Fillable Online If You Claim an Overpayment, Fax Email 2021

Understanding the CT-3-S Form

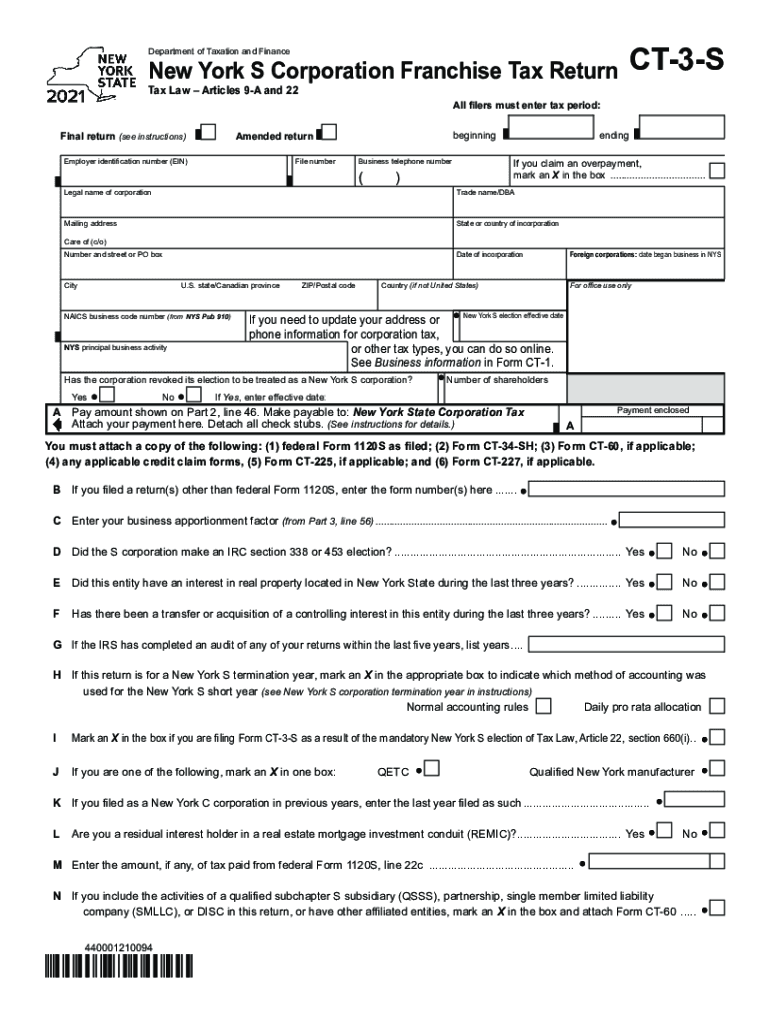

The CT-3-S form is the New York State S Corporation Franchise Tax Return. It is specifically designed for S corporations to report their income, deductions, and credits. This form is essential for ensuring compliance with New York tax regulations. S corporations must file the CT-3-S annually, detailing their financial activities and determining their tax obligations. The form includes sections for reporting income, calculating tax credits, and claiming any overpayments from previous years.

Steps to Complete the CT-3-S Form

Completing the CT-3-S form involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, accurately fill out the form, ensuring that all income and deductions are reported correctly. Pay special attention to the sections that require detailed calculations, such as the apportionment of income if the corporation operates in multiple states. After completing the form, review it for accuracy and ensure that all signatures are in place before submission.

Filing Deadlines for the CT-3-S Form

The filing deadline for the CT-3-S form typically aligns with the federal tax deadline. For most S corporations, this means the form is due on the fifteenth day of the third month following the end of the tax year. It's crucial to be aware of these deadlines to avoid penalties and interest on any taxes owed. If the deadline falls on a weekend or holiday, the due date is extended to the next business day.

Legal Use of the CT-3-S Form

The CT-3-S form is legally binding and must be completed in accordance with New York State tax laws. When filed correctly, it serves as the official record of the corporation’s tax obligations and can be used as evidence in case of audits or disputes. To ensure legal compliance, S corporations should adhere to all instructions provided with the form and maintain accurate records of all financial transactions related to the filing.

Form Submission Methods

The CT-3-S form can be submitted through various methods. Corporations have the option to file online using the New York State Department of Taxation and Finance's e-filing system, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. Each submission method has its own processing times, so it is advisable to choose the one that best suits the corporation’s needs.

Key Elements of the CT-3-S Form

Several key elements must be included in the CT-3-S form to ensure it is complete. These include the corporation's name, employer identification number (EIN), total income, deductions, and any applicable credits. Additionally, the form requires detailed information about shareholders and their respective shares in the corporation. Accurate reporting of these elements is critical for the form's acceptance by the New York State tax authorities.

Quick guide on how to complete fillable online if you claim an overpayment fax email

Effortlessly Complete Fillable Online If You Claim An Overpayment, Fax Email on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to obtain the required form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Fillable Online If You Claim An Overpayment, Fax Email on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Edit and Electronically Sign Fillable Online If You Claim An Overpayment, Fax Email with Ease

- Locate Fillable Online If You Claim An Overpayment, Fax Email and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark signNow sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements for document management in just a few clicks from whichever device you prefer. Edit and electronically sign Fillable Online If You Claim An Overpayment, Fax Email to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online if you claim an overpayment fax email

Create this form in 5 minutes!

How to create an eSignature for the fillable online if you claim an overpayment fax email

The way to make an e-signature for your PDF file online

The way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is ct 3 s in relation to airSlate SignNow?

The term 'ct 3 s' refers to a specific feature within airSlate SignNow that enhances the electronic signing process. It allows users to quickly create and manage signatures, ensuring compliance and security. This functionality streamlines the workflow, making it easier for businesses to obtain eSignatures efficiently.

-

How does airSlate SignNow's ct 3 s feature improve document management?

airSlate SignNow's ct 3 s feature provides tools for efficient document management, enabling users to organize and track their documents effortlessly. It automates many aspects of document workflows, helping to reduce errors and save time. With ct 3 s, businesses can manage signatures and documents all in one place.

-

What are the pricing options for airSlate SignNow that include ct 3 s functionalities?

airSlate SignNow offers several pricing tiers that incorporate the ct 3 s features, ensuring flexibility for various business sizes. The pricing is competitive and includes different plans geared towards small businesses and enterprises alike. Each plan is designed to provide full access to the essential functionalities of ct 3 s.

-

Can I integrate airSlate SignNow's ct 3 s with other software?

Yes, airSlate SignNow's ct 3 s can integrate seamlessly with several popular applications to streamline your workflow. This includes CRM tools, project management software, and cloud storage services. By using these integrations, businesses can enhance efficiency and maintain a cohesive digital ecosystem.

-

What benefits does using ct 3 s offer for remote teams?

Using ct 3 s from airSlate SignNow provides signNow benefits for remote teams, such as the ability to sign documents from anywhere at any time. It ensures that the signing process is swift, secure, and compliant with necessary regulations. This is particularly important for remote teams looking for effective digital solutions to manage their documents.

-

Is airSlate SignNow's ct 3 s feature user-friendly for non-technical users?

Absolutely! The ct 3 s feature in airSlate SignNow is designed with user-friendliness in mind, making it accessible for all users regardless of their technical background. The intuitive interface guides users through the signing process, ensuring a smooth experience. Training resources are also available for those who need extra assistance.

-

How secure is the ct 3 s functionality in airSlate SignNow?

The security of the ct 3 s functionality is paramount at airSlate SignNow. It employs advanced encryption and authentication measures to protect your documents and sensitive information. Additionally, the platform is compliant with industry standards, providing users peace of mind while utilizing its eSigning features.

Get more for Fillable Online If You Claim An Overpayment, Fax Email

Find out other Fillable Online If You Claim An Overpayment, Fax Email

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF