Form 763S, Virginia Special Nonresident Claim for Individual Income Tax Withheld 2022

What is the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

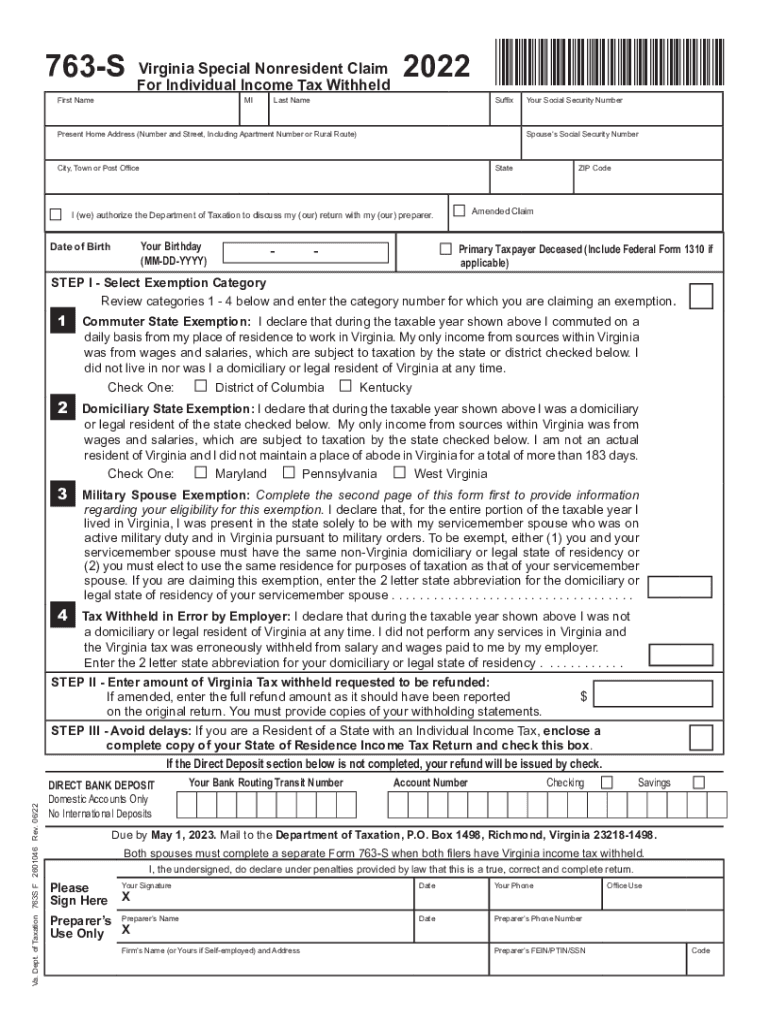

The Virginia 763S special claim form is designed for nonresidents who wish to claim a refund of Virginia income tax withheld from their wages. This form is particularly relevant for individuals who earn income in Virginia but do not reside in the state. By filing the 763S, taxpayers can ensure they receive any overpayment of taxes, promoting fair tax practices and compliance with state regulations. Understanding the purpose of this form is essential for nonresidents to navigate their tax obligations effectively.

How to use the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

Using the Virginia 763S form involves a straightforward process. Nonresidents must first gather necessary documentation, such as W-2 forms showing Virginia tax withheld. The next step is to accurately complete the form, ensuring all sections are filled out correctly. Once completed, the form can be submitted either electronically or by mail, depending on the taxpayer's preference. It is crucial to keep copies of all submitted documents for personal records and future reference.

Steps to complete the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

Completing the Virginia 763S form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including W-2 forms and any other relevant income statements.

- Provide personal information, including your name, address, and Social Security number.

- Indicate the amount of Virginia tax withheld as shown on your W-2 forms.

- Calculate your refund amount based on the taxes withheld and any applicable deductions.

- Sign and date the form to certify that the information is accurate.

Following these steps will help ensure that the form is completed correctly and submitted in a timely manner.

Key elements of the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

The Virginia 763S form contains several key elements that are essential for accurate completion. These include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Information: Taxpayers must report all income earned in Virginia, along with the amount of state tax withheld.

- Refund Calculation: This part of the form helps determine the total refund amount due to the taxpayer.

- Signature: A signature is required to validate the information provided and confirm its accuracy.

Understanding these elements is crucial for ensuring that the form is filled out correctly and that all necessary information is provided.

Eligibility Criteria

To qualify for filing the Virginia 763S form, certain eligibility criteria must be met. Nonresidents must have had Virginia income tax withheld from their earnings during the tax year. Additionally, they must not be residents of Virginia for tax purposes. It's important to review these criteria before submitting the form to ensure compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Virginia 763S form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can use electronic filing options available through authorized platforms.

- Mail: The completed form can be printed and mailed to the appropriate Virginia tax office.

- In-Person: Some taxpayers may choose to deliver the form in person at designated tax offices.

Choosing the right submission method can help ensure timely processing of the refund claim.

Quick guide on how to complete 2022 form 763s virginia special nonresident claim for individual income tax withheld

Complete Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely maintain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld seamlessly

- Locate Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld and click on Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that lead to the need for printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Alter and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 763s virginia special nonresident claim for individual income tax withheld

Create this form in 5 minutes!

People also ask

-

What is the Virginia 763s special claim form?

The Virginia 763s special claim form is a document used by individuals to submit claims for certain benefits under Virginia law. It serves as an essential tool for those seeking to expedite their claims process while ensuring all necessary information is provided accurately.

-

How can I fill out the Virginia 763s special claim form using airSlate SignNow?

Filling out the Virginia 763s special claim form with airSlate SignNow is simple and efficient. Our platform allows you to digitally input your information, ensuring easy navigation and quick completion of the form, all in a secure online environment.

-

Is there a cost associated with using airSlate SignNow for the Virginia 763s special claim form?

Yes, while airSlate SignNow offers various pricing plans, using it to complete the Virginia 763s special claim form is cost-effective compared to traditional methods. We provide tools that streamline the signing process and reduce paper usage, which can lead to savings over time.

-

What features does airSlate SignNow offer for managing the Virginia 763s special claim form?

airSlate SignNow offers several features to manage the Virginia 763s special claim form, including document templates, electronic signatures, and real-time tracking. These features enhance efficiency and ensure your claims are submitted quickly and accurately.

-

Are there any integrations available when using airSlate SignNow for the Virginia 763s special claim form?

Absolutely! airSlate SignNow integrates seamlessly with various software and applications, enhancing your experience while completing the Virginia 763s special claim form. This integration allows you to import data and sync with other tools efficiently.

-

What are the benefits of using airSlate SignNow for the Virginia 763s special claim form?

Using airSlate SignNow for the Virginia 763s special claim form offers numerous benefits, including increased speed, reduced errors, and enhanced security. Our platform ensures that your documents are handled with the utmost care while expediting the claims process.

-

Can I track the status of my Virginia 763s special claim form submission with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Virginia 763s special claim form submissions. You will receive notifications and updates on the status of your claim, ensuring you stay informed throughout the entire process.

Get more for Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

Find out other Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word