M 6 Rev , Hawaii Estate Tax Return 2024-2026

What is the M-6 Rev, Hawaii Estate Tax Return

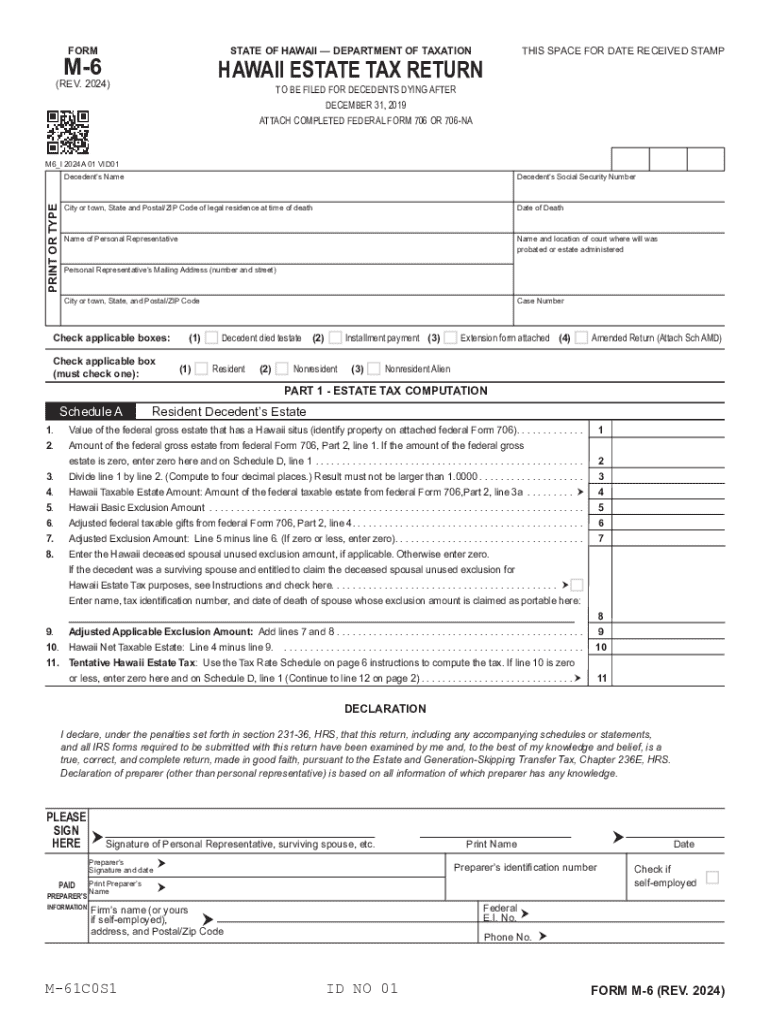

The M-6 Rev, Hawaii Estate Tax Return, is a crucial document used to report the estate tax obligations of decedents in the state of Hawaii. This form is required for estates that exceed a certain value threshold, which is subject to change based on state regulations. The M-6 Rev captures essential information regarding the decedent's assets, liabilities, and the overall value of the estate. Completing this form accurately is vital for compliance with Hawaii's estate tax laws and ensures that the estate is settled according to legal requirements.

Steps to complete the M-6 Rev, Hawaii Estate Tax Return

Completing the M-6 Rev involves several important steps to ensure accuracy and compliance. Start by gathering all necessary financial documents related to the decedent's assets, including bank statements, property deeds, and investment records. Next, calculate the total value of the estate by summing up all assets and subtracting any liabilities. Once you have this information, fill out the M-6 Rev form, providing detailed information about the decedent, the estate's value, and any deductions that may apply. Finally, review the completed form for any errors before submitting it to the appropriate state authority.

Required Documents

To successfully complete the M-6 Rev, several documents are necessary. These include the decedent's death certificate, a list of all assets and liabilities, property valuations, and any relevant financial statements. Additionally, if the estate includes real property, you may need to provide copies of property deeds. It's essential to ensure that all documents are accurate and up-to-date, as discrepancies can lead to delays or penalties in the estate tax process.

Filing Deadlines / Important Dates

Filing the M-6 Rev is subject to specific deadlines that must be adhered to in order to avoid penalties. Generally, the estate tax return must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It's important to stay informed about any changes in state regulations regarding deadlines to ensure timely submission of the form.

Legal use of the M-6 Rev, Hawaii Estate Tax Return

The M-6 Rev serves a legal purpose in the administration of estates in Hawaii. It is used by the state to assess estate tax liabilities and ensure compliance with tax laws. Filing this form is not only a legal requirement but also a critical step in the process of settling an estate. Failure to file the M-6 Rev can result in legal consequences, including penalties and interest on unpaid taxes.

Examples of using the M-6 Rev, Hawaii Estate Tax Return

Understanding practical examples of the M-6 Rev can clarify its application. For instance, if an individual passes away leaving a house, bank accounts, and investments valued at over a specified threshold, the executor of the estate must file the M-6 Rev. Another example could involve an estate with multiple properties and significant liabilities, where the executor must accurately report all assets and deductions to determine the estate's tax obligations. These scenarios highlight the importance of accurately completing the form to reflect the estate's true financial situation.

Create this form in 5 minutes or less

Find and fill out the correct m 6 rev hawaii estate tax return

Create this form in 5 minutes!

How to create an eSignature for the m 6 rev hawaii estate tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is computation decedent decimal in the context of airSlate SignNow?

Computation decedent decimal refers to the precise calculation methods used in airSlate SignNow to ensure accurate document processing. This feature helps users maintain clarity and accuracy in their electronic signatures and document management, making it essential for businesses that rely on precise data.

-

How does airSlate SignNow handle pricing for computation decedent decimal features?

airSlate SignNow offers competitive pricing plans that include access to computation decedent decimal features. These plans are designed to cater to businesses of all sizes, ensuring that you can find a solution that fits your budget while still benefiting from advanced document processing capabilities.

-

What are the key benefits of using computation decedent decimal in airSlate SignNow?

The key benefits of computation decedent decimal in airSlate SignNow include enhanced accuracy in document processing and improved compliance with legal standards. This ensures that your electronic signatures are not only valid but also reliable, which is crucial for maintaining trust with your clients.

-

Can I integrate computation decedent decimal features with other software?

Yes, airSlate SignNow allows for seamless integration of computation decedent decimal features with various third-party applications. This flexibility enables businesses to streamline their workflows and enhance productivity by connecting their existing tools with our eSigning solution.

-

Is there a trial period for testing computation decedent decimal features?

Absolutely! airSlate SignNow offers a free trial period that allows you to explore the computation decedent decimal features without any commitment. This trial gives you the opportunity to assess how these features can benefit your document management processes.

-

How does computation decedent decimal improve document security?

Computation decedent decimal enhances document security by ensuring that all calculations and data entries are accurate and verifiable. This reduces the risk of errors and fraud, providing peace of mind for businesses that require secure and reliable electronic signatures.

-

What types of documents can benefit from computation decedent decimal?

Any document that requires precise calculations or data entries can benefit from computation decedent decimal in airSlate SignNow. This includes contracts, invoices, and legal agreements, where accuracy is paramount to ensure compliance and avoid disputes.

Get more for M 6 Rev , Hawaii Estate Tax Return

Find out other M 6 Rev , Hawaii Estate Tax Return

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online