Form CT 3 S New York S Corporation Franchise Tax Return Tax Year 2022

What is the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

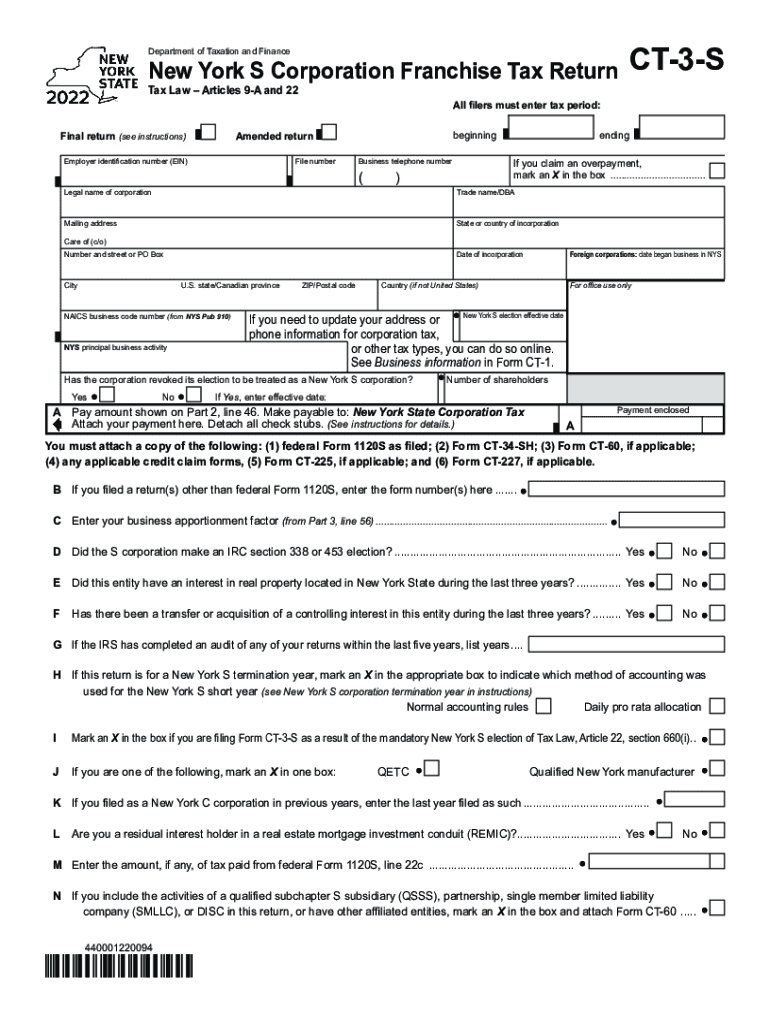

The Form CT 3 S is a tax return specifically designed for S corporations operating in New York State. This form is essential for reporting income, deductions, and credits, as well as calculating the franchise tax owed by S corporations. It is crucial for businesses to accurately complete this form to comply with state tax regulations and avoid penalties. The form must be filed annually, and it reflects the financial activities of the corporation for the tax year, which typically runs from January first to December thirty-first.

Steps to complete the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

Completing the Form CT 3 S involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Detail allowable deductions, such as business expenses and losses.

- Calculate the franchise tax based on the corporation's income and applicable rates.

- Review the completed form for accuracy before submission.

Legal use of the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

The Form CT 3 S is legally binding when completed and submitted in accordance with New York State tax laws. To ensure its legal standing, the form must be signed by an authorized officer of the corporation. Additionally, it must comply with the New York State Department of Taxation and Finance regulations. Filing the form accurately and on time is essential to avoid potential legal issues, including fines and penalties for non-compliance.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form CT 3 S to avoid penalties. The deadline for filing this form is typically the fifteenth day of the third month following the end of the tax year. For corporations operating on a calendar year, this means the form is due by March fifteenth. Extensions may be available, but they require filing a request before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 3 S can be submitted through various methods to accommodate different preferences:

- Online: Corporations can file electronically using the New York State Department of Taxation and Finance's online services.

- Mail: Completed forms can be mailed to the appropriate address listed in the form instructions.

- In-Person: Corporations may also submit the form in person at designated tax offices, though this option may vary based on location.

Key elements of the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

Several key elements are essential for accurately completing the Form CT 3 S:

- Income Reporting: Accurate reporting of all sources of income is crucial.

- Deductions: Understanding which expenses are deductible can significantly impact the tax liability.

- Franchise Tax Calculation: Familiarity with the tax rates and calculation methods is necessary to determine the correct amount owed.

- Signature: The form must be signed by an authorized representative to validate the submission.

Quick guide on how to complete form ct 3 s new york s corporation franchise tax return tax year 2022

Complete Form CT 3 S New York S Corporation Franchise Tax Return Tax Year seamlessly on any device

The management of online documents has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it in the cloud. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any holdups. Handle Form CT 3 S New York S Corporation Franchise Tax Return Tax Year on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Form CT 3 S New York S Corporation Franchise Tax Return Tax Year with ease

- Obtain Form CT 3 S New York S Corporation Franchise Tax Return Tax Year and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or redact sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign function, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form CT 3 S New York S Corporation Franchise Tax Return Tax Year and ensure effective communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 s new york s corporation franchise tax return tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 s new york s corporation franchise tax return tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 3 s in airSlate SignNow?

The ct 3 s refers to the advanced features within airSlate SignNow that streamline the document signing process. It includes automated workflows and customizable templates, making it easier for businesses to manage their documents efficiently. Utilizing ct 3 s enhances productivity by simplifying the signing process.

-

How does airSlate SignNow's ct 3 s feature improve document management?

With ct 3 s, airSlate SignNow provides businesses with tools to automate document requests and track the status of signings in real-time. This level of transparency helps teams stay organized and reduces the likelihood of errors. Overall, ct 3 s enhances document workflow for better efficiency.

-

What are the pricing options available for airSlate SignNow's ct 3 s features?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including access to ct 3 s features. You can choose from monthly or yearly subscriptions, and discounts are available for annual commitments. This ensures that companies can select a plan that suits their budget while benefiting from ct 3 s capabilities.

-

Are there integrations available with ct 3 s in airSlate SignNow?

Yes, airSlate SignNow's ct 3 s features seamlessly integrate with various applications, enhancing functionality. Popular integrations include CRM platforms, cloud storage services, and project management tools. These integrations help streamline your workflows and improve collaboration using ct 3 s.

-

Can beginners easily use ct 3 s features in airSlate SignNow?

Absolutely! airSlate SignNow is designed for users of all skill levels, and the ct 3 s features are intuitive and easy to navigate. With user-friendly interfaces and helpful tutorials, beginners can quickly learn how to make the most of ct 3 s to streamline their document signing process.

-

What are the benefits of using airSlate SignNow’s ct 3 s features for remote teams?

airSlate SignNow's ct 3 s features greatly benefit remote teams by enabling them to collaborate on documents from anywhere. The platform offers real-time notifications and easy sharing options, ensuring everyone stays in sync while working remotely. This enhances productivity and makes document management smoother for remote teams.

-

Is there a mobile app available for accessing ct 3 s features?

Yes, airSlate SignNow offers a mobile app that allows you to utilize ct 3 s features on the go. This means you can send, receive, and sign documents directly from your smartphone or tablet. The mobile solution ensures that you can manage your document workflows anytime, anywhere.

Get more for Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

- Identity theft by known imposter package pennsylvania form

- Pennsylvania assets form

- Essential documents for the organized traveler package pennsylvania form

- Essential documents for the organized traveler package with personal organizer pennsylvania form

- Postnuptial agreements package pennsylvania form

- Pa recommendation sample form

- Pennsylvania mechanics form

- Pa assist form

Find out other Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple