Income Tax Return 2020

What is the Income Tax Return

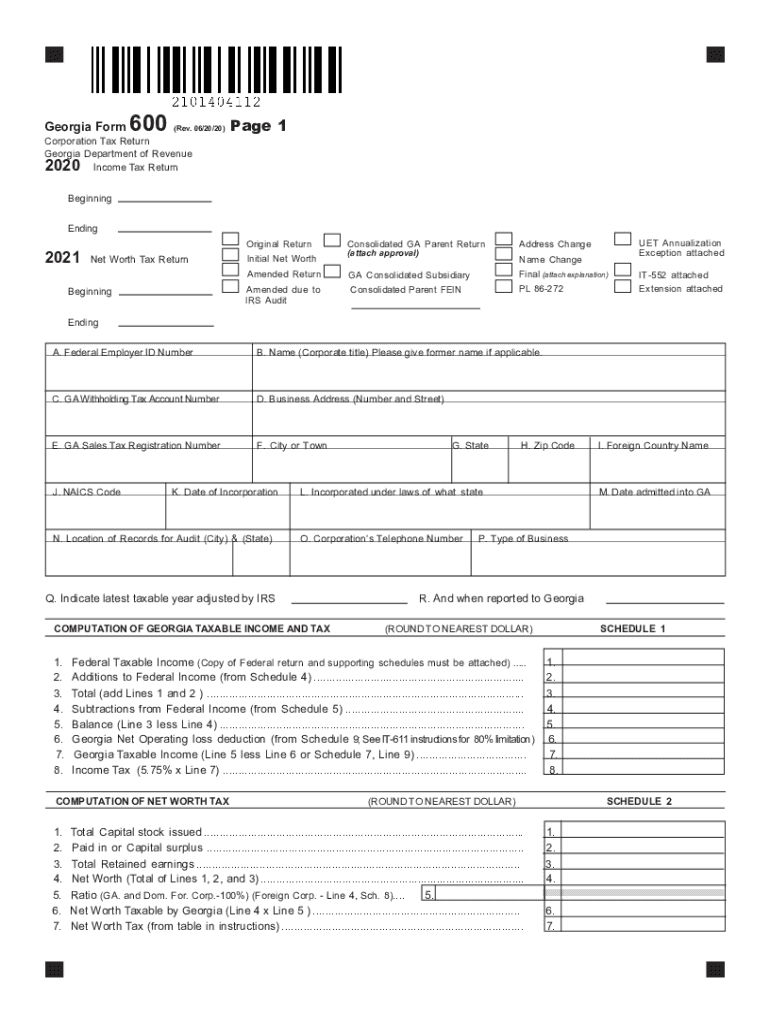

The Income Tax Return, specifically the Georgia Form 600, is a document used by corporations to report their income, deductions, and tax liability to the state of Georgia. This form is essential for businesses operating within the state, as it ensures compliance with state tax laws. The form captures various financial details, including gross income, allowable deductions, and credits, which ultimately determine the corporation's tax obligation.

Steps to complete the Income Tax Return

Completing the Georgia Form 600 involves several key steps that ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and prior tax returns. Next, accurately fill out the form by entering the required financial information in the designated sections. It is crucial to double-check all entries for accuracy. After completing the form, calculate the total tax due based on the provided instructions. Finally, sign and date the form before submitting it to the Georgia Department of Revenue.

Key elements of the Income Tax Return

The Georgia Form 600 includes several critical elements that must be accurately reported. These elements consist of the corporation's name, federal employer identification number (FEIN), and the tax year being reported. Additionally, the form requires detailed reporting of income, including sales, dividends, and interest. Deductions for business expenses, such as operating costs and depreciation, are also essential components. Understanding these key elements is vital for ensuring that the form is completed correctly and submitted on time.

Required Documents

To successfully complete the Georgia Form 600, certain documents are required. These include financial statements, such as profit and loss statements and balance sheets, which provide a comprehensive overview of the corporation's financial health. Additionally, documentation supporting any claimed deductions, such as receipts and invoices, should be gathered. It is also advisable to have a copy of the previous year's tax return for reference. Ensuring that all required documents are ready will facilitate a smoother filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Georgia Form 600 are crucial for compliance. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the due date is April 15. It is important to be aware of any extensions that may be available, as well as any changes to deadlines that may occur due to state regulations. Keeping track of these dates ensures that the corporation avoids penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The Georgia Form 600 can be submitted through various methods, providing flexibility for businesses. Corporations may choose to file online via the Georgia Department of Revenue's e-filing system, which offers a streamlined process and faster processing times. Alternatively, the form can be mailed to the appropriate address provided in the instructions, ensuring that it is postmarked by the filing deadline. In-person submissions are also accepted at designated state offices, allowing for direct interaction with tax officials if needed.

Penalties for Non-Compliance

Failing to comply with the filing requirements for the Georgia Form 600 can result in significant penalties. Corporations may face late filing fees, which can accumulate over time, increasing the overall tax liability. Additionally, interest may be charged on any unpaid taxes, further compounding the financial impact. In severe cases, non-compliance can lead to legal action or revocation of business licenses. Understanding these penalties underscores the importance of timely and accurate filing.

Quick guide on how to complete 2020 income tax return

Complete Income Tax Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Income Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to alter and electronically sign Income Tax Return with ease

- Locate Income Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in a few clicks from any device you prefer. Modify and electronically sign Income Tax Return and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 income tax return

The way to create an e-signature for your PDF in the online mode

The way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What are the GA Form 600 instructions for completing the form accurately?

The GA Form 600 instructions provide a step-by-step guide to ensure that all required fields are completed correctly. This includes details on the necessary documentation and electronic signatures that must accompany the form. Following these instructions closely will help streamline the submission process and reduce any potential delays.

-

How can airSlate SignNow assist with GA Form 600 submissions?

airSlate SignNow simplifies the process of signing and sending the GA Form 600 through its secure eSignature platform. Users can easily upload their documents, add electronic signatures, and send them for approval directly from the interface. This ease of use is in line with the GA Form 600 instructions, making compliance straightforward.

-

Is airSlate SignNow affordable for businesses needing to handle GA Form 600?

Yes, airSlate SignNow offers competitive pricing that is well-suited for businesses looking to manage documentation efficiently, including the GA Form 600. The platform provides a cost-effective solution without compromising on features or security, making it accessible for businesses of any size.

-

What features does airSlate SignNow offer for managing GA Form 600?

AirSlate SignNow provides essential features such as document templates, reusable field placements, and easy sharing options, all of which enhance the GA Form 600 preparation. Additionally, tracking and notifications keep you informed, ensuring that every submission meets the GA Form 600 instructions correctly.

-

Can I integrate other tools with airSlate SignNow for GA Form 600 processing?

Yes, airSlate SignNow seamlessly integrates with various other tools and software, allowing for a streamlined process in managing GA Form 600 submissions. Integrations with CRMs, document management systems, and email platforms enhance your workflow efficiency and make compliance easier.

-

What benefits does using airSlate SignNow bring to GA Form 600 submissions?

Using airSlate SignNow for GA Form 600 submissions ensures a faster, more secure, and organized process. It eliminates the hassle of physical paperwork and allows for better tracking and compliance with GA Form 600 instructions, leading to improved efficiency in your document-handling operations.

-

Are electronic signatures valid for GA Form 600 submissions?

Yes, electronic signatures are legally recognized for GA Form 600 submissions, provided that all GA Form 600 instructions regarding their use are followed. AirSlate SignNow ensures that your electronic signatures meet legal standards, offering a reliable solution for your document signing needs.

Get more for Income Tax Return

Find out other Income Tax Return

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online