1350 STATE of SOUTH CAROLINA DEPARTMENT of REVENUE Application for 2022-2026

Understanding the South Carolina Department of Revenue Application

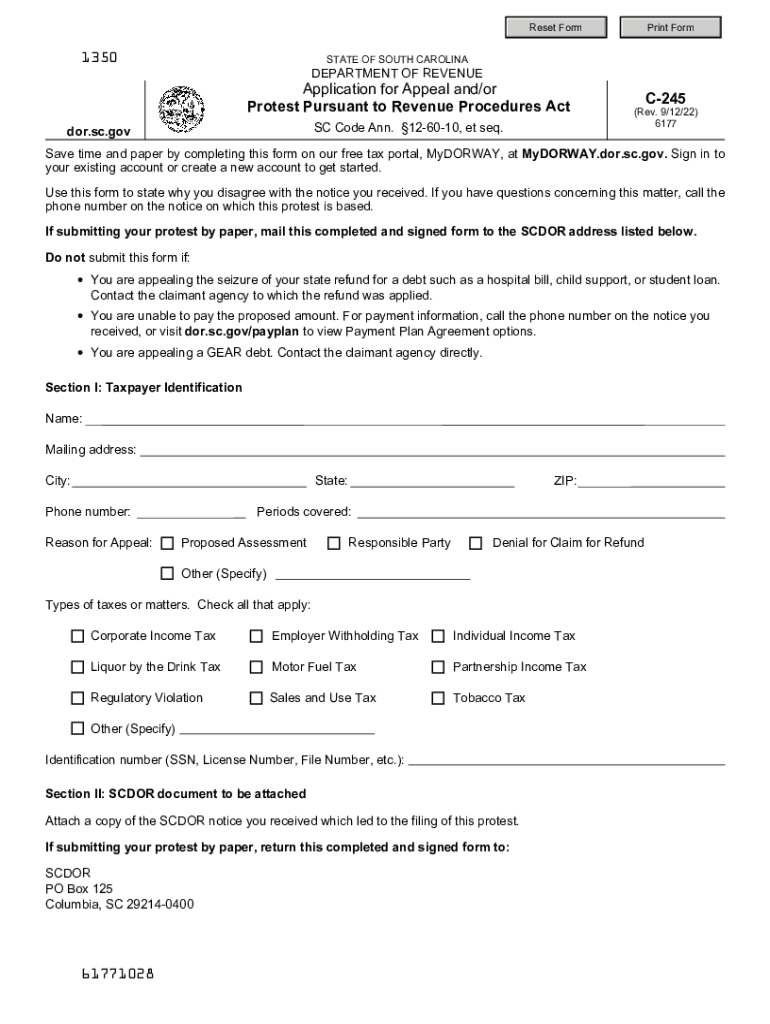

The 1350 State of South Carolina Department of Revenue Application serves as a critical document for individuals and businesses seeking to comply with state tax regulations. This application is primarily used for various tax-related purposes, including the registration of new businesses, tax exemption requests, and other financial obligations mandated by the South Carolina Department of Revenue. Understanding its purpose is essential for ensuring compliance and avoiding penalties.

Steps to Complete the South Carolina Department of Revenue Application

Completing the 1350 application involves several key steps that ensure accurate submission. First, gather all necessary information, including your business details, tax identification numbers, and any relevant financial records. Next, fill out the application form carefully, ensuring all sections are completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the application through the designated method, whether online, by mail, or in person, depending on the requirements set by the South Carolina Department of Revenue.

Required Documents for the South Carolina Department of Revenue Application

When preparing to submit the 1350 application, it is important to compile the required documents to support your application. Commonly needed documents may include:

- Proof of identity, such as a driver's license or state ID.

- Tax identification number (EIN or SSN).

- Business formation documents, such as articles of incorporation or partnership agreements.

- Financial statements or records that may be relevant to your application.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods for the South Carolina Department of Revenue Application

The 1350 application can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many applicants prefer to submit their forms electronically via the South Carolina Department of Revenue's website, which often provides instant confirmation.

- Mail: Applicants may choose to print the completed form and mail it to the appropriate address provided by the department.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the application in person at a local Department of Revenue office is also an option.

Eligibility Criteria for the South Carolina Department of Revenue Application

Eligibility for the 1350 application typically depends on the nature of your business and its tax obligations. Generally, any individual or entity that conducts business within South Carolina is required to apply for the necessary permits and registrations. This includes:

- New businesses starting operations in the state.

- Existing businesses making changes to their structure or operations.

- Non-profit organizations seeking tax-exempt status.

It is important to review specific eligibility requirements based on your business type to ensure compliance.

Legal Use of the South Carolina Department of Revenue Application

The legal use of the 1350 application is governed by state tax laws and regulations. Submitting this application accurately and timely is essential to avoid penalties and ensure compliance with the South Carolina Department of Revenue. It is crucial to understand that any misinformation or failure to submit required documents can lead to legal consequences, including fines or delays in processing. Therefore, applicants should ensure that all information provided is truthful and complete.

Quick guide on how to complete 1350 state of south carolina department of revenue application for

Complete 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application For effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application For on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and electronically sign 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application For effortlessly

- Find 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application For and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application For while ensuring excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1350 state of south carolina department of revenue application for

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow solution for the South Carolina Department?

The airSlate SignNow solution is designed to streamline document management for the South Carolina Department, enabling efficient sending and eSigning of official documents. This user-friendly, cost-effective platform ensures compliance and security while providing tools tailored to government needs.

-

How does airSlate SignNow ensure compliance for South Carolina Department users?

airSlate SignNow adheres to various compliance standards required by the South Carolina Department, including secure data encryption and eSignature laws. Our platform offers audit trails, ensuring that your documents meet all regulatory requirements while maintaining integrity and security.

-

What are the pricing options available for the South Carolina Department?

airSlate SignNow offers flexible pricing plans tailored for the South Carolina Department's needs. These plans are designed to accommodate different document volume requirements and provide cost-effective solutions for both small and large departments, ensuring the best value for your budget.

-

What features of airSlate SignNow are beneficial for the South Carolina Department?

The airSlate SignNow platform includes features such as customizable templates, automated workflows, and real-time collaboration, all advantageous for the South Carolina Department. These features enhance operational efficiency and help reduce turnaround times on document processing.

-

Can airSlate SignNow integrate with other systems used by the South Carolina Department?

Yes, airSlate SignNow supports integrations with various software applications commonly used by the South Carolina Department, such as CRM and document storage systems. These integrations allow for seamless workflows, making it easier to manage documents and data across platforms.

-

What are the benefits of using airSlate SignNow for the South Carolina Department?

Using airSlate SignNow, the South Carolina Department can enhance transparency, reduce paperwork, and improve efficiency in document signing processes. This leads to quicker approvals and a more organized workflow, which is crucial for government operations.

-

Is training available for South Carolina Department employees using airSlate SignNow?

Yes, airSlate SignNow provides comprehensive training resources for South Carolina Department employees to ensure they can effectively use the platform. This includes tutorials, webinars, and dedicated support to help staff become proficient and maximize the solution's features.

Get more for 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application For

- Transfer death deed 497323621 form

- Notice nonresponsibility 497323622 form

- Claim of lien by individual oregon form

- Quitclaim deed by two individuals to corporation oregon form

- Warranty deed from two individuals to corporation oregon form

- Oregon lien 497323627 form

- Filing lien oregon form

- Quitclaim deed from individual to corporation oregon form

Find out other 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Application For

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer