2021-2025 Form

What is the Dor georgia gov600 corporation tax return600 Corporation Tax ReturnGeorgia Department Of Revenue

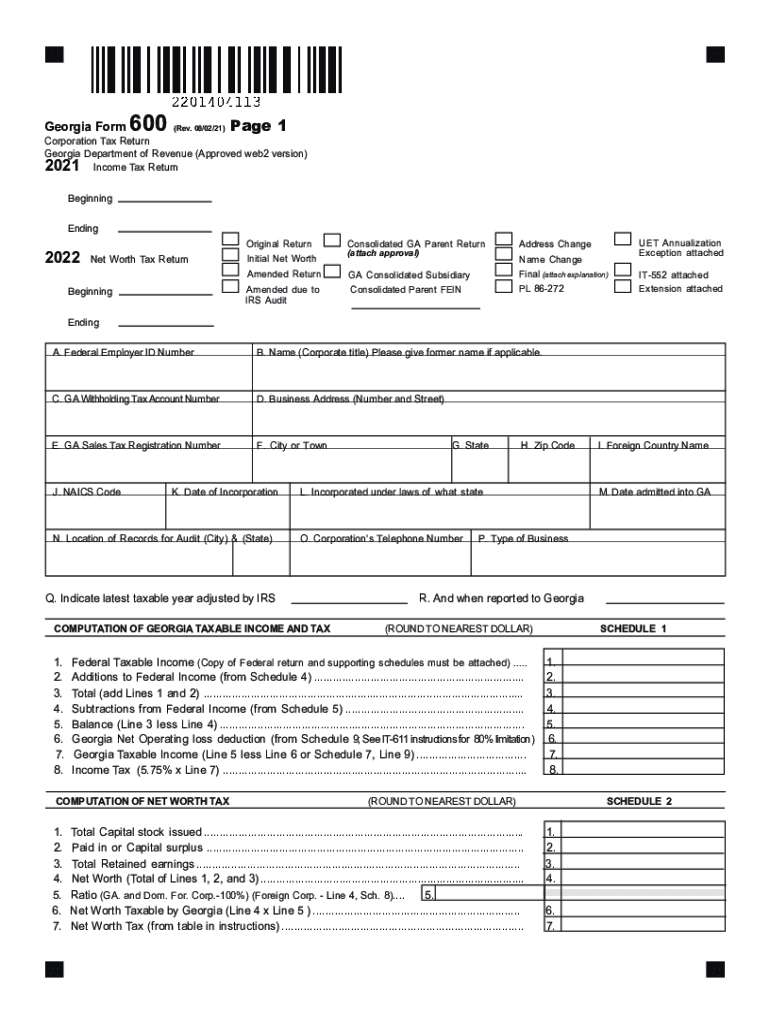

The Dor georgia gov600 corporation tax return600 Corporation Tax Return is a specific tax form required by the Georgia Department of Revenue for corporations operating within the state. This form is essential for reporting corporate income and calculating the amount of tax owed to the state. It ensures that businesses comply with state tax laws and contribute appropriately to state revenue. Understanding this form is crucial for any corporation to maintain compliance and avoid penalties.

Steps to complete the Dor georgia gov600 corporation tax return600 Corporation Tax ReturnGeorgia Department Of Revenue

Completing the Dor georgia gov600 corporation tax return600 Corporation Tax Return involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and any previous tax returns.

- Access the form through the Georgia Department of Revenue website or authorized platforms.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported correctly.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference and the guidelines provided by the Georgia Department of Revenue.

Legal use of the Dor georgia gov600 corporation tax return600 Corporation Tax ReturnGeorgia Department Of Revenue

The legal use of the Dor georgia gov600 corporation tax return600 Corporation Tax Return is governed by state tax laws. For the form to be considered valid, it must be completed accurately and submitted by the designated deadline. Electronic signatures are legally binding, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Ensuring compliance with these regulations is essential for the form's acceptance by the Georgia Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Dor georgia gov600 corporation tax return600 Corporation Tax Return are crucial for compliance. Typically, corporations must file their returns by the 15th day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines to avoid late fees and penalties.

Required Documents

To complete the Dor georgia gov600 corporation tax return600 Corporation Tax Return, several documents are required:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Prior year tax returns for reference.

- Documentation for any deductions or credits claimed.

Form Submission Methods (Online / Mail / In-Person)

The Dor georgia gov600 corporation tax return600 Corporation Tax Return can be submitted through various methods. Corporations can file electronically via the Georgia Department of Revenue's online portal, which is often the fastest and most efficient option. Alternatively, businesses may choose to mail the completed form to the appropriate address provided by the department. In-person submissions are also possible at designated offices, although this method may involve longer wait times.

Quick guide on how to complete dorgeorgiagov600 corporation tax return600 corporation tax returngeorgia department of revenue

Effortlessly prepare [SKS] on any device

Digital document management has gained popularity among businesses and individuals. It serves as a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorgeorgiagov600 corporation tax return600 corporation tax returngeorgia department of revenue

Related searches to Dor georgia gov600 corporation tax return600 Corporation Tax ReturnGeorgia Department Of Revenue

Create this form in 5 minutes!

People also ask

-

What is a Dor georgia gov600 corporation tax return600 Corporation Tax Return?

The Dor georgia gov600 corporation tax return600 Corporation Tax Return refers to the tax form required for corporations in Georgia to report their income and determine their tax liability. Completing this form is essential for compliance with the Georgia Department Of Revenue requirements. Properly filing this return can help avoid penalties and ensure timely tax obligations are met.

-

How can airSlate SignNow help with the Dor georgia gov600 corporation tax return600 Corporation Tax Return process?

airSlate SignNow simplifies the process of preparing and submitting your Dor georgia gov600 corporation tax return600 Corporation Tax Return by allowing users to eSign necessary documents securely. This feature streamlines your workflow and reduces the time spent on document management, ensuring that all forms are completed accurately and efficiently. Using airSlate SignNow can enhance your overall tax filing experience.

-

What features of airSlate SignNow support the filing of the Dor georgia gov600 corporation tax return600 Corporation Tax Return?

Key features of airSlate SignNow include eSigning, document templates, and secure storage options. These features allow users to create, manage, and sign essential documents related to the Dor georgia gov600 corporation tax return600 Corporation Tax Return easily. Additionally, the platform ensures that all documents are compliant with the Georgia Department Of Revenue guidelines.

-

Is airSlate SignNow cost-effective for small businesses managing the Dor georgia gov600 corporation tax return600 Corporation Tax Return?

Yes, airSlate SignNow offers a cost-effective solution for small businesses navigating the Dor georgia gov600 corporation tax return600 Corporation Tax Return process. The pricing plans are designed to fit different budgets while providing comprehensive features that enhance document management. This affordability allows small businesses to efficiently handle their tax return needs without incurring high costs.

-

What benefits does airSlate SignNow provide in relation to the Dor georgia gov600 corporation tax return600 Corporation Tax Return?

By utilizing airSlate SignNow, businesses can enjoy benefits such as increased efficiency, reduced turnaround times, and improved accuracy when completing the Dor georgia gov600 corporation tax return600 Corporation Tax Return. The ability to manage documents electronically minimizes the risk of errors and ensures that all submissions are timely and well-organized. These advantages make tax filing less stressful for businesses.

-

Can I integrate airSlate SignNow with other tools I use for the Dor georgia gov600 corporation tax return600 Corporation Tax Return?

Absolutely! AirSlate SignNow offers integrations with various third-party applications that can enhance your workflow when preparing the Dor georgia gov600 corporation tax return600 Corporation Tax Return. By linking with accounting software and other productivity tools, you can streamline data entry and document management. This integration ensures a seamless experience for all your tax-related tasks.

-

How does airSlate SignNow ensure security when managing the Dor georgia gov600 corporation tax return600 Corporation Tax Return?

AirSlate SignNow prioritizes security and compliance, employing industry-standard encryption and authentication measures to protect sensitive information related to the Dor georgia gov600 corporation tax return600 Corporation Tax Return. The platform also adheres to regulations set forth by the Georgia Department Of Revenue, ensuring that your data remains secure throughout the eSigning process. This commitment to security builds trust and confidence in our solution.

Get more for Dor georgia gov600 corporation tax return600 Corporation Tax ReturnGeorgia Department Of Revenue

- Carding tutorial pdf form

- Uhconline content request form final 5 doc

- Meda users guide form

- Twc flc h 2b job posting request form texas workforce twc state tx

- As 2k real estate form

- Essilor employee handbook form

- Ferpa release form winston salem state university wssu

- Rental application cosigner 101516 form

Find out other Dor georgia gov600 corporation tax return600 Corporation Tax ReturnGeorgia Department Of Revenue

- eSignature Missouri Plumbing Cease And Desist Letter Secure

- eSignature Mississippi Plumbing Executive Summary Template Online

- How Do I eSignature Mississippi Plumbing Executive Summary Template

- Help Me With eSignature Mississippi Plumbing Executive Summary Template

- eSignature Mississippi Plumbing Executive Summary Template Computer

- eSignature Missouri Plumbing Cease And Desist Letter Fast

- How Can I eSignature Mississippi Plumbing Executive Summary Template

- Can I eSignature Mississippi Plumbing Executive Summary Template

- eSignature Mississippi Plumbing Executive Summary Template Mobile

- eSignature Missouri Plumbing Cease And Desist Letter Simple

- eSignature Missouri Plumbing Job Description Template Online

- eSignature Mississippi Plumbing Executive Summary Template Now

- eSignature Missouri Plumbing Job Description Template Computer

- eSignature Missouri Plumbing Job Description Template Mobile

- eSignature Mississippi Plumbing Executive Summary Template Later

- eSignature Missouri Plumbing Cease And Desist Letter Easy

- eSignature Missouri Plumbing Job Description Template Now

- eSignature Missouri Plumbing Job Description Template Later

- eSignature Mississippi Plumbing Executive Summary Template Myself

- eSignature Missouri Plumbing Job Description Template Myself