Form RI 1040NR 2022-2026

What is the Form RI 1040NR

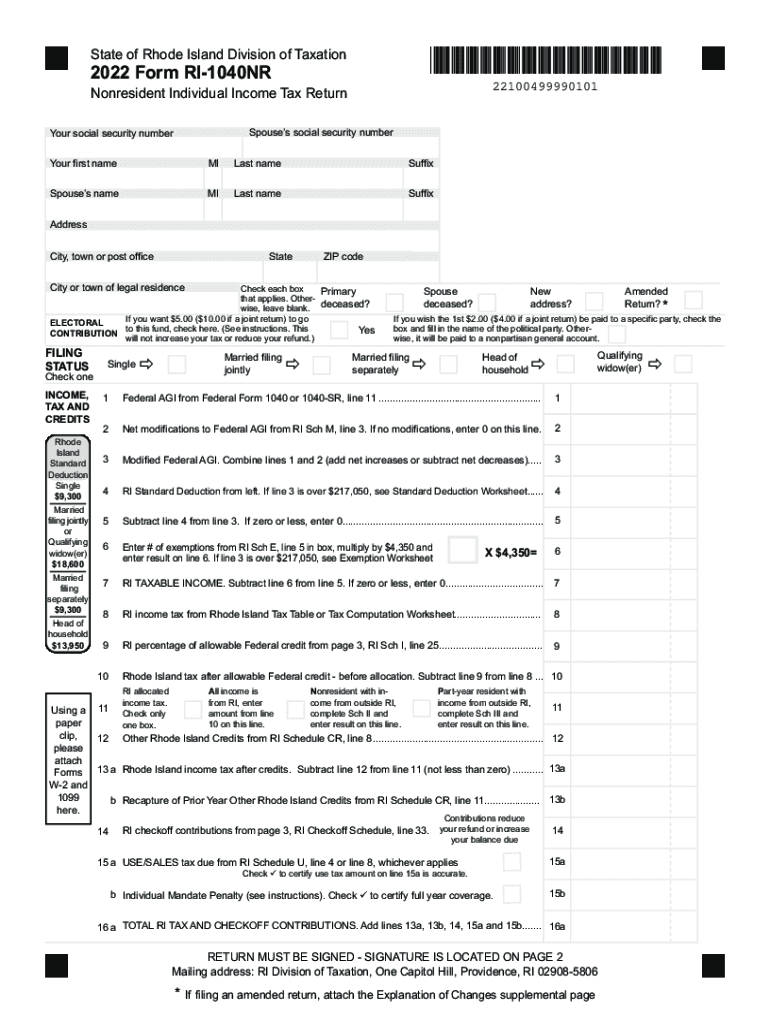

The Form RI 1040NR is the Rhode Island state tax form designed for non-residents who earn income in the state. This form allows individuals who do not reside in Rhode Island but have income sourced from the state to report their earnings and calculate their tax liability. It is crucial for non-residents to use this form to ensure compliance with state tax regulations and avoid potential penalties.

How to obtain the Form RI 1040NR

The Form RI 1040NR can be obtained from the Rhode Island Division of Taxation's official website. It is available for download in PDF format, allowing users to print and complete the form manually. Additionally, tax software that supports Rhode Island tax filings may also provide access to this form, making it easier for taxpayers to fill it out electronically.

Steps to complete the Form RI 1040NR

Completing the Form RI 1040NR involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income earned in Rhode Island, ensuring to include all relevant sources.

- Calculate your tax liability based on the income reported and applicable tax rates.

- Review the form for accuracy before submission.

Legal use of the Form RI 1040NR

The Form RI 1040NR is legally binding when filled out correctly and submitted to the Rhode Island Division of Taxation. To ensure its legal standing, it must be signed by the taxpayer or an authorized representative. Additionally, compliance with state tax laws and regulations is essential to avoid issues with tax authorities.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Form RI 1040NR. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify the specific date for the tax year in question to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Form RI 1040NR can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically using approved tax software that supports Rhode Island forms.

- Mail: The completed form can be printed and mailed to the Rhode Island Division of Taxation at the designated address.

- In-Person: Taxpayers may also choose to deliver the form in person at the Division of Taxation office.

Quick guide on how to complete 2022 form ri 1040nr

Complete Form RI 1040NR effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form RI 1040NR on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Form RI 1040NR seamlessly

- Find Form RI 1040NR and click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Form RI 1040NR while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form ri 1040nr

Create this form in 5 minutes!

How to create an eSignature for the 2022 form ri 1040nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rhode Island state tax form 2021, and who should use it?

The Rhode Island state tax form 2021 is a document required for individuals and businesses to report their income and calculate the taxes owed to the state. It is essential for residents and non-residents with income generated within Rhode Island. Using this form ensures compliance with state tax laws and helps avoid penalties.

-

How can airSlate SignNow help me complete the Rhode Island state tax form 2021?

airSlate SignNow offers an efficient platform for eSigning and managing your Rhode Island state tax form 2021. With its user-friendly interface, you can easily fill out and sign the required fields digitally, saving time and ensuring accuracy. Plus, you can share the form with tax professionals or collaborators seamlessly.

-

Is there a cost associated with using airSlate SignNow for the Rhode Island state tax form 2021?

Yes, airSlate SignNow operates on a subscription basis, offering various pricing plans based on your specific needs. The pricing is competitive, and for users who frequently handle documents like the Rhode Island state tax form 2021, it can be a cost-effective solution for eSigning. There might be a free trial available to test the platform.

-

What features does airSlate SignNow offer for eSigning the Rhode Island state tax form 2021?

airSlate SignNow provides features such as custom templates, secure storage, and mobile access for eSigning the Rhode Island state tax form 2021. Users can track document statuses, send reminders for signatures, and manage documents easily through a centralized dashboard. These features enhance productivity and streamline the signing process.

-

Can I integrate airSlate SignNow with other software when working on the Rhode Island state tax form 2021?

Yes, airSlate SignNow offers robust integrations with various software platforms, making it easier to manage the Rhode Island state tax form 2021. You can connect it with accounting software, CRMs, and more, allowing you to streamline your workflow and maintain consistency across platforms. This flexibility helps in enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for the Rhode Island state tax form 2021?

Using airSlate SignNow for the Rhode Island state tax form 2021 offers numerous benefits, including time savings, enhanced security, and easier document management. The platform provides a hassle-free way to get signatures and approvals, which speeds up the filing process. Additionally, the digital approach minimizes the risk of errors and discrepancies.

-

How secure is airSlate SignNow when handling the Rhode Island state tax form 2021?

airSlate SignNow takes security seriously, employing encryption and advanced security measures to protect your documents, including the Rhode Island state tax form 2021. Features like user authentication and audit trails ensure that your sensitive information is secure throughout the signing process. This commitment to security helps users feel confident in using the platform.

Get more for Form RI 1040NR

- Financial account transfer to living trust maryland form

- Assignment to living trust maryland form

- Notice of assignment to living trust maryland form

- Revocation of living trust maryland form

- Letter to lienholder to notify of trust maryland form

- Md sale contract form

- Maryland forest products form

- Md easement form

Find out other Form RI 1040NR

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document