Fillable Online Personal Income Tax Forms Rhode Island 2021

What is the Fillable Online Personal Income Tax Forms Rhode Island

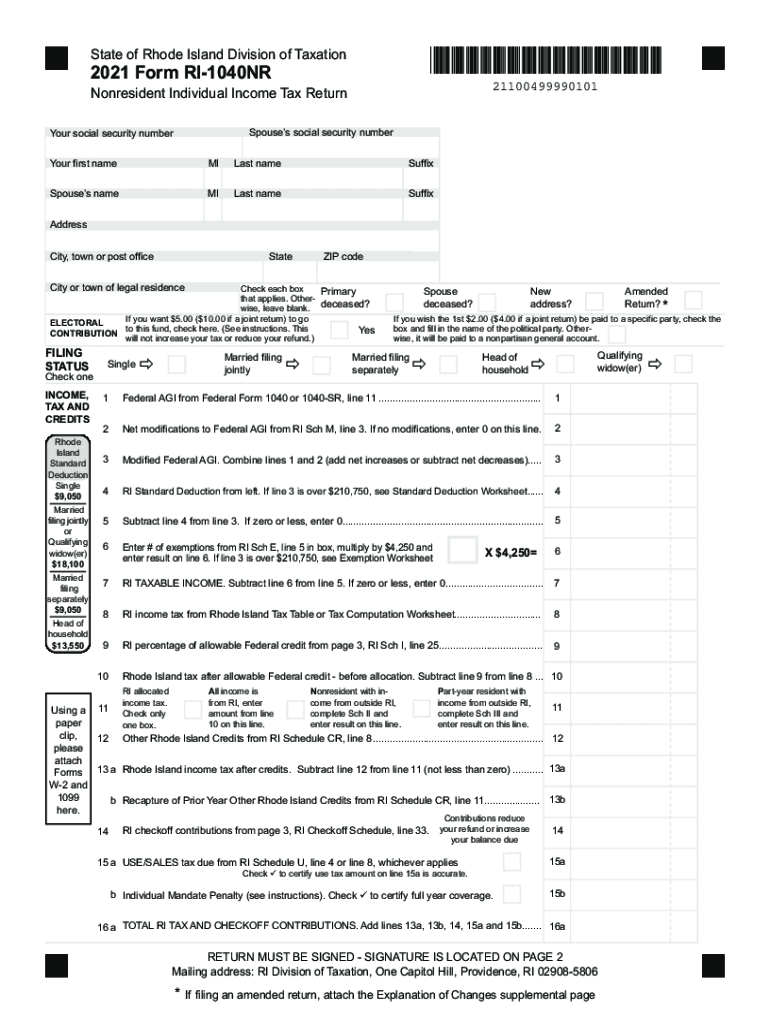

The fillable online personal income tax forms for Rhode Island are digital documents designed for residents to report their income and calculate their tax liability. These forms are compliant with state regulations and allow taxpayers to input their financial information directly into the document. The primary form used is the RI-1040, which is essential for individual income tax filing in Rhode Island. By utilizing these online forms, taxpayers can streamline their filing process, ensuring accuracy and efficiency.

Steps to complete the Fillable Online Personal Income Tax Forms Rhode Island

Completing the fillable online personal income tax forms for Rhode Island involves several key steps:

- Access the official online tax forms through the state’s tax website.

- Select the appropriate form, typically the RI-1040, based on your filing status.

- Fill in your personal information, including your name, address, and Social Security number.

- Input your income details, including wages, interest, and any other sources of income.

- Calculate your deductions and credits as applicable.

- Review your information for accuracy before submission.

- Submit the completed form electronically or print it for mailing.

Legal use of the Fillable Online Personal Income Tax Forms Rhode Island

The fillable online personal income tax forms for Rhode Island are legally recognized as valid submissions when completed accurately and submitted according to state guidelines. To ensure compliance, taxpayers must adhere to specific requirements, such as using the latest version of the forms and providing accurate information. These forms are designed to meet the standards set forth by the Rhode Island Division of Taxation, ensuring that they are accepted for processing by state authorities.

Filing Deadlines / Important Dates

Taxpayers in Rhode Island should be aware of key filing deadlines to avoid penalties. The typical deadline for filing personal income tax returns is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should note any important dates related to estimated tax payments, which are generally due quarterly. Staying informed about these deadlines helps ensure timely compliance with state tax obligations.

Required Documents

To complete the fillable online personal income tax forms for Rhode Island, taxpayers will need several documents, including:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as interest or dividends.

- Records of deductions, including receipts for charitable contributions and medical expenses.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Rhode Island have several options for submitting their personal income tax forms. The most efficient method is electronic submission through the state’s online portal, which allows for immediate processing. Alternatively, forms can be printed and mailed to the Rhode Island Division of Taxation. In-person submissions are also accepted at designated tax offices, providing taxpayers with flexibility in how they choose to file their returns.

Quick guide on how to complete fillable online personal income tax forms rhode island

Complete Fillable Online Personal Income Tax Forms Rhode Island effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Fillable Online Personal Income Tax Forms Rhode Island on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to adjust and eSign Fillable Online Personal Income Tax Forms Rhode Island hassle-free

- Obtain Fillable Online Personal Income Tax Forms Rhode Island and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize crucial sections of your documents or redact sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from a device of your choice. Modify and eSign Fillable Online Personal Income Tax Forms Rhode Island and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online personal income tax forms rhode island

Create this form in 5 minutes!

How to create an eSignature for the fillable online personal income tax forms rhode island

The way to create an e-signature for your PDF in the online mode

The way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What are the Rhode Island income tax rates for individuals?

The Rhode Island income tax rates for individuals range from 3.75% to 5.99% depending on the income bracket. It’s essential to understand these rates when preparing your taxes, as they directly affect your tax liability. Knowing these rates can help you plan your financial decisions more effectively.

-

How do Rhode Island income tax rates compare to other states?

Rhode Island income tax rates are relatively moderate compared to other states in the Northeastern U.S. While some states have no income tax imposed, Rhode Island offers a tiered rate system that can benefit those with lower incomes. Understanding these nuances can influence where you live and work in relation to your tax obligations.

-

Are there ways to reduce my tax burden with Rhode Island income tax rates?

Yes, there are several strategies to reduce your tax burden under Rhode Island income tax rates. Taking advantage of deductions, credits, and tax-advantaged accounts can minimize your taxable income. Consulting with a tax professional can also provide tailored strategies specific to your situation.

-

What forms are required to file taxes in Rhode Island based on income tax rates?

To file taxes in Rhode Island, you typically need Form RI-1040 and potentially additional schedules that correspond with your income sources. Familiarizing yourself with these forms can expedite the filing process and help ensure compliance with Rhode Island income tax rates. Keeping your documentation organized is advisable to avoid mistakes.

-

How does airSlate SignNow help with managing Rhode Island income tax documents?

AirSlate SignNow provides a seamless solution for managing and eSigning important tax documents. Our platform allows you to store and send your Rhode Island income tax forms securely, ensuring that you have quick access to your valuable information. This can save time and reduce stress during tax season.

-

What are the integration capabilities of airSlate SignNow for tax-related applications?

AirSlate SignNow integrates with various tax and accounting software solutions to streamline your sign and document management process. You can link our platform with your preferred tax applications to enhance your workflow and ensure accuracy with your Rhode Island income tax rates documentation. This integration helps in centralizing all your financial tasks efficiently.

-

Can airSlate SignNow assist businesses with collective tax filings under Rhode Island income tax rates?

Absolutely! AirSlate SignNow can assist businesses in managing collective tax filings by providing features for easy document sharing and tracking. This is particularly important for organizations with multiple employees who must comply with Rhode Island income tax rates. Collaborating efficiently can lead to accurate and timely filings.

Get more for Fillable Online Personal Income Tax Forms Rhode Island

- Decree granting authority to compromise and settle claim of minor without guardianship mississippi form

- Petition for authority to compromise and settle claim of a minor without guardianship divorced parents mississippi form

- Decree granting authority to compromise and settle claim of minor without guardianship mississippi 497314562 form

- Doubtful claim form

- Doubtful claim 497314564 form

- Removal minority form

- Mississippi execute form

- Settle claim form

Find out other Fillable Online Personal Income Tax Forms Rhode Island

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy