M 6 Rev , Hawaii Estate Tax Return Form 2021

What is the M-6 Rev, Hawaii Estate Tax Return Form

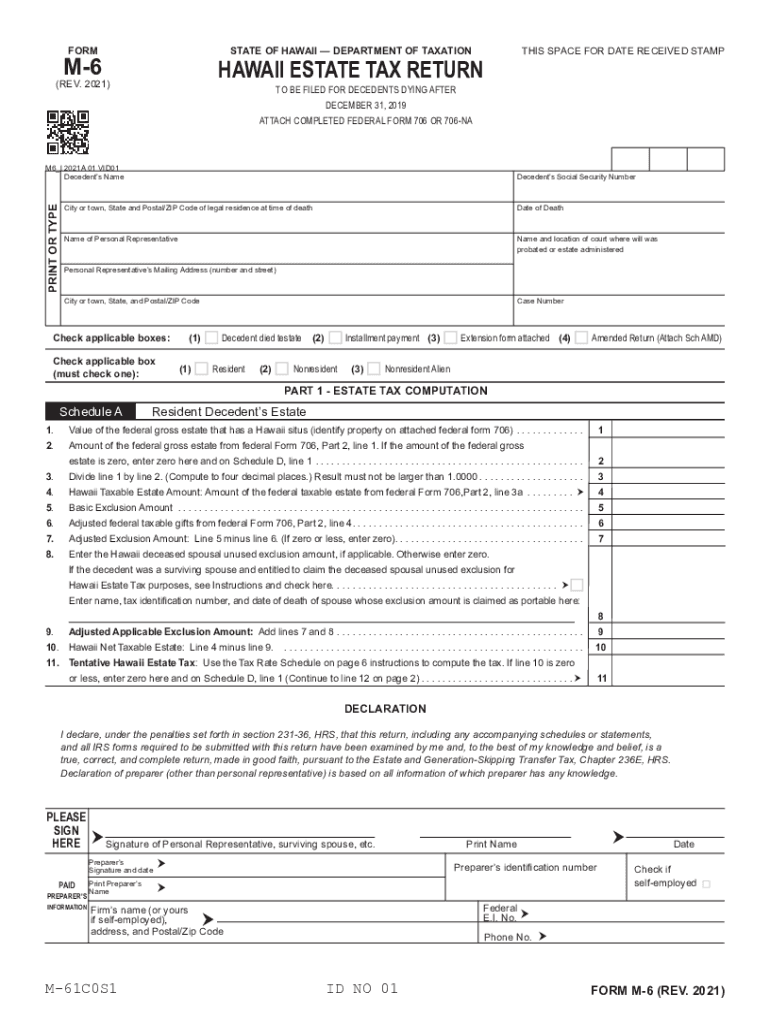

The M-6 Rev, commonly referred to as the Hawaii Estate Tax Return Form, is a crucial document used to report the estate tax liability of a deceased individual in Hawaii. This form is specifically designed for estates that exceed the state’s exemption threshold, which is subject to change. The information provided on this form helps the state assess the estate tax owed based on the value of the deceased's assets, including real estate, personal property, and financial accounts. Understanding the M-6 Rev is essential for executors and administrators of estates to ensure compliance with Hawaii tax laws.

Steps to Complete the M-6 Rev, Hawaii Estate Tax Return Form

Completing the M-6 Rev involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including the decedent's financial records, property valuations, and any prior tax returns. Next, fill out the form by providing detailed information about the estate's assets and liabilities. Pay attention to the specific sections that require disclosure of deductions and credits applicable to the estate. After completing the form, review it thoroughly for any errors or omissions. Finally, sign the form and prepare it for submission according to the guidelines set by the state.

Legal Use of the M-6 Rev, Hawaii Estate Tax Return Form

The M-6 Rev is legally binding when filled out and submitted according to Hawaii state law. It serves as an official declaration of the estate's tax obligations and must be filed within the stipulated deadlines to avoid penalties. The form must be signed by the executor or administrator of the estate, affirming that the information provided is accurate and complete. Failure to file the M-6 Rev can result in significant legal and financial consequences, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing the M-6 Rev is subject to specific deadlines that must be adhered to in order to avoid penalties. Generally, the estate tax return is due within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is crucial for executors to be aware of these deadlines and plan accordingly to ensure timely submission of the form. Missing the deadline can lead to additional tax liabilities and complications in the estate settlement process.

Required Documents for the M-6 Rev, Hawaii Estate Tax Return Form

To complete the M-6 Rev, several documents are necessary to provide a comprehensive overview of the estate's financial situation. Required documents typically include the decedent's death certificate, a list of all assets and liabilities, property appraisals, and any relevant financial statements. Additionally, documentation supporting any deductions or credits claimed on the form should be included. Having these documents organized and readily available will facilitate a smoother completion of the M-6 Rev.

Form Submission Methods for the M-6 Rev

The M-6 Rev can be submitted through various methods to accommodate different preferences. Executors may choose to file the form online through the Hawaii Department of Taxation’s e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. It is important to keep a copy of the submitted form and any confirmation of submission for personal records.

Key Elements of the M-6 Rev, Hawaii Estate Tax Return Form

The M-6 Rev contains several key elements that must be accurately filled out to ensure compliance. These include sections for reporting the decedent's personal information, a detailed inventory of the estate's assets, liabilities, and deductions. Additionally, the form requires calculations to determine the total estate value and the corresponding tax owed. Understanding these elements is crucial for executors to effectively manage the estate's tax obligations and avoid errors that could lead to audits or penalties.

Quick guide on how to complete m 6 rev 2021 hawaii estate tax return form 2021

Complete M 6 Rev , Hawaii Estate Tax Return Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage M 6 Rev , Hawaii Estate Tax Return Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to modify and eSign M 6 Rev , Hawaii Estate Tax Return Form with ease

- Obtain M 6 Rev , Hawaii Estate Tax Return Form and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Overcome the issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign M 6 Rev , Hawaii Estate Tax Return Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m 6 rev 2021 hawaii estate tax return form 2021

Create this form in 5 minutes!

How to create an eSignature for the m 6 rev 2021 hawaii estate tax return form 2021

The best way to generate an e-signature for a PDF file in the online mode

The best way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is the Hawaii Form M 6 and how can airSlate SignNow help with it?

The Hawaii Form M 6 is a crucial document for various administrative processes in Hawaii. With airSlate SignNow, you can easily fill out, sign, and manage your Hawaii Form M 6 digitally, streamlining the process and ensuring compliance with state regulations.

-

How much does airSlate SignNow cost for using the Hawaii Form M 6?

AirSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on the features you choose, you can find the right plan that fits your budget while providing full access to tools for managing the Hawaii Form M 6 and other essential documents.

-

What features does airSlate SignNow offer for managing the Hawaii Form M 6?

AirSlate SignNow provides a range of features including customizable templates, secure eSigning, and cloud storage. These tools not only simplify the process of handling the Hawaii Form M 6 but also enhance collaboration with your team and clients.

-

Is airSlate SignNow user-friendly for filling out the Hawaii Form M 6?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy to navigate and complete the Hawaii Form M 6. Even users with minimal technical skills can quickly learn how to utilize the platform effectively.

-

Can I integrate airSlate SignNow with other applications for the Hawaii Form M 6?

Yes, airSlate SignNow supports integrations with various platforms such as Google Drive, Dropbox, and CRM systems. This allows you to access and manage the Hawaii Form M 6 efficiently alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for my Hawaii Form M 6?

Using airSlate SignNow for your Hawaii Form M 6 provides numerous benefits including time savings, enhanced security, and improved tracking of document status. These advantages help ensure that your forms are processed quickly and efficiently.

-

How does electronic signing of the Hawaii Form M 6 work with airSlate SignNow?

Electronic signing on airSlate SignNow is simple and secure. You can invite signers to complete the Hawaii Form M 6 via email, and they can sign documents anywhere, anytime, increasing flexibility and reducing delays in processing.

Get more for M 6 Rev , Hawaii Estate Tax Return Form

- Assignment of deed of trust by corporate mortgage holder district of columbia form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property district of form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497301607 form

- Dc notice vacate form

- Dc notice tenant form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property district of columbia form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497301611 form

- Dc termination form

Find out other M 6 Rev , Hawaii Estate Tax Return Form

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online