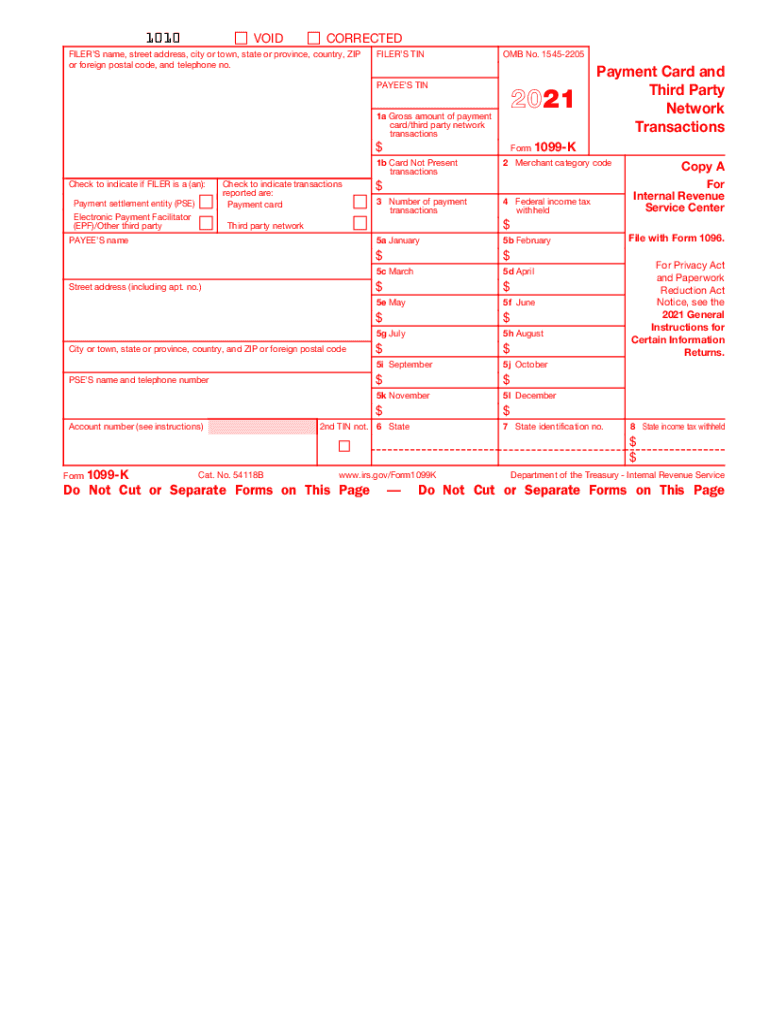

Form 1099 K Payment Card and Third Party Network Transactions 2021

What is the Form 1099 K Payment Card and Third Party Network Transactions

The Form 1099 K is a tax document used to report payment card and third-party network transactions. It is primarily issued by payment processors to report the gross amount of payments made to a business or individual during the tax year. This form is essential for those who receive payments through platforms such as PayPal, Venmo, or credit card transactions. The IRS requires this form to ensure accurate reporting of income, helping taxpayers comply with tax obligations.

How to Use the Form 1099 K Payment Card and Third Party Network Transactions

Using the Form 1099 K involves understanding the information it provides and how it affects your tax return. Taxpayers should carefully review the amounts reported on the form, as they represent the total gross payments received. It is crucial to reconcile these amounts with your own records to ensure accuracy. Any discrepancies should be addressed with the payment processor before filing your tax return.

Steps to Complete the Form 1099 K Payment Card and Third Party Network Transactions

Completing the Form 1099 K requires specific steps to ensure compliance. First, gather all relevant payment information from your payment processors. Next, verify the total gross payments reported on the form against your own records. If everything matches, you can use the information to report your income on your tax return. If there are discrepancies, contact the payment processor for corrections. Finally, retain a copy of the form for your records.

IRS Guidelines

The IRS has established guidelines for the use of Form 1099 K, which include specific thresholds for reporting. Payment processors must issue a Form 1099 K if a payee receives over twenty thousand dollars in gross payments and has more than two hundred transactions in a calendar year. It is important for taxpayers to be aware of these thresholds to understand when they will receive the form and how to report their income accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 K are crucial for compliance. Payment processors must send the form to the IRS and the payee by January thirty-first of the year following the tax year in which payments were made. Taxpayers should be aware of these deadlines to ensure they report their income correctly and avoid penalties for late filing.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of Form 1099 K can result in significant penalties. The IRS imposes fines for late, incomplete, or incorrect filings. These penalties can accumulate, making it essential for taxpayers to ensure accurate reporting. Understanding the implications of non-compliance can help individuals and businesses maintain good standing with the IRS.

Quick guide on how to complete 2021 form 1099 k payment card and third party network transactions

Prepare Form 1099 K Payment Card And Third Party Network Transactions effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to easily locate the right template and securely store it online. airSlate SignNow provides you with all the resources needed to generate, adjust, and electronically sign your documents promptly without delays. Manage Form 1099 K Payment Card And Third Party Network Transactions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to adjust and electronically sign Form 1099 K Payment Card And Third Party Network Transactions without hassle

- Locate Form 1099 K Payment Card And Third Party Network Transactions and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Form 1099 K Payment Card And Third Party Network Transactions to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1099 k payment card and third party network transactions

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1099 k payment card and third party network transactions

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is a 1099 K and who needs it?

A 1099 K is a tax form used to report payment card and third-party network transactions. It's essential for businesses and freelancers who receive payments through platforms like PayPal or debit/credit cards. If you meet the income thresholds for these transactions, you'll need to file a 1099 K during tax season.

-

How does airSlate SignNow help with 1099 K forms?

airSlate SignNow allows you to securely sign and send your 1099 K documents efficiently. With our eSignature solution, you can easily collect signatures and streamline the process, ensuring compliance and timely filing for tax reporting. This reduces paperwork errors and helps maintain accurate records.

-

What features does airSlate SignNow offer for managing 1099 K forms?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking specifically for forms like the 1099 K. These tools help you manage your tax documents more efficiently and ensure better compliance during audit seasons. Additionally, you can integrate your workflow with accounting software to simplify your financial processes.

-

Is airSlate SignNow cost-effective for handling 1099 K documents?

Yes, airSlate SignNow provides a cost-effective solution for managing your 1099 K documents. Our pricing structure is designed to accommodate businesses of all sizes, from freelancers to large enterprises. By reducing the costs associated with printing, mailing, and filing, you can save both time and money.

-

Can I integrate airSlate SignNow for 1099 K filing with my existing software?

Absolutely! airSlate SignNow integrates seamlessly with various financial and accounting software, making 1099 K filing easier. You can connect with popular platforms like QuickBooks or Xero, simplifying your financial management and ensuring all your forms are accurately processed.

-

What are the benefits of using airSlate SignNow for 1099 K forms compared to traditional methods?

Using airSlate SignNow for your 1099 K forms offers numerous benefits over traditional methods, including speed, efficiency, and security. You can sign and send documents electronically, reducing the potential for errors associated with manual handling. Plus, our platform provides an audit trail for compliance purposes.

-

How does eSigning 1099 K forms improve my workflow?

eSigning 1099 K forms through airSlate SignNow streamlines your workflow by eliminating the need for printing, signing, and scanning documents. This digital approach not only saves time but also enhances collaboration among stakeholders. With our platform, you can send, receive, and store signed documents all in one place.

Get more for Form 1099 K Payment Card And Third Party Network Transactions

- Living trust for individual who is single divorced or widow or widower with no children idaho form

- Living trust for individual who is single divorced or widow or widower with children idaho form

- Living trust for husband and wife with one child idaho form

- Living trust for husband and wife with minor and or adult children idaho form

- Amendment to living trust idaho form

- Living trust property record idaho form

- Financial account transfer to living trust idaho form

- Assignment to living trust idaho form

Find out other Form 1099 K Payment Card And Third Party Network Transactions

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate