Georgia Form 600 Corporation Tax Return 202 5HY 2024-2026

Understanding the Georgia Form 600 Corporation Tax Return

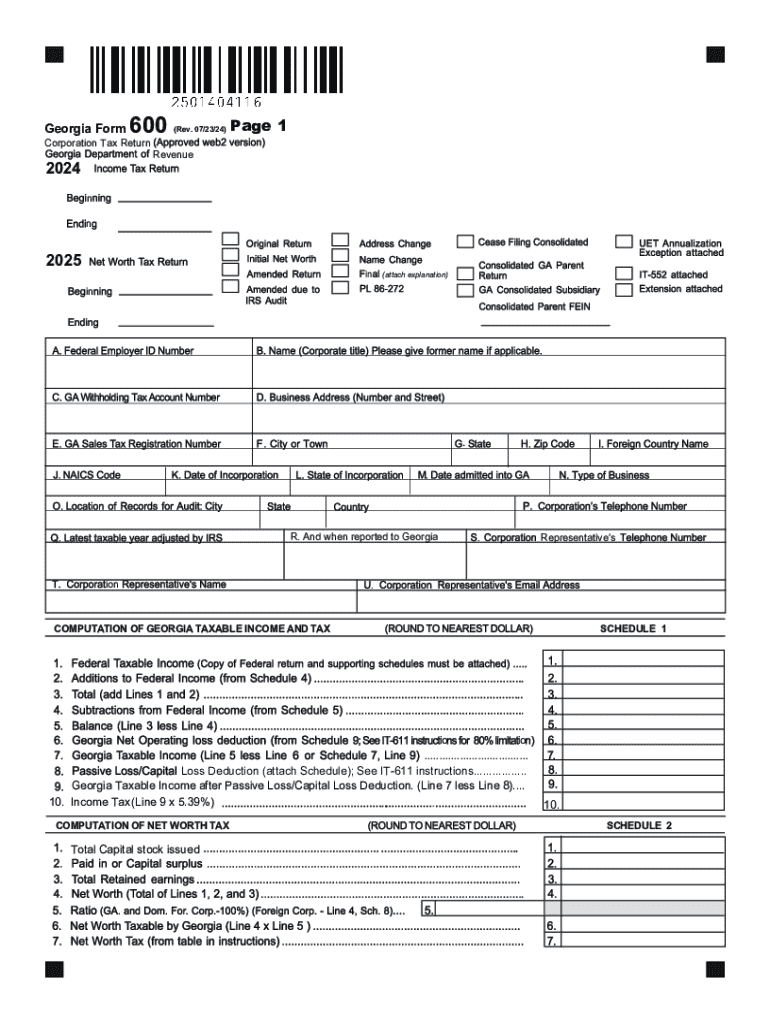

The Georgia Form 600 is a corporation tax return used by businesses operating in Georgia to report their income, deductions, and tax liability. This form is essential for corporations, including C corporations, that are subject to Georgia corporate income tax. It facilitates compliance with state tax regulations and ensures that businesses accurately report their financial activities for the tax year.

Steps to Complete the Georgia Form 600 Corporation Tax Return

Filling out the Georgia Form 600 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and receipts for deductions.

- Complete the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other sources of revenue.

- Detail allowable deductions, such as business expenses, which can reduce taxable income.

- Calculate the tax liability based on the applicable tax rates for the reporting period.

- Review the form for accuracy and completeness before submission.

Legal Use of the Georgia Form 600 Corporation Tax Return

The Georgia Form 600 must be used in accordance with state tax laws. Corporations are legally required to file this form annually if they meet the income threshold set by the Georgia Department of Revenue. Failure to file or inaccuracies in reporting can lead to penalties, interest on unpaid taxes, and potential audits by state tax authorities.

Required Documents for Filing the Georgia Form 600

To successfully complete the Georgia Form 600, certain documents are necessary:

- Financial statements, including income statements and balance sheets.

- Records of all income sources and business expenses.

- Previous year’s tax returns, if applicable.

- Documentation supporting any claimed deductions or credits.

Filing Deadlines for the Georgia Form 600

The filing deadline for the Georgia Form 600 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. Extensions may be available, but they must be requested before the original deadline to avoid penalties.

Form Submission Methods for the Georgia Form 600

The Georgia Form 600 can be submitted through various methods:

- Electronically through the Georgia Department of Revenue’s online filing system.

- By mail, sending the completed form to the appropriate state address.

- In-person at designated state tax offices, if necessary.

Penalties for Non-Compliance with the Georgia Form 600

Failure to file the Georgia Form 600 on time or inaccuracies in the submitted information can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, calculated from the due date until payment is made.

- Possible audits by the Georgia Department of Revenue, leading to further scrutiny of the corporation's financial practices.

Create this form in 5 minutes or less

Find and fill out the correct georgia form 600 corporation tax return 202 5hy

Create this form in 5 minutes!

How to create an eSignature for the georgia form 600 corporation tax return 202 5hy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 form 600 and how can airSlate SignNow help?

The 2024 form 600 is a crucial document for businesses that need to report specific financial information. airSlate SignNow simplifies the process by allowing users to easily fill out, sign, and send the 2024 form 600 electronically, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for the 2024 form 600?

airSlate SignNow provides a range of features for the 2024 form 600, including customizable templates, secure eSignature capabilities, and real-time tracking of document status. These features streamline the completion and submission process, making it easier for businesses to manage their documentation.

-

Is airSlate SignNow cost-effective for handling the 2024 form 600?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using airSlate SignNow for the 2024 form 600, companies can save on printing and mailing costs while benefiting from a user-friendly platform.

-

Can I integrate airSlate SignNow with other software for the 2024 form 600?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the 2024 form 600 alongside your existing tools. This integration enhances workflow efficiency and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the 2024 form 600?

Using airSlate SignNow for the 2024 form 600 offers numerous benefits, including increased speed in document processing, enhanced security for sensitive information, and improved collaboration among team members. These advantages help businesses stay organized and compliant.

-

How secure is airSlate SignNow when handling the 2024 form 600?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your data. When handling the 2024 form 600, you can trust that your information is safe and secure throughout the signing process.

-

Is there customer support available for questions about the 2024 form 600?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions regarding the 2024 form 600. Whether you need help with features, integrations, or troubleshooting, our support team is ready to help you.

Get more for Georgia Form 600 Corporation Tax Return 202 5HY

- Temporary event food vendor application san mateo county form

- Dlt ri form

- Cse 1178a arizona department of economic security azgov form

- Consent and notice of privacy practices form

- Residential college roommate agreement case western reserve case form

- Nc dhsr forms and applications

- Summer camp medical form 2019 finaldocx

- Third party liability accident information form

Find out other Georgia Form 600 Corporation Tax Return 202 5HY

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement