Form CT 3 S New York S Corporation Franchise Tax Return Tax Year 2020

What is the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

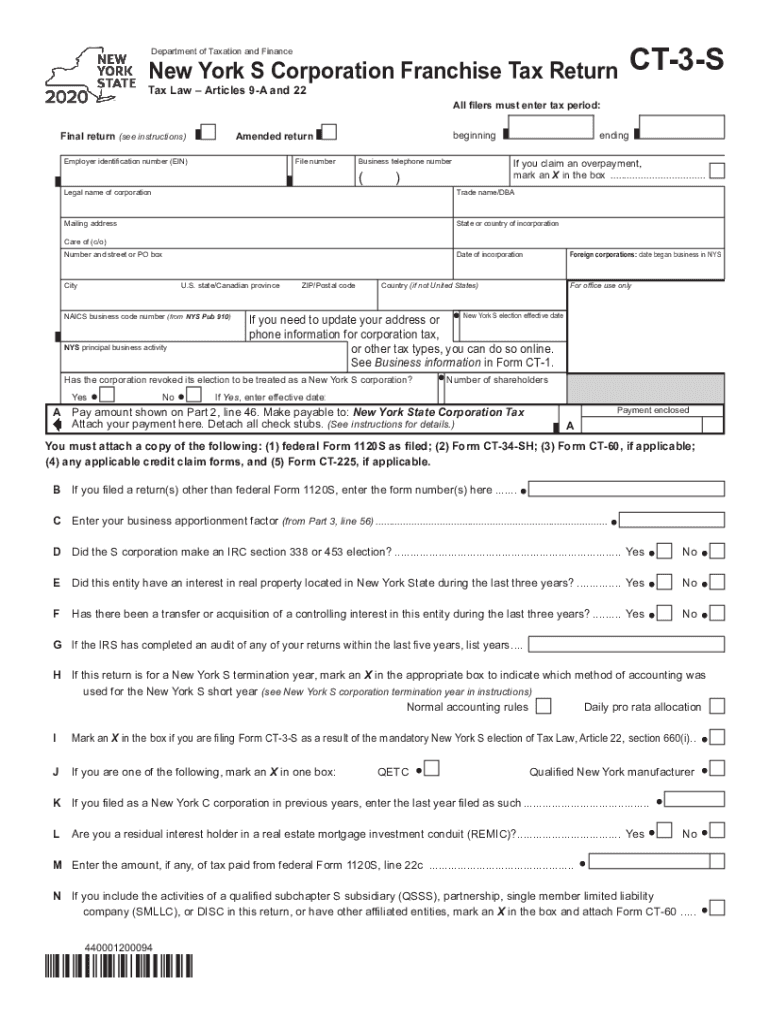

The Form CT 3 S is the New York State S Corporation Franchise Tax Return, specifically designed for S corporations operating within New York. This form is essential for reporting the corporation's income, deductions, and credits, which ultimately determine the tax liability of the business. The tax year for which the form is filed can vary, allowing S corporations to align their reporting with their fiscal year or the calendar year. Understanding the purpose and requirements of this form is crucial for compliance with New York State tax regulations.

Steps to complete the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

Completing the Form CT 3 S involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and prior year tax returns. Next, fill out the form by entering the corporation's gross income, allowable deductions, and credits. It is important to follow the instructions provided with the form carefully, as specific calculations and entries are required. After completing the form, review it for accuracy, sign it, and prepare it for submission. Properly documenting all figures will facilitate a smoother filing process.

Legal use of the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

The legal use of the Form CT 3 S is governed by New York State tax laws, which stipulate that S corporations must file this form to report their income and pay any applicable franchise taxes. The form must be completed accurately to ensure compliance and avoid penalties. E-signatures are accepted, provided the electronic signing process meets the requirements set forth by the Electronic Signatures and Records Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Ensuring that the form is filed on time and in accordance with legal standards is essential for maintaining good standing with the state.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 3 S are critical for S corporations to avoid penalties and interest charges. Generally, the form is due on the 15th day of the third month following the end of the tax year. For corporations operating on a calendar year, this typically means that the form is due by March 15. It is advisable to mark important dates on the calendar and to allow ample time for preparation and submission to ensure compliance with state regulations.

Required Documents

To successfully complete the Form CT 3 S, several documents are required. These include the corporation's financial statements, such as balance sheets and income statements, previous year tax returns, and any documentation supporting deductions and credits claimed. Additionally, records of shareholder distributions and any other relevant financial information should be gathered. Having these documents ready will streamline the completion of the form and help ensure that all necessary information is accurately reported.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 3 S can be submitted through various methods to accommodate different preferences. Corporations have the option to file online using the New York State Department of Taxation and Finance's e-filing system, which provides a secure and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate address provided in the filing instructions. In-person submission is also an option, though it is less common. Each method has its own advantages, and businesses should choose the one that best fits their needs.

Key elements of the Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

Key elements of the Form CT 3 S include sections for reporting gross income, allowable deductions, and credits. The form also requires information about the corporation's shareholders and their respective shares of income. Accurate reporting of these elements is essential for determining the franchise tax owed. Additionally, the form includes various schedules that may need to be completed based on the corporation's specific tax situation. Understanding these key components will help ensure a thorough and compliant filing process.

Quick guide on how to complete form ct 3 s new york s corporation franchise tax return tax year 2020

Effortlessly Prepare Form CT 3 S New York S Corporation Franchise Tax Return Tax Year on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Form CT 3 S New York S Corporation Franchise Tax Return Tax Year on any platform using the airSlate SignNow Android or iOS applications, and enhance any document-centric process today.

How to Easily Modify and eSign Form CT 3 S New York S Corporation Franchise Tax Return Tax Year Without Strain

- Find Form CT 3 S New York S Corporation Franchise Tax Return Tax Year and click on Get Form to initiate the process.

- Utilize the tools available to fill in your form.

- Highlight important sections of the documents or obscure sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your adjustments.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks on any device of your choice. Edit and eSign Form CT 3 S New York S Corporation Franchise Tax Return Tax Year, and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 s new york s corporation franchise tax return tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 s new york s corporation franchise tax return tax year 2020

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is ct3s and how does it relate to airSlate SignNow?

ct3s is a powerful feature within airSlate SignNow that enables users to streamline their document signing processes. It enhances user experience by simplifying workflows and improving document management efficiency.

-

How much does airSlate SignNow with ct3s cost?

airSlate SignNow offers various pricing plans that include access to ct3s functionalities. Pricing varies depending on the features selected, but it remains a cost-effective solution for businesses of all sizes.

-

What features does ct3s offer in airSlate SignNow?

ct3s provides several robust features, including customizable templates, real-time tracking, and advanced security options. These functionalities help to improve the overall efficiency of document handling and signing.

-

How can ct3s benefit my business?

Utilizing ct3s within airSlate SignNow can signNowly reduce the time spent on document management. The efficient workflow and robust features increase productivity while ensuring that your documents are secure and compliant.

-

Does ct3s integrate with other applications?

Yes, ct3s in airSlate SignNow offers seamless integrations with various applications such as CRMs and cloud storage platforms. This ensures that you can create a unified workflow tailored to your business needs.

-

Is it easy to transition to airSlate SignNow with ct3s?

Transitioning to airSlate SignNow with ct3s is designed to be smooth and user-friendly. The platform provides comprehensive support and guidance to help users adapt quickly to the new system.

-

What types of documents can I manage with ct3s in airSlate SignNow?

ct3s allows you to manage a wide array of documents, including contracts, agreements, and invoices. The flexibility of airSlate SignNow accommodates various document types to suit your specific needs.

Get more for Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

- Assam university original certificate online apply form

- Buried in treasures facilitator guide form

- Anibase change of address form

- Febgif form

- Cleaning contracts form

- Fsa receipt template 255109667 form

- Petition for incorporation of a city signature sheet form

- Georgia planning for healthy babies form

Find out other Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now