600 Corporation Tax Return Georgia Department of Revenue 2019

What is the 600 Corporation Tax Return Georgia Department Of Revenue

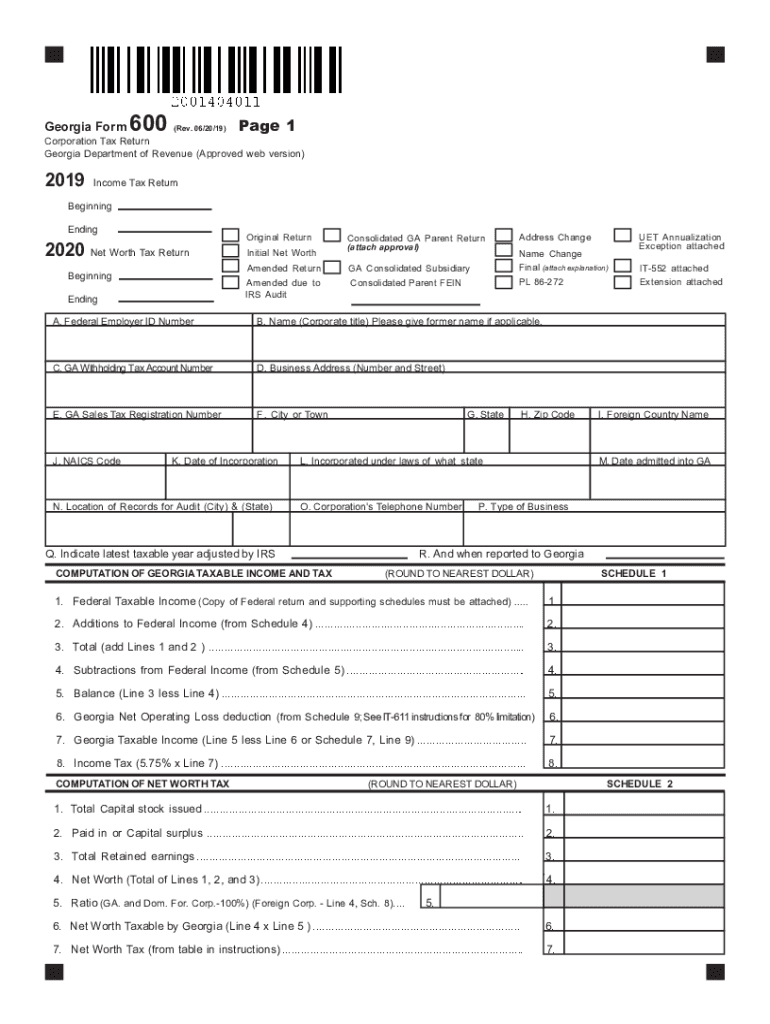

The 600 Corporation Tax Return is a tax form required by the Georgia Department of Revenue for corporations operating within the state. This form is essential for reporting the corporation's income, deductions, and credits, allowing the state to assess the appropriate amount of tax owed. The form is specifically designed for C corporations, which are taxed separately from their owners. Understanding the purpose and requirements of the form is crucial for compliance and accurate tax reporting.

Steps to complete the 600 Corporation Tax Return Georgia Department Of Revenue

Completing the 600 Corporation Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, download the form from the Georgia Department of Revenue website or access it through a digital platform. Fill out the form by entering relevant financial information, ensuring all calculations are correct. Once completed, review the form for any errors or omissions before submitting it to the appropriate state authority.

Legal use of the 600 Corporation Tax Return Georgia Department Of Revenue

The legal use of the 600 Corporation Tax Return is governed by state tax laws and regulations. To ensure the form is legally valid, it must be completed accurately and submitted by the designated deadline. Electronic signatures are acceptable if the submission is made through a compliant eSignature platform, which provides a secure and legally recognized method of signing documents. Compliance with these legal standards is essential to avoid penalties and ensure that the corporation meets its tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 600 Corporation Tax Return are critical for compliance. Typically, the return is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes in deadlines, as extensions may be available under certain circumstances. Failure to file on time can result in penalties and interest on any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The 600 Corporation Tax Return can be submitted through various methods to accommodate different preferences. Corporations have the option to file online through the Georgia Department of Revenue's e-filing system, which offers a streamlined process and immediate confirmation of submission. Alternatively, the form can be mailed directly to the appropriate address provided by the department. In some cases, in-person submissions may also be accepted at designated state offices, although this method is less common.

Key elements of the 600 Corporation Tax Return Georgia Department Of Revenue

Key elements of the 600 Corporation Tax Return include sections for reporting gross income, deductions, and tax credits. Corporations must provide detailed financial information, including revenue from sales, cost of goods sold, and operating expenses. It is also essential to include any applicable tax credits, such as those for job creation or investment in certain areas. Ensuring that all key elements are accurately reported is vital for calculating the correct tax liability and maintaining compliance with state regulations.

Quick guide on how to complete 600 corporation tax return georgia department of revenue

Complete 600 Corporation Tax Return Georgia Department Of Revenue effortlessly on any device

Online document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 600 Corporation Tax Return Georgia Department Of Revenue on any platform using the airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to modify and electronically sign 600 Corporation Tax Return Georgia Department Of Revenue with ease

- Locate 600 Corporation Tax Return Georgia Department Of Revenue and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 600 Corporation Tax Return Georgia Department Of Revenue and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 600 corporation tax return georgia department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 600 corporation tax return georgia department of revenue

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the form 600 corporation tax form?

The form 600 corporation tax form is a tax return that corporations must file annually with the IRS to report their income, deductions, and credits. Properly completing and submitting this form ensures compliance with tax laws, thereby avoiding penalties. Utilizing tools like airSlate SignNow can streamline the signing and submission process for your form 600 corporation tax form.

-

How can airSlate SignNow help with the form 600 corporation tax form?

airSlate SignNow offers an efficient platform to electronically sign and send your form 600 corporation tax form and other essential documents. With features like secure eSignature and document tracking, you can ensure that your forms are completed and submitted on time. Our user-friendly interface simplifies the handling of important tax documents.

-

Is airSlate SignNow cost-effective for submitting the form 600 corporation tax form?

Yes, airSlate SignNow provides a cost-effective solution for managing your form 600 corporation tax form. Our pricing plans are designed to cater to various business sizes, ensuring that you get robust features without exceeding your budget. You can handle multiple forms at a fraction of traditional costs while maintaining high compliance standards.

-

What features are included for managing the form 600 corporation tax form?

When you use airSlate SignNow for your form 600 corporation tax form, you benefit from features such as customizable templates, secure storage, and real-time notifications. These functionalities ensure that your documents are not only easily manageable but also securely archived. With airSlate SignNow, you'll have the tools to keep your corporation tax forms organized.

-

Can I integrate airSlate SignNow with other software for my form 600 corporation tax form?

Absolutely! airSlate SignNow allows seamless integration with various accounting and tax software to streamline your workflow for the form 600 corporation tax form. This capability lets you import data, automate submission processes, and manage documents more effectively across platforms. Integration enhances accuracy and saves time in preparing your tax returns.

-

What are the benefits of using airSlate SignNow for my form 600 corporation tax form?

Using airSlate SignNow for your form 600 corporation tax form provides numerous benefits, including faster completion times, reduced paper waste, and enhanced document security. The electronic signature feature boosts efficiency, allowing multiple signers to collaborate with ease. These advantages not only simplify the tax process but also enhance your environmental commitment.

-

How secure is airSlate SignNow when handling the form 600 corporation tax form?

Security is a top priority at airSlate SignNow. When handling sensitive documents like the form 600 corporation tax form, we utilize industry-standard encryption and secure access controls to protect your information. With our secure eSignature process, you can have peace of mind knowing that your tax documents are kept confidential and safe from unauthorized access.

Get more for 600 Corporation Tax Return Georgia Department Of Revenue

- Name affidavit of seller wyoming form

- Non foreign affidavit under irc 1445 wyoming form

- Owners or sellers affidavit of no liens wyoming form

- Wyoming affidavit financial form

- Complex will with credit shelter marital trust for large estates wyoming form

- Child support modification information and instructions wyoming

- Wyoming child support form

- Wyoming child support 497432402 form

Find out other 600 Corporation Tax Return Georgia Department Of Revenue

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple