnesota board of chiropractic examiners mn chiroboard mn

- Puerto rico form as 2745 a 2003

Find out other 1099 K Form

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter