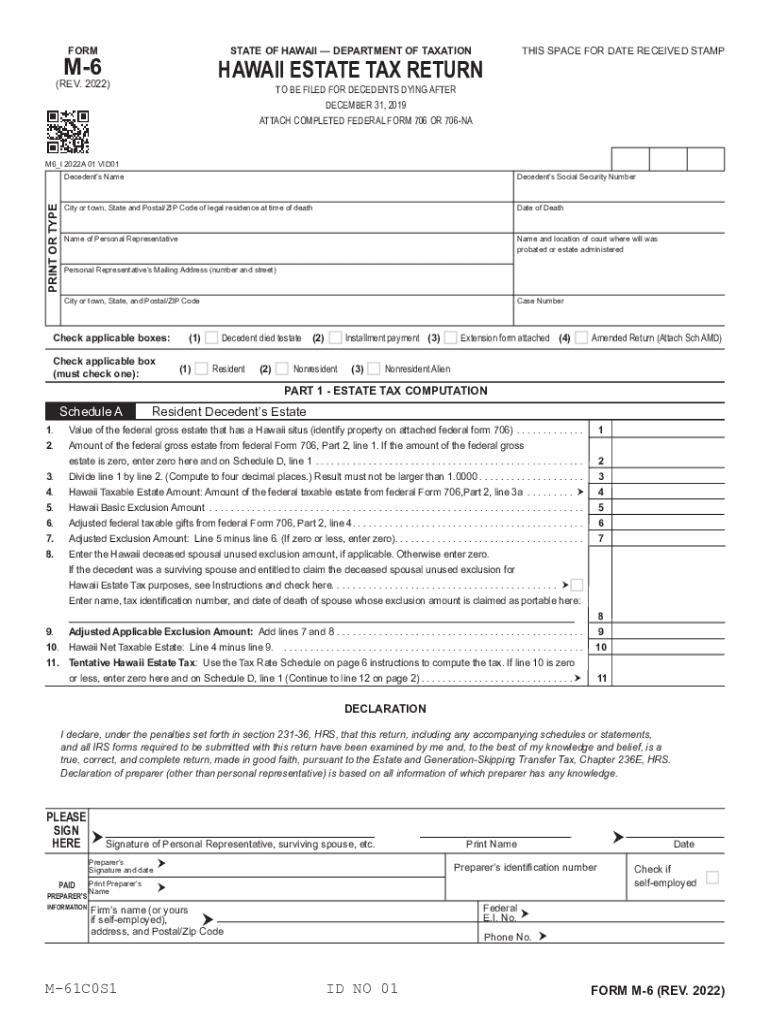

M 6 Rev , Hawaii Estate Tax Return 2022

What is the Hawaii Form M-6, Estate Tax Return?

The Hawaii Form M-6, also known as the Estate Tax Return, is a crucial document for reporting the estate tax liability of a decedent's estate in Hawaii. This form is required when the gross estate exceeds a specified threshold. The M-6 captures essential information about the decedent's assets, liabilities, and the overall value of the estate. Understanding this form is vital for executors and administrators to ensure compliance with Hawaii's estate tax laws.

Steps to Complete the Hawaii Form M-6

Completing the Hawaii Form M-6 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including the decedent's financial records, property deeds, and any relevant tax returns. Next, calculate the gross estate value by summing all assets, including real estate, bank accounts, and investments. After determining the value, complete the form by accurately filling in each section, including deductions and liabilities. Finally, review the form for completeness before submission.

Legal Use of the Hawaii Form M-6

The Hawaii Form M-6 is legally binding and must be filed within nine months of the decedent's death. This form serves as a declaration of the estate's tax liability and is subject to review by state tax authorities. Properly completing and submitting the M-6 ensures that the estate complies with Hawaii's tax laws, avoiding potential penalties or legal issues. Executors should retain copies of the submitted form and any supporting documents for their records.

Required Documents for the Hawaii Form M-6

To successfully file the Hawaii Form M-6, several documents are required. These include the decedent's death certificate, a detailed inventory of the estate's assets, documentation of any debts or liabilities, and any previous tax returns filed by the decedent. Additionally, supporting documents for deductions, such as funeral expenses and debts, should be included. Ensuring all required documents are prepared will facilitate a smoother filing process.

Filing Deadlines for the Hawaii Form M-6

The filing deadline for the Hawaii Form M-6 is typically nine months from the date of the decedent's death. However, an extension may be requested if more time is needed to gather necessary information. It is essential to adhere to this deadline to avoid penalties and interest on unpaid estate taxes. Executors should mark their calendars and prepare the form well in advance of the due date to ensure timely submission.

Examples of Using the Hawaii Form M-6

Examples of situations requiring the Hawaii Form M-6 include estates where the decedent owned real estate, had significant financial assets, or left behind business interests. For instance, if an individual passes away leaving a house valued at $800,000 and various bank accounts totaling $200,000, the estate would likely exceed the filing threshold, necessitating the completion of the M-6. Each estate's circumstances will dictate the specific details required on the form.

Quick guide on how to complete m 6 rev 2022 hawaii estate tax return

Complete M 6 Rev , Hawaii Estate Tax Return seamlessly on any gadget

Online document handling has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage M 6 Rev , Hawaii Estate Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify your document processes today.

How to edit and eSign M 6 Rev , Hawaii Estate Tax Return effortlessly

- Find M 6 Rev , Hawaii Estate Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign M 6 Rev , Hawaii Estate Tax Return to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m 6 rev 2022 hawaii estate tax return

Create this form in 5 minutes!

How to create an eSignature for the m 6 rev 2022 hawaii estate tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hawaii form m and how can airSlate SignNow help?

The hawaii form m is a specific document required for certain transactions in Hawaii. airSlate SignNow provides a user-friendly platform that allows you to easily create, send, and eSign this form, ensuring compliance and efficiency in your document management.

-

What are the pricing options for using airSlate SignNow for hawaii form m?

airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that simplify the signing and management of important documents like the hawaii form m, with cost-effective solutions starting at competitive rates.

-

Can I customize the hawaii form m using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the hawaii form m to fit your specific requirements. You can add your branding, modify fields, and ensure that the document meets all necessary legal standards for a tailored signing experience.

-

Is airSlate SignNow secure for handling sensitive documents like the hawaii form m?

Absolutely. airSlate SignNow is committed to ensuring the security and confidentiality of your documents. We use advanced encryption and security protocols to protect the hawaii form m and other sensitive information throughout the signing process.

-

What features does airSlate SignNow offer for managing hawaii form m?

airSlate SignNow offers a range of features ideal for managing hawaii form m, including templates, automated workflows, and real-time tracking. These tools streamline the signing process and enhance efficiency, giving you more time to focus on other business matters.

-

Can I integrate airSlate SignNow with other applications for hawaii form m?

Yes, airSlate SignNow easily integrates with various third-party applications, allowing for seamless workflow management. Whether you're using CRM systems or other document management tools, integration helps you manage the hawaii form m more effectively.

-

Are there mobile options available for signing hawaii form m?

Yes, airSlate SignNow provides a mobile-friendly platform that supports signing the hawaii form m on the go. With our mobile app, you can access and sign documents from anywhere, ensuring flexibility and convenience for busy professionals.

Get more for M 6 Rev , Hawaii Estate Tax Return

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair south carolina form

- South carolina broken form

- Letter from tenant to landlord with demand that landlord repair broken windows south carolina form

- Letter from tenant to landlord with demand that landlord repair plumbing problem south carolina form

- South carolina tenant landlord form

- Sc tenant landlord form

- Letter tenant demand sample 497325644 form

- Sc tenant landlord form

Find out other M 6 Rev , Hawaii Estate Tax Return

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself