Protest Pursuant to Revenue Procedures Act C 245 1350 2021

What is the Protest Pursuant To Revenue Procedures Act C

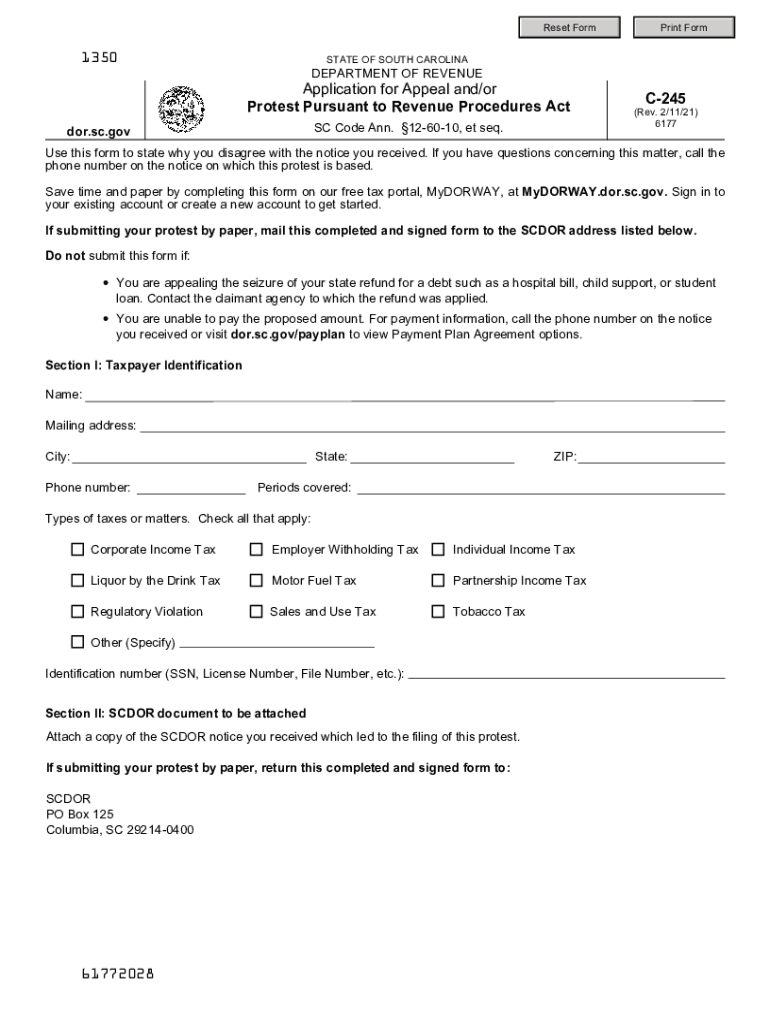

The Protest Pursuant To Revenue Procedures Act C is a formal document used in South Carolina for taxpayers to contest certain decisions made by the South Carolina Department of Revenue (SCDOR). This form allows individuals or businesses to formally protest tax assessments or determinations that they believe are incorrect. By filing this form, taxpayers can initiate a review process that may lead to a reassessment of their tax situation.

Steps to complete the Protest Pursuant To Revenue Procedures Act C

Completing the C 245 form involves several important steps to ensure that the protest is valid and considered by the SCDOR. Here are the key steps:

- Gather necessary documentation, including any notices received from the SCDOR that detail the assessment being protested.

- Clearly state the reasons for the protest, providing detailed explanations and supporting evidence to substantiate your claims.

- Complete the form accurately, ensuring all required fields are filled out, including taxpayer information and the specific tax year in question.

- Sign and date the form, as an unsigned protest may be deemed invalid.

- Submit the completed form to the appropriate SCDOR office, either electronically or via mail, depending on the submission guidelines.

Legal use of the Protest Pursuant To Revenue Procedures Act C

The legal use of the C 245 form is crucial for taxpayers seeking to challenge tax assessments. This form must be filed within a specific timeframe, typically within thirty days of receiving the tax assessment notice. Failure to adhere to this timeline may result in the loss of the right to contest the assessment. The form must be completed according to the SCDOR's guidelines, ensuring that all legal requirements are met to maintain the validity of the protest.

Required Documents

When filing the Protest Pursuant To Revenue Procedures Act C, certain documents are necessary to support your case. These may include:

- A copy of the tax assessment notice received from the SCDOR.

- Any relevant financial records or documentation that supports your claim.

- Previous tax returns or filings that may be pertinent to the protest.

- Correspondence with the SCDOR regarding the assessment.

Form Submission Methods

Taxpayers have several options for submitting the C 245 form to the SCDOR. These methods include:

- Online submission through the SCDOR's official website, if available.

- Mailing the completed form to the designated SCDOR office address.

- In-person delivery at a local SCDOR office, ensuring that you receive a timestamped copy for your records.

Filing Deadlines / Important Dates

Timeliness is essential when filing the C 245 form. The typical deadline for submission is within thirty days from the date of the tax assessment notice. It is advisable to check for any specific deadlines related to your case, as they may vary based on the type of tax or the nature of the assessment. Missing the deadline could result in the inability to contest the assessment.

Quick guide on how to complete protest pursuant to revenue procedures act c 245 1350

Effortlessly Prepare Protest Pursuant To Revenue Procedures Act C 245 1350 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to produce, modify, and electronically sign your files quickly and without interruptions. Handle Protest Pursuant To Revenue Procedures Act C 245 1350 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to alter and electronically sign Protest Pursuant To Revenue Procedures Act C 245 1350 effortlessly

- Obtain Protest Pursuant To Revenue Procedures Act C 245 1350 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you want to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that demand reprinting of new document versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Alter and electronically sign Protest Pursuant To Revenue Procedures Act C 245 1350 and ensure remarkable communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct protest pursuant to revenue procedures act c 245 1350

Create this form in 5 minutes!

How to create an eSignature for the protest pursuant to revenue procedures act c 245 1350

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the c 245 form South Carolina?

The c 245 form South Carolina is a specific document used for tax purposes, particularly for those dealing with sales tax in the state. It's essential for businesses to accurately report their sales and remit the appropriate taxes to the South Carolina Department of Revenue.

-

How can airSlate SignNow help with the c 245 form South Carolina?

airSlate SignNow simplifies the process of filling out and eSigning the c 245 form South Carolina. With an intuitive interface, users can quickly complete the form, ensuring compliance while saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the c 245 form South Carolina?

Yes, airSlate SignNow offers a range of pricing plans to accommodate various business needs. Users can choose a plan that best fits their requirements for handling documents like the c 245 form South Carolina, ensuring efficient and cost-effective operations.

-

What features does airSlate SignNow offer for signing the c 245 form South Carolina?

airSlate SignNow includes robust features such as eSigning, document tracking, and secure storage, all of which enhance the process of managing the c 245 form South Carolina. These features provide users with confidence in their document workflow.

-

Can I integrate airSlate SignNow with other software for processing the c 245 form South Carolina?

Absolutely! airSlate SignNow supports various integrations with popular software tools, enabling seamless workflows for handling the c 245 form South Carolina. This connectivity facilitates easier data management and enhances productivity.

-

Are there any specific benefits of using airSlate SignNow for the c 245 form South Carolina?

Using airSlate SignNow for the c 245 form South Carolina offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced compliance. These advantages make it easier for businesses to manage their tax-related documents effectively.

-

How secure is airSlate SignNow when dealing with the c 245 form South Carolina?

airSlate SignNow prioritizes security, employing industry-standard encryption and compliance measures to protect sensitive information related to the c 245 form South Carolina. Users can trust that their data is safe and secure throughout the entire signing process.

Get more for Protest Pursuant To Revenue Procedures Act C 245 1350

- Co signer agreement form

- California application form online

- Inventory and condition of leased premises for pre lease and post lease california form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out california form

- Property manager agreement california form

- Agreement for delayed or partial rent payments california form

- Repair request form

- California guarantor form

Find out other Protest Pursuant To Revenue Procedures Act C 245 1350

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe