Form 1099 K Rev March 2024-2026

What is the Form 1099-K?

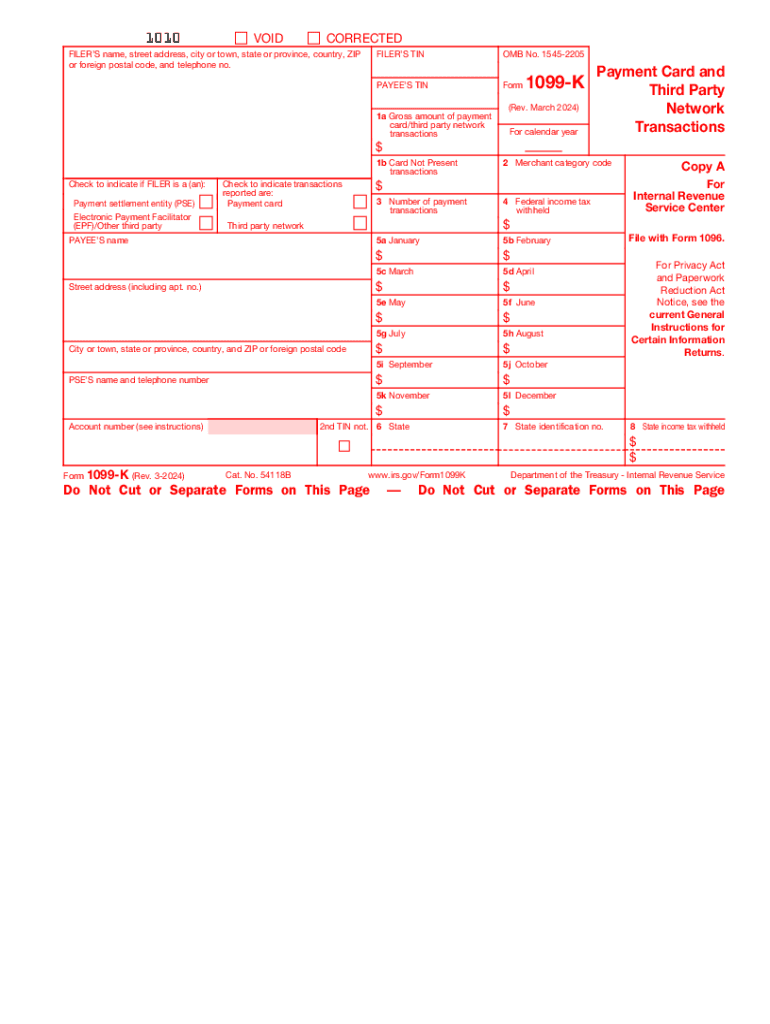

The Form 1099-K is a tax document used in the United States to report certain payment transactions. It is primarily issued by payment settlement entities, such as credit card companies and third-party payment networks, to report transactions made through their services. This form is essential for individuals and businesses that receive payments through platforms like PayPal, Venmo, or credit card processors. The IRS uses the information on the 1099-K to ensure that income is accurately reported on tax returns.

How to Complete the Form 1099-K

Completing the Form 1099-K involves several important steps. First, gather all relevant transaction data, including the total number of transactions and the gross amount received. Next, accurately fill in the payer information, which includes the name, address, and taxpayer identification number of the payment settlement entity. In the designated fields, report the gross payment amount for the calendar year, ensuring that the figures are correct. It is crucial to review the completed form for accuracy before submission to avoid any discrepancies that could lead to penalties.

Filing Deadlines for Form 1099-K

The filing deadlines for the Form 1099-K vary depending on how the form is submitted. For forms submitted electronically, the deadline is typically March thirty-first of the year following the tax year. If filing by mail, the deadline is usually January thirty-first. It is important to adhere to these deadlines to avoid potential penalties from the IRS for late filing. Additionally, recipients of the 1099-K should receive their copies by January thirty-first, allowing them ample time to prepare their tax returns.

IRS Guidelines for Form 1099-K

The IRS has established specific guidelines for the use and reporting of the Form 1099-K. These guidelines include the requirement that payment settlement entities must issue the form if a payee has received over twenty thousand dollars in gross payments and has more than two hundred transactions in a calendar year. The IRS also mandates that the form must accurately reflect the total gross payments received, without any deductions for fees or refunds. Understanding these guidelines is essential for both issuers and recipients to ensure compliance with tax regulations.

Legal Use of the Form 1099-K

The Form 1099-K serves a legal purpose in the U.S. tax system by providing a record of income received from electronic payment transactions. It is crucial for taxpayers to report this income on their tax returns, as failure to do so can lead to audits and penalties. The legal use of the form extends to ensuring that all income is accurately reported to the IRS, promoting transparency and compliance. Taxpayers should retain their copies of the 1099-K for their records and use them to substantiate their reported income during tax filing.

Who Issues the Form 1099-K?

The Form 1099-K is typically issued by payment settlement entities, which include credit card companies and third-party payment processors. These entities are responsible for tracking and reporting transactions made through their platforms. Common issuers of the 1099-K include companies like PayPal, Square, and Stripe. It is important for recipients to verify that they have received the correct form from the appropriate issuer, as this form is essential for accurately reporting income on tax returns.

Examples of Using the Form 1099-K

Examples of situations where the Form 1099-K is applicable include freelancers who receive payments through platforms like PayPal or Uber drivers who earn income through ridesharing services. In these cases, the payment settlement entity will issue a 1099-K if the individual meets the reporting thresholds. For instance, if a freelancer receives over twenty thousand dollars and has more than two hundred transactions in a year, they will receive a 1099-K. This form will help them report their earnings accurately and comply with tax obligations.

Quick guide on how to complete form 1099 k rev march

Complete Form 1099 K Rev March effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed forms and signatures, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delay. Manage Form 1099 K Rev March on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1099 K Rev March with ease

- Locate Form 1099 K Rev March and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Update and eSign Form 1099 K Rev March and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 k rev march

Create this form in 5 minutes!

How to create an eSignature for the form 1099 k rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 K form?

The 1099 K form is a tax document used to report payments received through third-party networks. It is essential for businesses that process transactions via platforms like PayPal or credit card processors. Understanding the 1099 K is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with 1099 K forms?

airSlate SignNow simplifies the process of sending and eSigning 1099 K forms. With our user-friendly platform, you can easily prepare, send, and track your 1099 K documents, ensuring that your tax filings are accurate and timely. This streamlines your workflow and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective, ensuring you get the best value for managing your 1099 K forms and other documents. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for managing 1099 K forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software. This allows you to manage your 1099 K forms alongside your other financial documents, enhancing efficiency and accuracy. Our integrations help streamline your overall document management process.

-

What features does airSlate SignNow offer for 1099 K management?

airSlate SignNow provides features such as eSigning, document templates, and real-time tracking for 1099 K forms. These tools make it easy to create, send, and manage your tax documents securely. Our platform ensures that you stay organized and compliant with tax regulations.

-

How does airSlate SignNow ensure the security of my 1099 K documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your 1099 K documents. Our platform complies with industry standards to ensure that your sensitive information remains safe and confidential.

-

Can I customize my 1099 K forms using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your 1099 K forms to meet your specific business needs. You can add your branding, adjust fields, and create templates that streamline the process for future use, making tax season much easier.

Get more for Form 1099 K Rev March

Find out other Form 1099 K Rev March

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document