Instructions for Form it 214 Claim for Real Property Tax Credit for Homeowners and Renters Tax Year 2023

Overview of Form IT-214 for Property Tax Credit

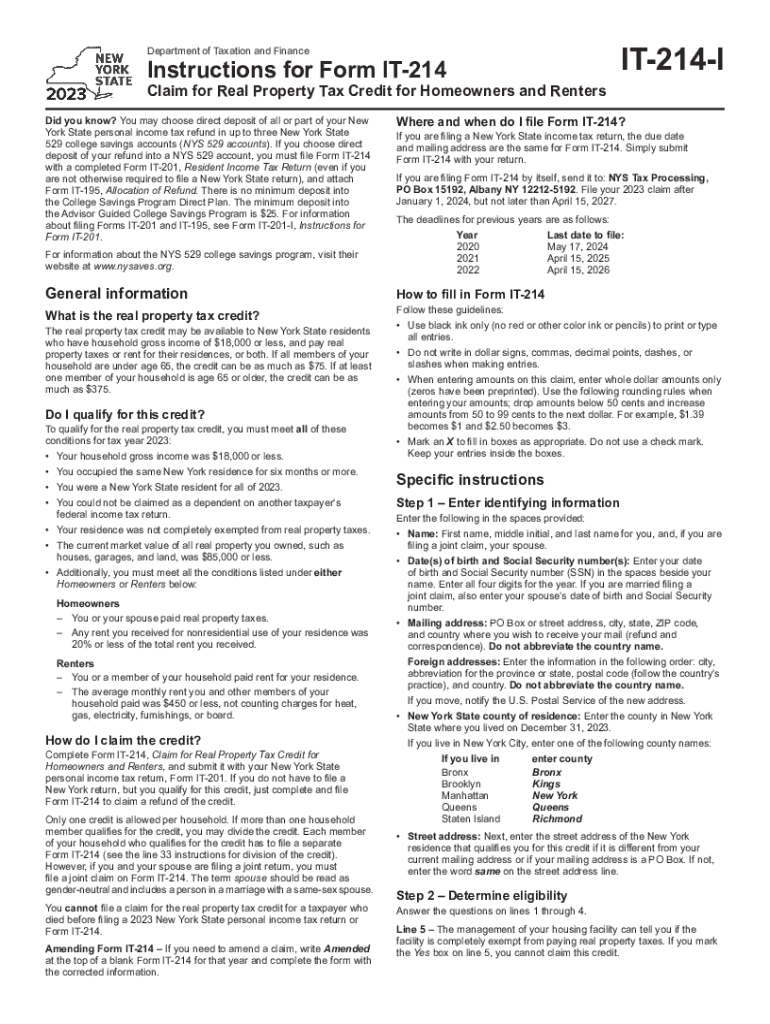

The IT-214 form, officially known as the Claim for Real Property Tax Credit for Homeowners and Renters, is essential for eligible individuals in the United States seeking to claim a tax credit. This form is specifically designed for those who have paid real property taxes or rent during the tax year. Understanding the purpose of this form is crucial for maximizing potential tax benefits and ensuring compliance with state regulations.

Instructions for Completing Form IT-214

Completing the IT-214 form requires careful attention to detail. The instructions outline the necessary steps to fill out the form accurately. Taxpayers must provide personal information, including their name, address, and social security number. Additionally, details regarding property taxes paid or rent incurred must be included. It is important to follow the guidelines closely to avoid errors that could delay processing or result in penalties.

Eligibility Criteria for IT-214 Tax Credit

To qualify for the IT-214 tax credit, applicants must meet specific eligibility criteria. Generally, homeowners and renters may be eligible if they meet income limits and have paid property taxes or rent during the tax year. The form includes sections that help determine eligibility based on income levels and residency status. Understanding these criteria is vital for ensuring that the claim is valid and can be processed without issues.

Required Documents for Form IT-214 Submission

When submitting the IT-214 form, certain documents may be required to support the claim. These typically include proof of property tax payments or rental agreements, as well as income verification documents. Having these documents ready can expedite the review process and help prevent any complications that may arise from incomplete submissions.

Filing Deadlines for IT-214

Timely submission of the IT-214 form is crucial to ensure that taxpayers receive their credits without delay. The filing deadlines can vary, so it is important to check the current year's specific dates. Missing the deadline may result in a loss of eligibility for the tax credit, making it essential to stay informed about these important dates.

Submission Methods for Form IT-214

Taxpayers have several options for submitting the IT-214 form. The form can typically be filed online, mailed, or submitted in person at designated locations. Each method has its own processing times and requirements, so individuals should choose the option that best fits their needs while ensuring that they comply with any submission guidelines.

Common Mistakes to Avoid When Filing IT-214

Filing the IT-214 form can be straightforward, but there are common mistakes that applicants should avoid. These include incorrect personal information, failure to include necessary documentation, and missing the filing deadline. Being aware of these pitfalls can help taxpayers ensure a smooth filing process and increase the likelihood of receiving their tax credits promptly.

Quick guide on how to complete instructions for form it 214 claim for real property tax credit for homeowners and renters tax year

Complete Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, edit, and eSign your documents quickly without delays. Handle Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year without hassle

- Find Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would prefer to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 214 claim for real property tax credit for homeowners and renters tax year

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 214 claim for real property tax credit for homeowners and renters tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 214 form 2024 and how does it work?

The IT 214 form 2024 is a specific document that individuals and businesses use to claim certain tax credits. Completing this form accurately can lead to signNow savings. Utilizing airSlate SignNow, you can easily fill out and eSign the IT 214 form 2024, streamlining your submission process.

-

Are there any costs associated with using airSlate SignNow for the IT 214 form 2024?

AirSlate SignNow offers various pricing plans catering to different needs. You can use it to prepare and eSign the IT 214 form 2024 at a cost-effective rate compared to traditional methods. Check the pricing section on our website for detailed information on plans.

-

What features does airSlate SignNow provide for the IT 214 form 2024?

With airSlate SignNow, you can enjoy features like customizable templates, cloud storage, and secure eSignatures. These features make completing your IT 214 form 2024 quick and efficient. Plus, real-time collaboration simplifies communication between all parties involved.

-

How can I ensure my IT 214 form 2024 is secure when using airSlate SignNow?

AirSlate SignNow employs industry-standard security measures, including encryption, to safeguard your documents. This ensures that your IT 214 form 2024 remains confidential and secure throughout the process. Trust us with your electronic signatures and document management.

-

Can I integrate airSlate SignNow with other applications for the IT 214 form 2024?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow efficiency. You can easily integrate tools like Google Drive, Dropbox, and more while preparing the IT 214 form 2024. This flexibility allows for a seamless document management experience.

-

What are the benefits of using airSlate SignNow for the IT 214 form 2024?

Using airSlate SignNow for the IT 214 form 2024 saves time and reduces errors associated with manual signatures. Our platform simplifies the eSigning process and ensures compliance, giving you peace of mind. Explore the benefits of faster processing and better document organization.

-

Is there customer support available for assistance with the IT 214 form 2024?

Absolutely! AirSlate SignNow provides dedicated customer support to assist you with your IT 214 form 2024 needs. Whether you have questions about the signing process or need help with a specific feature, our team is here to help.

Get more for Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year

- Texas real estate fillable sellers disclosure form 2007

- Texas deposit demand form

- Residential earnest money contact form

- Purchase and sale agreement texas form

- Trec 37 2013 form

- Purchase agreement instructions form

- Texas real estate forms manual 2017

- Editable texas association of realtors residential lease form

Find out other Instructions For Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document