Instructions for Form it 214 "Claim for Real Property Tax 2020

What is the Instructions For Form IT-214 "Claim For Real Property Tax"

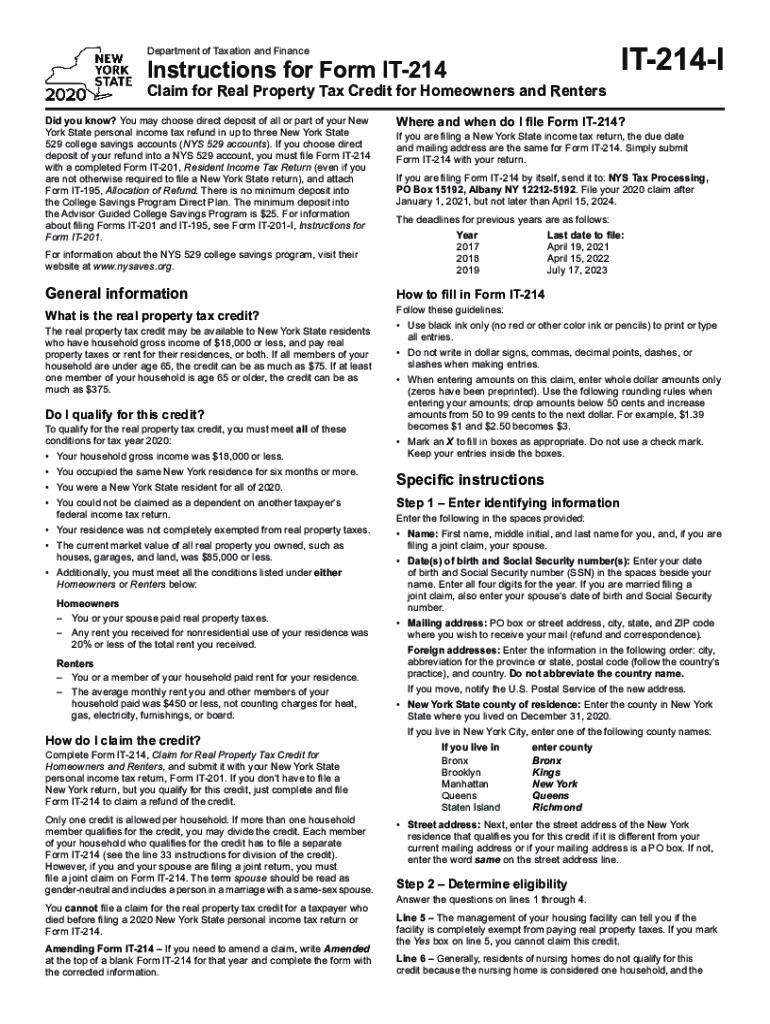

The Instructions For Form IT-214, commonly referred to as the "Claim For Real Property Tax," is a document used by property owners in the United States to claim a property tax exemption. This form is particularly relevant for individuals who own residential property and wish to apply for a reduction in their property tax liability. The instructions provide detailed guidance on eligibility criteria, necessary documentation, and the process for submitting the claim to the appropriate state or local tax authority.

Steps to Complete the Instructions For Form IT-214 "Claim For Real Property Tax"

Completing the Instructions For Form IT-214 involves several key steps to ensure accuracy and compliance. First, gather all required documentation, which may include proof of ownership, income statements, and any previous tax assessments. Next, carefully read through the instructions to understand the eligibility requirements and specific information needed on the form. Fill out the form accurately, ensuring that all sections are completed as required. Finally, review your submission for any errors before submitting it to the designated tax authority, either online or by mail.

Legal Use of the Instructions For Form IT-214 "Claim For Real Property Tax"

The legal use of the Instructions For Form IT-214 is governed by state and local tax laws. To be valid, the claim must be submitted within the specified deadlines and must meet all eligibility criteria outlined in the instructions. Properly completed forms can provide significant tax relief, making it essential for claimants to adhere to the legal guidelines. Failure to comply with these regulations may result in denial of the claim or potential penalties.

Eligibility Criteria for the Instructions For Form IT-214 "Claim For Real Property Tax"

Eligibility for filing the Instructions For Form IT-214 typically includes criteria such as ownership of the property, residency status, and income limits. Most states require that the property be the primary residence of the claimant. Additionally, there may be specific income thresholds that applicants must meet to qualify for the exemption. It is important to review the specific eligibility requirements for your state to ensure compliance.

Required Documents for the Instructions For Form IT-214 "Claim For Real Property Tax"

When completing the Instructions For Form IT-214, several documents may be required to support your claim. Commonly needed documents include:

- Proof of property ownership, such as a deed or title.

- Income verification documents, like tax returns or pay stubs.

- Previous property tax statements to establish prior assessments.

Gathering these documents in advance can streamline the process and help ensure that your claim is processed without delays.

Form Submission Methods for the Instructions For Form IT-214 "Claim For Real Property Tax"

The Instructions For Form IT-214 can typically be submitted in several ways, depending on the regulations of your state or local jurisdiction. Common submission methods include:

- Online submission through the state tax authority's website.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices or local government buildings.

Choosing the right submission method can affect the processing time of your claim, so it is advisable to check local guidelines for the most efficient option.

Quick guide on how to complete instructions for form it 214 ampquotclaim for real property tax

Finalize Instructions For Form IT 214 "Claim For Real Property Tax seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to generate, modify, and electronically sign your documents rapidly without delays. Manage Instructions For Form IT 214 "Claim For Real Property Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-based procedure today.

How to modify and electronically sign Instructions For Form IT 214 "Claim For Real Property Tax with ease

- Find Instructions For Form IT 214 "Claim For Real Property Tax and then select Get Form to begin.

- Use the tools available to finish your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools provided specifically for this task by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, painstaking form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Revise and electronically sign Instructions For Form IT 214 "Claim For Real Property Tax to ensure exceptional communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 214 ampquotclaim for real property tax

Create this form in 5 minutes!

People also ask

-

What are the Instructions For Form IT 214 "Claim For Real Property Tax"?

The Instructions For Form IT 214 "Claim For Real Property Tax" provide guidelines on how to properly fill out and submit the form to claim property tax relief in your state. Understanding these instructions is crucial for ensuring that you meet all necessary requirements and deadlines. By following these instructions carefully, you can maximize your chances of receiving a tax benefit.

-

How can airSlate SignNow assist me with the Instructions For Form IT 214 "Claim For Real Property Tax"?

AirSlate SignNow offers a streamlined platform to eSign and send documents, including the Instructions For Form IT 214 "Claim For Real Property Tax". With our easy-to-use interface, you can quickly attach the necessary forms and share them for eSignature, ensuring your applications are completed and submitted efficiently.

-

Is there a cost associated with using airSlate SignNow for submitting the Instructions For Form IT 214 "Claim For Real Property Tax"?

Yes, airSlate SignNow features various pricing plans, making it a cost-effective solution for managing your documents, including the Instructions For Form IT 214 "Claim For Real Property Tax". Our plans are designed to fit different business needs and budgets, allowing you to choose one that best suits your requirements.

-

What features does airSlate SignNow offer for handling Instructions For Form IT 214 "Claim For Real Property Tax"?

AirSlate SignNow provides key features such as document templates, customizable workflows, and real-time tracking, which are essential for managing the Instructions For Form IT 214 "Claim For Real Property Tax". These features enhance your ability to complete and monitor the status of your claims, making the entire process smoother.

-

Can I integrate airSlate SignNow with other software for the Instructions For Form IT 214 "Claim For Real Property Tax"?

Absolutely! AirSlate SignNow supports integrations with many popular business applications, allowing you to streamline your workflow when dealing with the Instructions For Form IT 214 "Claim For Real Property Tax". This means you can easily import or export data to and from other platforms you use.

-

What are the benefits of using airSlate SignNow for the Instructions For Form IT 214 "Claim For Real Property Tax"?

Using airSlate SignNow for the Instructions For Form IT 214 "Claim For Real Property Tax" offers numerous advantages, such as improved efficiency, reduced turnaround time, and enhanced document security. Our platform ensures your sensitive information is protected while allowing you to manage your tax claims with ease.

-

How do I get started with airSlate SignNow and the Instructions For Form IT 214 "Claim For Real Property Tax"?

Getting started with airSlate SignNow is simple: just sign up for an account, and you're ready to begin managing your documents, including the Instructions For Form IT 214 "Claim For Real Property Tax". Our user-friendly interface guides you through the process of uploading, sending, and signing your documents seamlessly.

Get more for Instructions For Form IT 214 "Claim For Real Property Tax

- Time log form full day of 24 hours right attitudes

- Louisville ky recycle bin form

- Dental hygiene applicant shadowing form centralgatech edu

- Indian consulate sfo form

- Molecular markers application in modern plant research form

- Analogies worksheet form

- Certificate of fictitious business name form

- Ocs application packet form

Find out other Instructions For Form IT 214 "Claim For Real Property Tax

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online