Form Ri 1040nr 2017

What is the Form Ri 1040nr

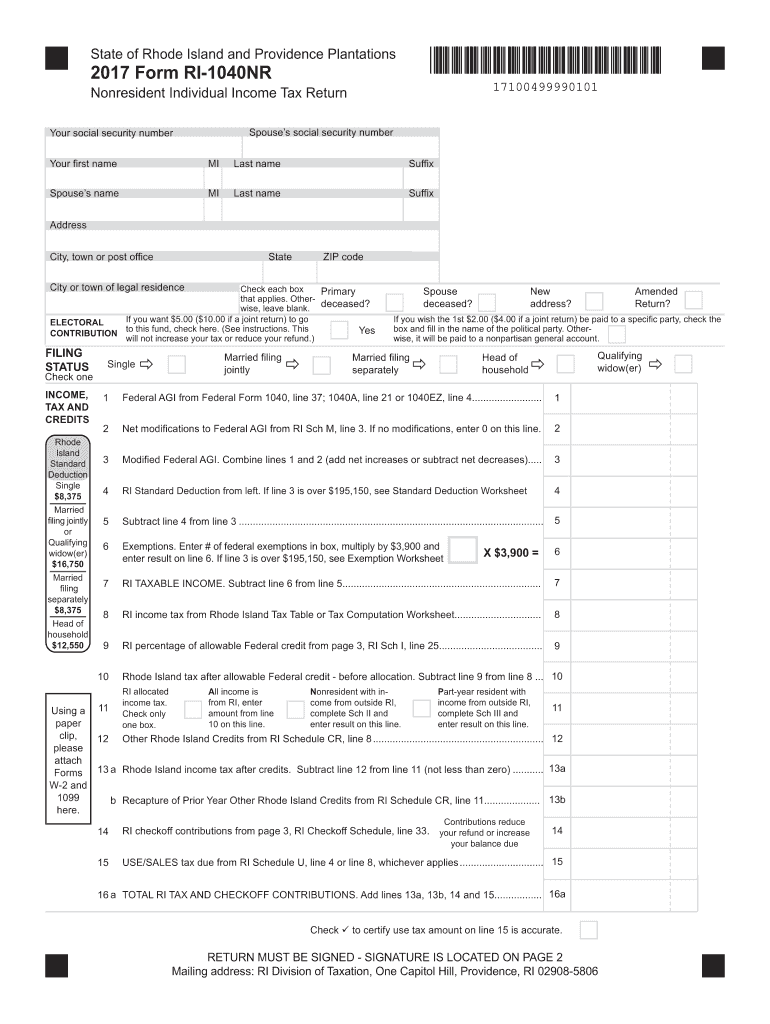

The Form Ri 1040nr is a tax document specifically designed for non-resident aliens who need to report their income to the Internal Revenue Service (IRS). This form is essential for individuals who earn income in the United States but do not qualify as residents for tax purposes. Completing the Form Ri 1040nr accurately ensures compliance with U.S. tax laws and helps avoid potential penalties.

How to use the Form Ri 1040nr

To use the Form Ri 1040nr, taxpayers must first gather all relevant financial information, including income earned in the U.S., applicable deductions, and credits. The form requires detailed reporting of income sources, such as wages, dividends, and interest. After completing the form, it must be signed and dated, and then submitted to the IRS by the appropriate deadline. Utilizing electronic filing options can streamline the process and enhance accuracy.

Steps to complete the Form Ri 1040nr

Completing the Form Ri 1040nr involves several key steps:

- Gather necessary documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Report all income earned in the U.S., ensuring to include all relevant sources.

- Claim any eligible deductions or credits that apply to your situation.

- Review the completed form for accuracy before signing it.

- Submit the form electronically or via mail, ensuring it is sent to the correct IRS address.

Legal use of the Form Ri 1040nr

The Form Ri 1040nr is legally recognized by the IRS for reporting income by non-resident aliens. It is important that the form is completed in accordance with IRS guidelines to ensure its validity. Misreporting or failing to file can lead to legal repercussions, including fines or audits. Taxpayers should keep copies of their submitted forms and any supporting documents for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ri 1040nr typically align with the general tax filing season. Non-resident aliens must file their returns by April fifteenth of the year following the tax year in question. If additional time is needed, taxpayers can request an extension, but it is important to understand that this does not extend the time to pay any taxes owed. Staying aware of these deadlines is crucial to avoid penalties.

Required Documents

When completing the Form Ri 1040nr, several documents are necessary to ensure accurate reporting:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits claimed.

- Taxpayer identification number or Social Security number.

Having these documents readily available can simplify the process and help ensure compliance with IRS requirements.

Quick guide on how to complete form ri 1040nr 2017

Your assistance manual on how to prepare your Form Ri 1040nr

If you’re curious about how to complete and submit your Form Ri 1040nr, here are some rapid instructions on how to facilitate tax filing.

To initiate, simply register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax forms effortlessly. Through its editor, you can toggle between text, checkboxes, and eSignatures and revisit to amend information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Form Ri 1040nr in minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Form Ri 1040nr in our editor.

- Input the necessary fillable fields with your information (text content, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to electronically file your taxes using airSlate SignNow. Please keep in mind that paper filing can increase return mistakes and delay refunds. Naturally, before e-filing your taxes, check the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ri 1040nr 2017

FAQs

-

Am I supposed to report income which is earned outside of the US? I have to fill the 1040NR form.

If you are a US citizen, resident(?), or company based within the US or its territories, you are required by the IRS to give them a part of whatever you made. I'm not going to go into specifics, but as they say, "the only difference between a tax man and a taxidermist is that the taxidermist leaves the skin" -Mark Twain

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form ri 1040nr 2017

How to make an eSignature for the Form Ri 1040nr 2017 online

How to make an electronic signature for the Form Ri 1040nr 2017 in Google Chrome

How to create an eSignature for signing the Form Ri 1040nr 2017 in Gmail

How to generate an eSignature for the Form Ri 1040nr 2017 from your mobile device

How to generate an electronic signature for the Form Ri 1040nr 2017 on iOS

How to make an electronic signature for the Form Ri 1040nr 2017 on Android

People also ask

-

What is Form Ri 1040nr?

Form Ri 1040nr is a tax form used by non-residents to report income earned in Rhode Island. This form is essential for fulfilling state tax obligations, and airSlate SignNow provides a streamlined way to eSign and submit it quickly and efficiently.

-

How does airSlate SignNow simplify the process of completing Form Ri 1040nr?

airSlate SignNow offers an easy-to-use interface that allows users to fill out Form Ri 1040nr digitally. With features like guided prompts and the ability to save your progress, filing your taxes has never been simpler.

-

Is there a cost associated with using airSlate SignNow for Form Ri 1040nr?

Yes, airSlate SignNow provides several pricing plans to accommodate various user needs. Each plan offers features suitable for filing Form Ri 1040nr, allowing you to choose one that best fits your budget.

-

Can I track the status of my Form Ri 1040nr submission with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Form Ri 1040nr submission in real-time. You'll receive notifications when your document is viewed and signed, ensuring seamless communication throughout the process.

-

Does airSlate SignNow integrate with other software to manage Form Ri 1040nr?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage Form Ri 1040nr. This integration helps streamline the document management process and centralizes your paperwork.

-

Are there templates available for completing Form Ri 1040nr in airSlate SignNow?

Yes, airSlate SignNow provides templates for Form Ri 1040nr to help users complete the form accurately. These templates come pre-filled with necessary information, making it simpler to ensure compliance with state regulations.

-

What security features does airSlate SignNow offer for Form Ri 1040nr?

airSlate SignNow employs advanced security measures, such as encryption and secure access controls, to protect your data when working with Form Ri 1040nr. This ensures that your sensitive information remains safe throughout the signing process.

Get more for Form Ri 1040nr

- Activity root words and biology form

- Mypgebenefits form

- Todays plan form

- Social emotional health survey michaelfurlonginfo form

- We verified your documents to support your identity theft irs gov form

- Metropolitan life insurance company beneficiary designation gbene des rk form

- Sanz name meaning ampamp sanz family history at ancestry com form

- Safe note agreement template form

Find out other Form Ri 1040nr

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple