Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form 2022

What is the LAT 5 inventory, Merchandise, Etc 20 Personal Property Tax Form

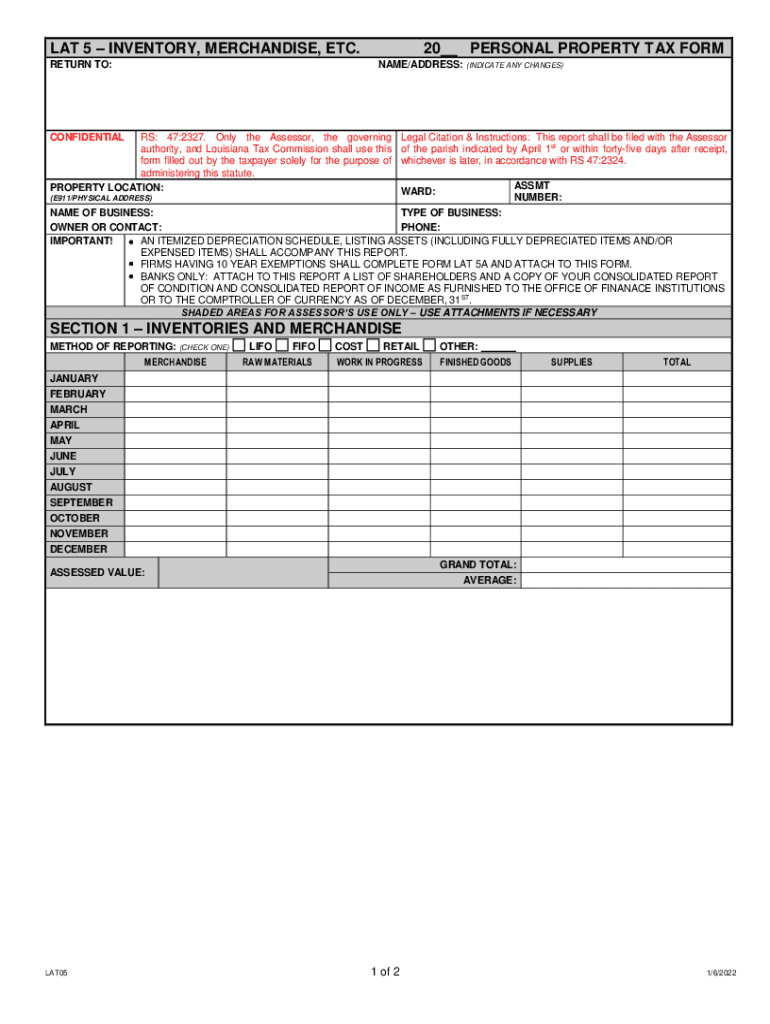

The LAT 5 inventory, Merchandise, Etc 20 Personal Property Tax Form is a document used in Louisiana for reporting personal property for tax purposes. This form is essential for businesses and individuals who own personal property, including inventory and equipment, as it helps assess the value of these assets for taxation. The information provided on the LAT 5 assists local assessors in determining property tax obligations, ensuring compliance with state regulations.

How to use the LAT 5 inventory, Merchandise, Etc 20 Personal Property Tax Form

Using the LAT 5 form involves several key steps. First, gather all necessary information about the personal property you own, including descriptions, values, and acquisition dates. Next, accurately fill out each section of the form, ensuring that all details are correct to avoid potential penalties. Once completed, you can submit the form to your local tax assessor's office by mail, in person, or electronically, depending on the submission options available in your area.

Steps to complete the LAT 5 inventory, Merchandise, Etc 20 Personal Property Tax Form

Completing the LAT 5 form requires careful attention to detail. Follow these steps:

- Gather all relevant documentation regarding your personal property.

- Fill out the form with accurate descriptions and values of each item.

- Ensure all sections of the form are completed, including any required signatures.

- Review the form for accuracy before submission.

- Submit the form by the designated deadline to avoid late fees.

Legal use of the LAT 5 inventory, Merchandise, Etc 20 Personal Property Tax Form

The LAT 5 form is legally binding and must be filled out in accordance with Louisiana state laws. It serves as a declaration of personal property ownership and value, which is crucial for tax assessment purposes. Failing to submit this form or providing inaccurate information can lead to penalties or legal repercussions. Therefore, it is important to ensure compliance with all legal requirements when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the LAT 5 form vary by jurisdiction within Louisiana. Typically, the form must be submitted by May 15 of each year. It is essential to check with your local assessor's office for specific deadlines and any potential extensions. Missing the deadline can result in penalties, so timely submission is crucial for compliance.

Form Submission Methods (Online / Mail / In-Person)

The LAT 5 form can be submitted through various methods, depending on the local assessor's office policies. Common submission methods include:

- Online submission via the local assessor's website.

- Mailing the completed form to the designated office address.

- Delivering the form in person to the local assessor's office.

It is advisable to confirm the preferred submission method with your local office to ensure proper processing.

Quick guide on how to complete lat 5inventory merchandise etc 20 personal property tax form

Effortlessly Prepare Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form on Any Device

The management of documents online has gained signNow traction among enterprises and individuals alike. It serves as an excellent environmentally-friendly substitute for traditional printed and signed papers since you can locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without complications. Manage Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form on any platform with the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to Modify and Electronically Sign Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form with Ease

- Obtain Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact confidential information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then press the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form and ensure exceptional communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lat 5inventory merchandise etc 20 personal property tax form

Create this form in 5 minutes!

How to create an eSignature for the lat 5inventory merchandise etc 20 personal property tax form

The best way to create an e-signature for a PDF file online

The best way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is LAT tax Louisiana and how does it affect my business?

LAT tax Louisiana, or Louisiana's local sales tax, impacts businesses operating within the state. It requires them to comply with state-specific tax regulations, which can be complex. Understanding LAT tax Louisiana is crucial to avoid penalties and ensure accurate filings.

-

How can airSlate SignNow help with LAT tax Louisiana documentation?

airSlate SignNow offers an efficient platform for managing and eSigning documents related to LAT tax Louisiana compliance. With our tools, businesses can easily send tax forms, agreements, and contracts, ensuring timely submissions and reducing administrative burdens.

-

Is there a cost associated with using airSlate SignNow for LAT tax Louisiana forms?

Yes, airSlate SignNow provides different pricing plans tailored to business needs. These plans offer various features that help manage LAT tax Louisiana documentation efficiently, making it a cost-effective solution for compliance and document management.

-

What features does airSlate SignNow offer to assist with LAT tax Louisiana filing?

airSlate SignNow includes features such as document templates, automated workflows, and secure eSigning, essential for LAT tax Louisiana filings. These functionalities help streamline the preparation and submission processes, ensuring accuracy and compliance.

-

Can I integrate airSlate SignNow with my existing accounting software for LAT tax Louisiana?

Absolutely! airSlate SignNow easily integrates with various accounting and tax software solutions. This integration allows businesses to synchronize their LAT tax Louisiana documents seamlessly, improving efficiency and accuracy in record keeping.

-

What benefits does airSlate SignNow provide for handling LAT tax Louisiana compliance?

Using airSlate SignNow for LAT tax Louisiana compliance offers numerous benefits, including improved document tracking, enhanced security, and reduced turnaround times. Our user-friendly platform simplifies the entire process, ensuring your business stays compliant without hassle.

-

Are there specific document types for LAT tax Louisiana that I can manage with airSlate SignNow?

Yes, with airSlate SignNow, you can manage various document types related to LAT tax Louisiana, such as tax returns and sales tax exemption forms. Our extensive library of templates ensures you have access to all necessary documents for compliance.

Get more for Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children mississippi form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure mississippi form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497313841 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497313842 form

- Ms codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497313844 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497313845 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497313846 form

Find out other Lat 5inventory, Merchandise, Etc 20 Personal Property Tax Form

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract