Corporation Tax Return 2022

What is the Corporation Tax Return

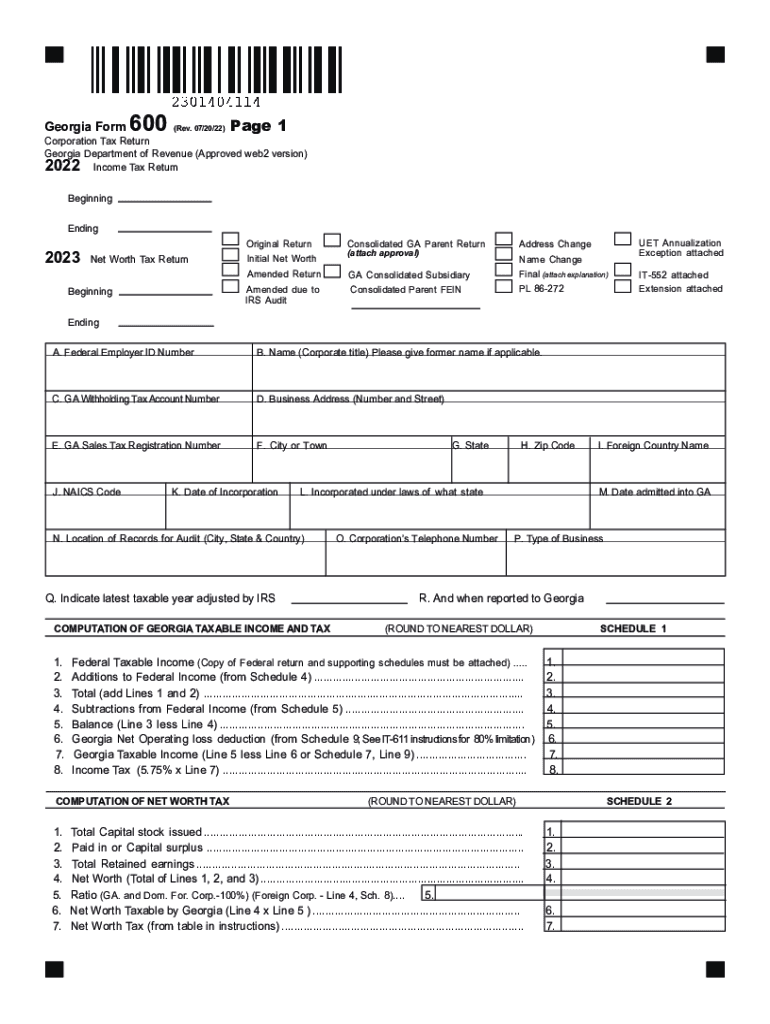

The 2023 Form 600, commonly referred to as the Corporation Tax Return, is a crucial document for corporations operating in Georgia. This form is used to report income, gains, losses, deductions, and credits for the tax year. Corporations must file this return to determine their tax liability and ensure compliance with state tax regulations. Understanding the purpose and requirements of this form is essential for maintaining good standing with the Georgia Department of Revenue.

Steps to complete the Corporation Tax Return

Completing the 2023 Form 600 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, accurately fill out each section of the form, detailing income and expenses. It's important to consult the specific instructions for the form to avoid common pitfalls. Once completed, review the form for errors before submission. Finally, submit the form either electronically or by mail, depending on your preference and the guidelines provided by the Georgia Department of Revenue.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the 2023 Form 600 to avoid penalties. The due date for filing the return is typically the 15th day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the return is due by April 15. It's essential to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances, but they must be requested in advance.

Required Documents

When preparing to file the 2023 Form 600, corporations should gather several key documents to ensure a complete and accurate submission. Required documents typically include:

- Financial statements, including income statements and balance sheets

- Records of all income received during the tax year

- Documentation of all deductions claimed

- Any applicable schedules or forms that support entries on the return

Having these documents organized will streamline the filing process and help avoid delays or issues with the Georgia Department of Revenue.

Legal use of the Corporation Tax Return

The 2023 Form 600 must be completed in accordance with Georgia tax laws to ensure its legal validity. This includes adhering to state regulations regarding income reporting, allowable deductions, and credits. Corporations must also ensure that all information provided is accurate and truthful, as any discrepancies can lead to audits or penalties. Utilizing a reliable electronic signature tool can enhance the legal standing of the document, ensuring compliance with eSignature laws.

IRS Guidelines

While the 2023 Form 600 is specific to Georgia, corporations must also be aware of relevant IRS guidelines that may impact their federal tax obligations. This includes understanding how state taxes interact with federal tax filings and any applicable credits or deductions that can be claimed on both state and federal returns. Keeping abreast of IRS updates can help corporations make informed decisions regarding their tax strategy.

Penalties for Non-Compliance

Failure to file the 2023 Form 600 by the deadline can result in significant penalties for corporations. These penalties may include late filing fees and interest on any unpaid taxes. In some cases, non-compliance can lead to further legal action or audits by the Georgia Department of Revenue. To avoid these consequences, it is crucial for corporations to adhere to filing deadlines and ensure all submitted information is accurate and complete.

Quick guide on how to complete corporation tax return

Complete Corporation Tax Return effortlessly on any gadget

Digital document management has become widely embraced by businesses and individuals. It offers an exemplary eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Corporation Tax Return on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Corporation Tax Return with ease

- Find Corporation Tax Return and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important parts of your documents or black out sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Corporation Tax Return and guarantee outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation tax return

Create this form in 5 minutes!

How to create an eSignature for the corporation tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow tool related to georgia form 600 instructions 2023?

airSlate SignNow offers a seamless eSigning process that simplifies the submission of your georgia form 600 instructions 2023. With features like templates, real-time collaboration, and secure storage, you can ensure your documents are completed accurately and promptly.

-

How much does airSlate SignNow cost for users needing georgia form 600 instructions 2023?

The pricing for airSlate SignNow varies based on your selected plan, but it remains an affordable and cost-effective solution for facilitating the georgia form 600 instructions 2023. Visit our pricing page to find the best plan that meets your needs without breaking the bank.

-

How does airSlate SignNow improve the efficiency of handling georgia form 600 instructions 2023?

With airSlate SignNow, you can streamline the process of preparing and signing your georgia form 600 instructions 2023. Automating document workflows decreases turnaround time, allowing your team to focus on more important tasks while ensuring compliance.

-

Is it easy to integrate airSlate SignNow with other software for georgia form 600 instructions 2023?

Yes, airSlate SignNow offers seamless integration with a variety of tools and platforms, making the processing of georgia form 600 instructions 2023 even more efficient. By integrating with your existing software, you can enhance productivity and manage your documents in one place.

-

What support is available for users managing georgia form 600 instructions 2023 with airSlate SignNow?

Our dedicated support team is available 24/7 to assist with your inquiries regarding georgia form 600 instructions 2023. Whether you need technical assistance or guidance on using specific features, we're here to help you navigate the process effortlessly.

-

Can I use airSlate SignNow on mobile devices for georgia form 600 instructions 2023?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to manage your georgia form 600 instructions 2023 on-the-go. The mobile app ensures that you can eSign and share documents anytime, anywhere, making your workflow more flexible.

-

What security measures does airSlate SignNow implement for documents related to georgia form 600 instructions 2023?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication measures to protect your documents, including those related to georgia form 600 instructions 2023, ensuring that your sensitive information remains secure during transmission and storage.

Get more for Corporation Tax Return

- Assumption agreement of mortgage and release of original mortgagors maine form

- Maine judgment form

- Small estate affidavit for estates not more than 40000 maine form

- Sworn closing statement by representative small estates maine form

- Maine landlord tenant eviction unlawful detainer forms package maine

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497310971 form

- Maine annual form

- Notices resolutions simple stock ledger and certificate maine form

Find out other Corporation Tax Return

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT