ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT of ASSESSMENTS 2022-2026

Understanding the Maryland Annual Report

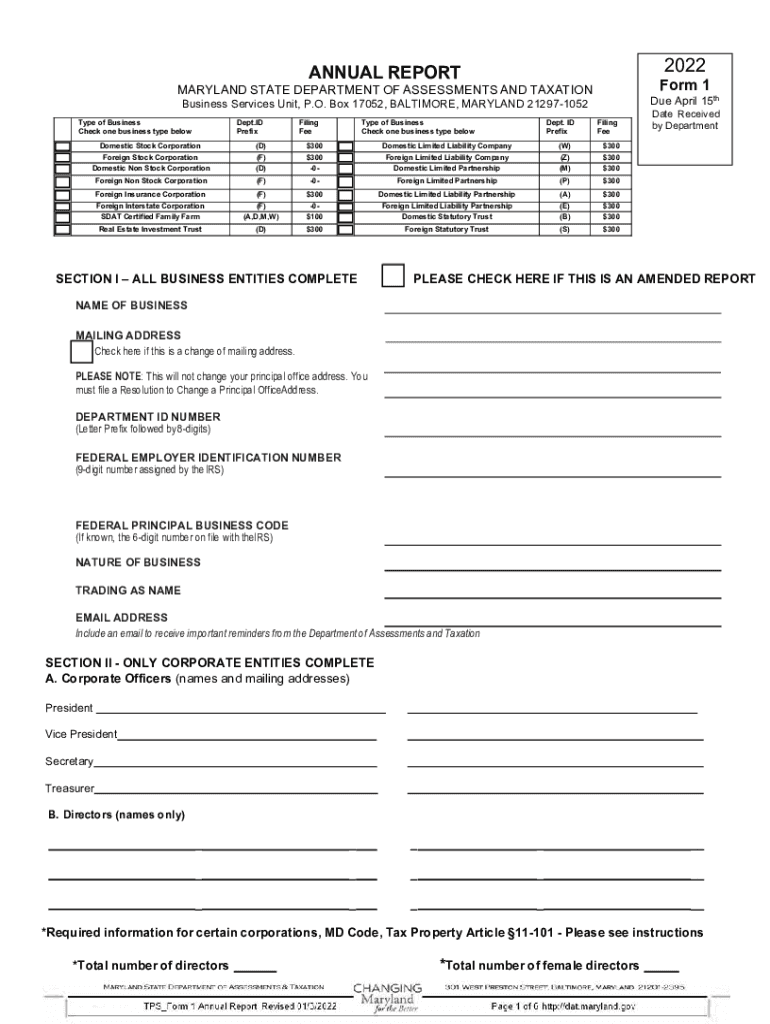

The Maryland annual report is a crucial document required for businesses operating in the state. This report provides essential information about a company's activities, financial status, and compliance with state regulations. It is typically submitted to the Maryland State Department of Assessments and Taxation (SDAT) and serves as a means for the state to keep track of business entities. The report must include details such as the business name, address, and the names of its officers or members. Failing to file this report can lead to penalties and even the dissolution of the business entity.

Steps to Complete the Maryland Annual Report

Filing the Maryland annual report involves several steps to ensure accuracy and compliance. First, gather all necessary information about your business, including the legal name, principal office address, and the names of officers or members. Next, access the Maryland annual report form, which can be completed online or downloaded for physical submission. Fill out the form carefully, ensuring all information is accurate and up to date. After completing the form, review it thoroughly before submission. Finally, submit the report either electronically or via mail, depending on your preference, and retain a copy for your records.

Filing Deadlines for the Maryland Annual Report

It is essential to be aware of the filing deadlines for the Maryland annual report. Generally, the report is due on April 15 each year for most business entities. However, certain entities may have different deadlines based on their formation date or specific regulations. Late filings can result in penalties, including fines and interest on any unpaid fees. To avoid complications, businesses should mark their calendars and prepare to submit their reports ahead of the deadline.

Required Documents for Filing

When preparing to file the Maryland annual report, businesses should gather several key documents. These typically include the previous year's annual report, financial statements, and any amendments made to the business structure. Additionally, businesses may need to provide identification information for officers or members, as well as any relevant tax identification numbers. Ensuring that all required documents are in order will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to file the Maryland annual report on time can lead to significant penalties for businesses. These penalties may include late fees, interest on unpaid amounts, and potential loss of good standing with the state. In severe cases, prolonged non-compliance can result in the administrative dissolution of the business entity. It is crucial for businesses to prioritize timely filing to avoid these repercussions and maintain their operational status.

Digital vs. Paper Filing of the Maryland Annual Report

Businesses have the option to file the Maryland annual report either digitally or through traditional paper methods. Digital filing is often more convenient, allowing for quicker processing and immediate confirmation of submission. It also reduces the risk of lost documents and provides a streamlined experience. On the other hand, paper filing may be preferred by those who are more comfortable with physical documentation. Regardless of the method chosen, ensuring that the report is completed accurately and submitted on time is vital for compliance.

Quick guide on how to complete annual report 20 maryland state department of assessments

Prepare ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT OF ASSESSMENTS effortlessly on any gadget

Web-based document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without complications. Handle ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT OF ASSESSMENTS on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The most effective way to alter and eSign ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT OF ASSESSMENTS with ease

- Locate ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT OF ASSESSMENTS and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and eSign ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT OF ASSESSMENTS and ensure outstanding communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual report 20 maryland state department of assessments

Create this form in 5 minutes!

People also ask

-

What is the Maryland annual report filing process?

The Maryland annual report filing process requires businesses to submit their annual reports to the Maryland State Department of Assessments and Taxation. This process ensures that your company remains compliant and maintains good standing. Using airSlate SignNow can streamline this process by allowing you to eSign and send required documents quickly and securely.

-

How can airSlate SignNow help with Maryland annual report filing?

airSlate SignNow offers a cost-effective solution for Maryland annual report filing by simplifying the document signing process. You can easily upload your annual report, send it for signatures, and securely store the completed file. This efficiency not only saves time but also reduces the potential for errors in your filings.

-

What are the costs associated with using airSlate SignNow for filing?

airSlate SignNow provides flexible pricing plans that cater to different business needs, making Maryland annual report filing affordable for all. Prices vary based on features and number of users, allowing businesses to choose a plan that fits their budget. There are often discounts available for annual subscriptions, which can further reduce costs.

-

Are there any specific features tailored for Maryland annual report filing?

Yes, airSlate SignNow includes features specifically designed to enhance the Maryland annual report filing experience. This includes easy document assembly, secure eSignature capabilities, and automated reminders to ensure you meet filing deadlines. These features help you maintain compliance effortlessly.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow for Maryland annual report filing offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced compliance. With the ability to track document statuses and collect eSignatures remotely, your business can save time while ensuring all filings are completed accurately and on time.

-

Can I integrate airSlate SignNow with other platforms for filing?

Absolutely! airSlate SignNow seamlessly integrates with a variety of platforms, making it easier to manage your Maryland annual report filing alongside other business processes. Whether you're using popular CRM systems or document management tools, these integrations can help streamline your workflow and enhance productivity.

-

Is airSlate SignNow secure for sensitive documents?

Yes, airSlate SignNow prioritizes security, ensuring that all documents related to your Maryland annual report filing are protected. With bank-level encryption, secure cloud storage, and compliance with legal regulations, you can trust that your sensitive information will be safeguarded throughout the filing process.

Get more for ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT OF ASSESSMENTS

- Oregon file order form

- Oregon estate real property form

- Supplemental affidavit 497324019 form

- Request for referral to parental access program and treatment programs oregon form

- Small claims judgment oregon form

- Response to petition for modification of custody and visitation forms and instructions oregon

- Landlord tenant closing statement to reconcile security deposit oregon form

- Name change notification package for brides court ordered name change divorced marriage for oregon oregon form

Find out other ANNUAL REPORT 20 MARYLAND STATE DEPARTMENT OF ASSESSMENTS

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement