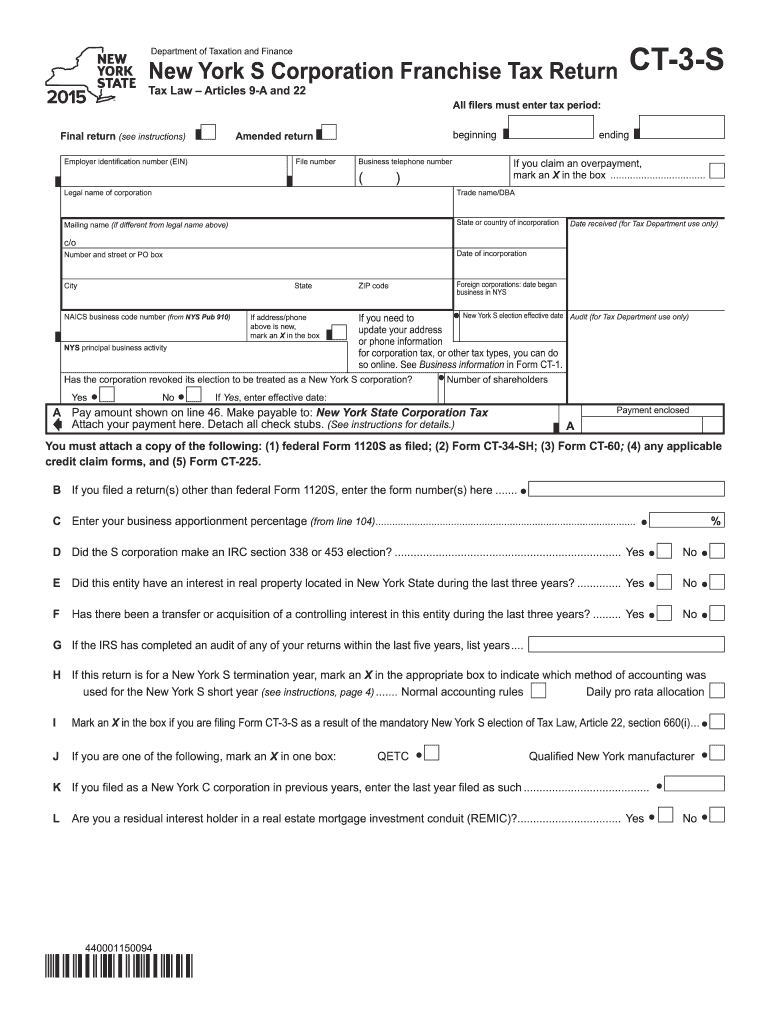

Ct 3 S Form 2015

What is the Ct 3 S Form

The Ct 3 S Form is a tax document used by corporations in the state of New York to report their income, deductions, and credits. It is specifically designed for small businesses that meet certain criteria, allowing them to file a simplified version of the standard corporate tax return. This form is essential for ensuring compliance with state tax laws and helps businesses accurately calculate their tax obligations.

How to use the Ct 3 S Form

To effectively use the Ct 3 S Form, businesses must first determine their eligibility based on the size and type of their corporation. Once eligibility is established, the form must be completed with accurate financial information, including total income, allowable deductions, and any applicable credits. After filling out the form, it is important to review all entries for accuracy before submission to avoid potential penalties.

Steps to complete the Ct 3 S Form

Completing the Ct 3 S Form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Determine eligibility for using the Ct 3 S Form based on business size and type.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the Ct 3 S Form

The Ct 3 S Form holds legal significance as it is required by the New York State Department of Taxation and Finance. Proper completion and timely submission of this form are necessary to maintain compliance with state tax regulations. Failure to file or inaccuracies in reporting can lead to legal consequences, including penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 S Form are crucial for businesses to adhere to in order to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. It is advisable for businesses to mark their calendars and prepare their documentation in advance to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Ct 3 S Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the New York State Department of Taxation and Finance website, which allows for quicker processing.

- Mailing the completed form to the appropriate address as specified by the tax authority.

- In-person submission at designated tax offices, which may be beneficial for businesses requiring immediate assistance.

Required Documents

To complete the Ct 3 S Form accurately, businesses must gather several key documents, including:

- Financial statements detailing income and expenses.

- Records of any deductions and credits being claimed.

- Previous tax returns, if applicable, for reference.

Quick guide on how to complete ct 3 s form 2015

Easily Prepare Ct 3 S Form on Any Device

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Ct 3 S Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

The Simplest Way to Modify and eSign Ct 3 S Form Effortlessly

- Find Ct 3 S Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using the tools specifically designed for this by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes only moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and then press the Done button to save your changes.

- Select your preferred method for sharing your form, whether via email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Ct 3 S Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 s form 2015

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s form 2015

How to create an electronic signature for your Ct 3 S Form 2015 in the online mode

How to generate an electronic signature for the Ct 3 S Form 2015 in Google Chrome

How to generate an eSignature for putting it on the Ct 3 S Form 2015 in Gmail

How to make an electronic signature for the Ct 3 S Form 2015 from your smartphone

How to create an electronic signature for the Ct 3 S Form 2015 on iOS devices

How to make an eSignature for the Ct 3 S Form 2015 on Android devices

People also ask

-

What is the Ct 3 S Form?

The Ct 3 S Form is a document required for small business tax reporting in Connecticut. It allows businesses to report income, deductions, and other tax-related information to the state. Completing the Ct 3 S Form accurately ensures compliance and can help avoid penalties.

-

How does airSlate SignNow help with the Ct 3 S Form?

airSlate SignNow offers a streamlined platform for businesses to complete and eSign the Ct 3 S Form efficiently. Our easy-to-use interface simplifies the process, allowing users to fill out the form online, ensuring accuracy and saving time. With airSlate SignNow, you can ensure your forms are securely signed and submitted.

-

Is airSlate SignNow a cost-effective solution for managing the Ct 3 S Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for document management, including the Ct 3 S Form. With a variety of pricing plans, businesses can choose the option that fits their budget while enjoying unlimited access to essential features. This affordability makes handling important forms like the Ct 3 S Form accessible for businesses of all sizes.

-

What are the key features of airSlate SignNow for the Ct 3 S Form?

Key features of airSlate SignNow include customizable templates, secure eSignature options, and real-time document tracking. These tools enable businesses to manage the Ct 3 S Form quickly and efficiently. Additionally, the platform supports collaboration, allowing multiple stakeholders to review and sign the document simultaneously.

-

Can airSlate SignNow integrate with other software for the Ct 3 S Form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow for the Ct 3 S Form. Whether you use accounting software or document management systems, our integrations help you streamline processes and maintain organized digital records.

-

What benefits does eSigning the Ct 3 S Form offer?

eSigning the Ct 3 S Form provides numerous benefits, including increased efficiency and enhanced security. With airSlate SignNow, you can ensure that your form is signed quickly without the hassles of printing and mailing. Additionally, the legally binding electronic signatures protect your documents against tampering and fraud.

-

Is it easy to get started with airSlate SignNow for the Ct 3 S Form?

Yes, getting started with airSlate SignNow is quick and easy. Simply sign up for an account, access the Ct 3 S Form templates, and begin filling them out. The user-friendly interface guides you through the process, ensuring you can manage your forms effectively from day one.

Get more for Ct 3 S Form

Find out other Ct 3 S Form

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking