Instructions for Form it 214 Claim for Real Property Tax Credit for Homeowners and Renters Tax Year 2024-2026

Understanding Form IT-214 for Real Property Tax Credit

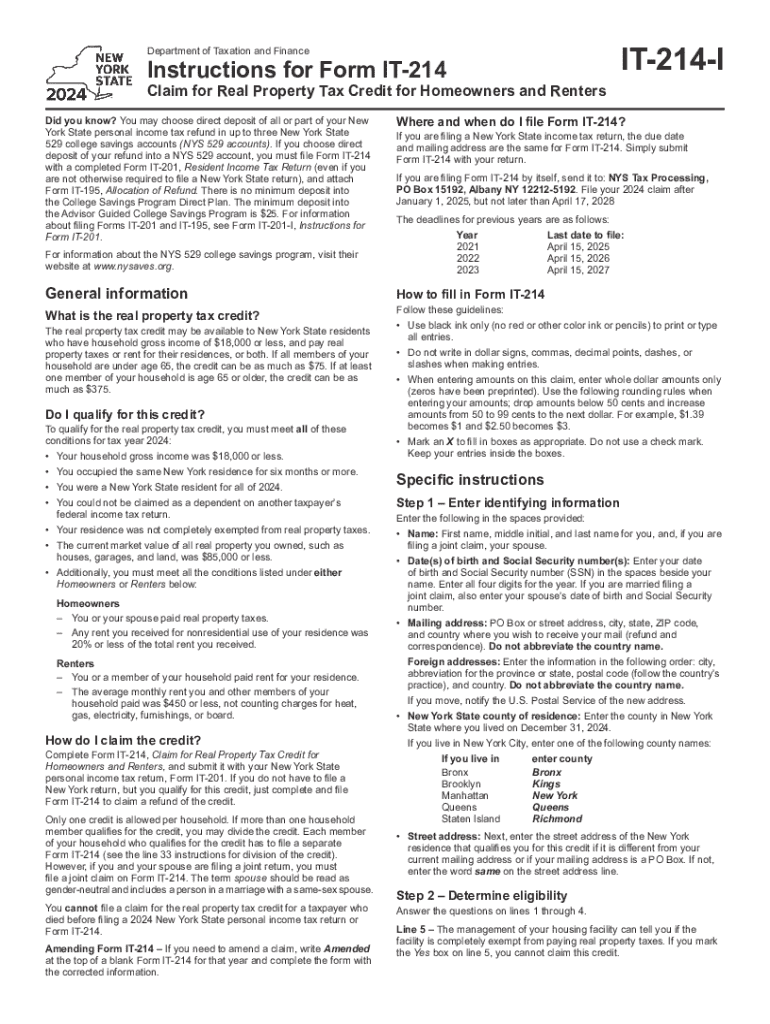

Form IT-214 is designed for taxpayers in the United States to claim a real property tax credit. This credit is available for both homeowners and renters, helping to alleviate some of the financial burdens associated with property taxes. The form outlines eligibility criteria, which typically include income limits and residency requirements. It is essential for applicants to understand the specifics of their state’s regulations, as these can vary significantly.

Steps to Complete Form IT-214

Completing Form IT-214 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income and property ownership or rental agreements. Next, accurately fill out each section of the form, paying close attention to the eligibility criteria and instructions provided. After completing the form, review it for any errors before submission. Finally, choose your submission method, whether online, by mail, or in person, to ensure timely processing.

Eligibility Criteria for Form IT-214

To qualify for the real property tax credit using Form IT-214, applicants must meet specific eligibility criteria. Generally, these criteria include being a resident of the state, meeting income limits, and having paid property taxes or rent during the tax year. It is important for applicants to verify their eligibility before proceeding with the form to avoid delays or rejections.

Required Documents for Form IT-214

When preparing to file Form IT-214, certain documents are required to support your claim. Commonly needed documents include proof of income, such as W-2 forms or pay stubs, documentation of property taxes paid, and rental agreements if applicable. Having these documents ready will streamline the filing process and help ensure that your claim is processed efficiently.

Filing Deadlines for Form IT-214

Filing deadlines for Form IT-214 can vary by state, but it is crucial to submit the form on time to avoid penalties or loss of the credit. Generally, the deadline coincides with the state income tax filing deadline. Taxpayers should check their state’s specific deadlines and plan accordingly to ensure compliance.

Form Submission Methods for IT-214

Form IT-214 can be submitted using various methods, depending on state regulations. Common submission methods include online filing through state tax websites, mailing a paper form to the appropriate tax office, or submitting in person at designated locations. Each method has its own advantages, such as speed or convenience, so taxpayers should choose the one that best suits their needs.

Key Elements of Form IT-214

Key elements of Form IT-214 include personal information, income details, and property tax or rent information. Each section must be completed accurately to ensure that the claim is valid. Additionally, the form may require signatures and dates to confirm the authenticity of the information provided. Understanding these elements is vital for a successful claim.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 214 claim for real property tax credit for homeowners and renters tax year 772017265

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 214 claim for real property tax credit for homeowners and renters tax year 772017265

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year?

The Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year provide detailed guidance on how to complete the form to claim your tax credit. This includes eligibility criteria, required documentation, and step-by-step instructions to ensure accurate submission.

-

How can airSlate SignNow help with the Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year?

airSlate SignNow simplifies the process of completing and submitting the Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year. Our platform allows you to easily fill out, sign, and send documents securely, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing tax documents like Form IT 214?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, which are essential for managing tax documents like Form IT 214. These features streamline the process, making it easier to handle important paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Each plan provides access to features that can assist with the Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to easily access the Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year and manage your documents in one place.

-

What are the benefits of using airSlate SignNow for tax credit claims?

Using airSlate SignNow for tax credit claims, including the Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for your sensitive information.

-

How secure is airSlate SignNow for handling tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. When dealing with sensitive information like the Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year, you can trust that your data is safe with us.

Get more for Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year

- Reading goals chart milford school district hp milfordk12 form

- Individualized home instruction plan sample form

- Glencoe accounting answer key form

- Scholarship acceptance form

- Dd form 2402 civil aircraft hold harmless t 34 association

- Boyer chute national wildlife refuge hunt brochure hunting form

- 211 a hiring and appointments draft 62501 form

- Restaurant employment agreement template form

Find out other Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document