Form it 214, Claim for Real Property Tax Credit Government of New York 2022

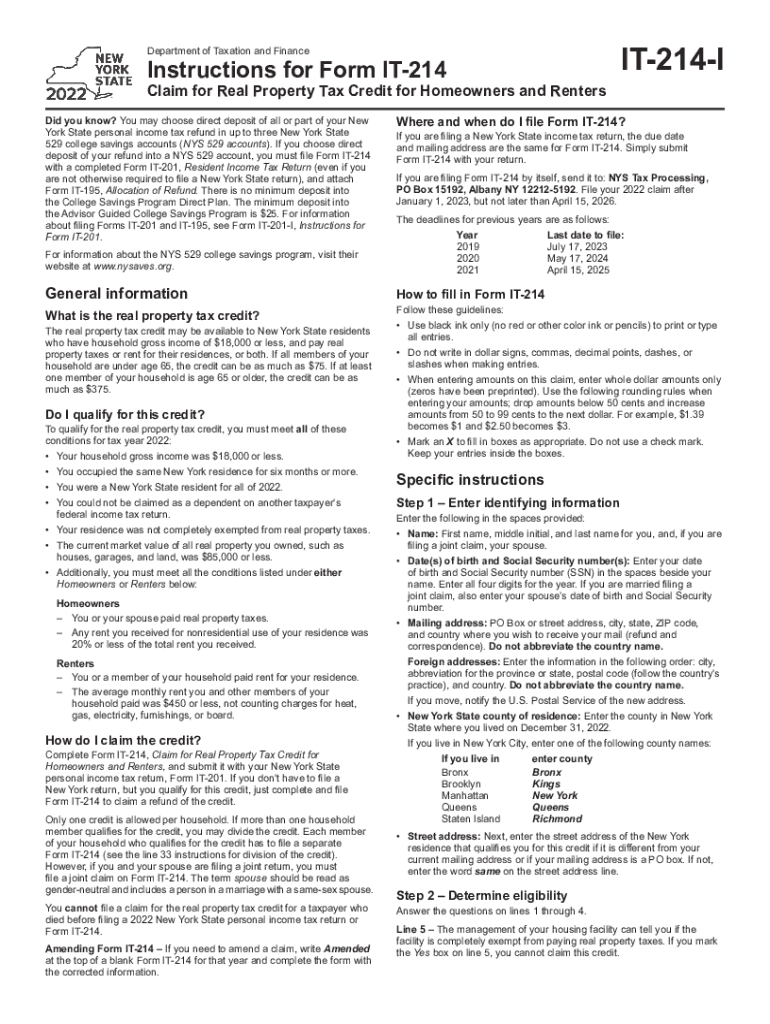

What is the Form IT 214?

The Form IT 214, officially known as the Claim for Real Property Tax Credit, is a tax form used by residents of New York to claim a credit for real property taxes paid on their primary residence. This form is designed to provide financial relief to homeowners and renters who meet specific eligibility criteria. The credit aims to reduce the financial burden of property taxes, making housing more affordable for New York residents.

Steps to Complete the Form IT 214

Completing the Form IT 214 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of property taxes paid and personal identification information. Next, fill out the form by providing your personal details, including your name, address, and Social Security number. Be sure to accurately report the amount of property tax you have paid. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Eligibility Criteria for the Form IT 214

To qualify for the Form IT 214, applicants must meet specific eligibility requirements. Generally, the applicant must be a resident of New York State and have paid real property taxes on their primary residence. Additionally, income limits may apply, and applicants must provide documentation to verify their income and tax payments. It is essential to review the latest guidelines provided by the New York State Department of Taxation and Finance to ensure compliance with all eligibility criteria.

How to Obtain the Form IT 214

The Form IT 214 can be obtained through various channels. It is available for download on the New York State Department of Taxation and Finance website in PDF format. Additionally, physical copies of the form can be requested from local tax offices or government buildings. For convenience, many tax preparation software programs also include the form, allowing users to complete it electronically.

Filing Deadlines for the Form IT 214

Filing deadlines for the Form IT 214 are typically aligned with the annual tax filing season. It is crucial to submit the form by the designated deadline to ensure eligibility for the tax credit. Generally, the deadline falls on April fifteenth of each year, but it may vary depending on specific circumstances or changes in tax law. Keeping track of these dates is essential for timely submission and to avoid penalties.

Form Submission Methods

The Form IT 214 can be submitted through multiple methods to accommodate different preferences. Residents can file the form electronically through approved tax software, which often streamlines the process. Alternatively, the form can be mailed directly to the appropriate tax authority or submitted in person at local tax offices. Each method has its advantages, and choosing the right one depends on individual circumstances and preferences.

Quick guide on how to complete form it 214 claim for real property tax credit government of new york

Complete Form IT 214, Claim For Real Property Tax Credit Government Of New York effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can easily find the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Form IT 214, Claim For Real Property Tax Credit Government Of New York on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form IT 214, Claim For Real Property Tax Credit Government Of New York with ease

- Obtain Form IT 214, Claim For Real Property Tax Credit Government Of New York and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Formulate your signature with the Sign tool, which requires just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Forget about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device you choose. Edit and eSign Form IT 214, Claim For Real Property Tax Credit Government Of New York to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 214 claim for real property tax credit government of new york

Create this form in 5 minutes!

People also ask

-

What is the it 214 form 2022 and why do I need it?

The it 214 form 2022 is a tax form used for claiming specific credits and deductions related to state taxes. Businesses and individuals may need it to ensure they accurately report their eligibility for tax benefits. Utilizing the it 214 form 2022 correctly can lead to reduced tax liabilities and increased refunds.

-

How can airSlate SignNow help me with the it 214 form 2022?

AirSlate SignNow provides a seamless platform for easily creating, signing, and managing the it 214 form 2022. With its user-friendly design, you can fill out and send the form for eSignature in no time. This efficient process minimizes delays, ensuring your documents are submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the it 214 form 2022?

AirSlate SignNow offers various pricing plans, making it affordable for anyone needing to manage the it 214 form 2022. Plans include different features, such as unlimited document signing and customizable templates. Users can choose a plan that best suits their needs and budget.

-

What features does airSlate SignNow offer for the it 214 form 2022?

Features of airSlate SignNow for the it 214 form 2022 include customizable templates, in-app editing, and cloud storage for easy access. It also offers real-time tracking of document statuses and seamless integration with various software applications. These features enhance your document management experience.

-

Can I integrate airSlate SignNow with other applications for handling the it 214 form 2022?

Yes, airSlate SignNow easily integrates with numerous applications that can streamline your workflow for the it 214 form 2022. Integration options include popular tools like Salesforce, Google Drive, and Microsoft Office. This ensures that you can manage your documents efficiently within your existing systems.

-

Is airSlate SignNow secure for handling sensitive information in the it 214 form 2022?

Absolutely! AirSlate SignNow prioritizes security and compliance, providing encryption and secure access for documents like the it 214 form 2022. With industry-standard security protocols in place, you can feel confident that your sensitive information is protected through the signing process.

-

How can I get started with airSlate SignNow for the it 214 form 2022?

Getting started with airSlate SignNow for the it 214 form 2022 is easy. Simply sign up for an account, choose a suitable plan, and access ready-made templates for the form. You can start creating, signing, and managing your documents instantly, enhancing your efficiency.

Get more for Form IT 214, Claim For Real Property Tax Credit Government Of New York

- Oklahoma cover sheet form

- Residential lease renewal agreement oklahoma form

- Notice to lessor exercising option to purchase oklahoma form

- Assignment of lease and rent from borrower to lender oklahoma form

- Assignment of lease from lessor with notice of assignment oklahoma form

- Oklahoma landlord 497323145 form

- Guaranty or guarantee of payment of rent oklahoma form

- Letter from landlord to tenant as notice of default on commercial lease oklahoma form

Find out other Form IT 214, Claim For Real Property Tax Credit Government Of New York

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form